Prepare for a stock market correction

- Stephen McBride

- |

- February 5, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Good morning.

US stocks are holding steady today… but there are important shifts happening underneath the surface you should know about.

But first…

- Elon Musk wants to put a chip in your brain. You in?

Elon is best known for building battery-powered cars (Tesla) and 400 ft. rocket ships to get us to Mars (SpaceX).

But his startup, Neuralink, might end up helping mankind the most.

Neuralink is building a special chip that will allow us to control computers with our minds. The big news is the first human received a Neuralink brain implant this week.

If you’re anything like me, you’re thinking, “Hell no is anything going in my brain.”

But Neuralink wasn’t built so you could skip intros on Netflix (NFLX) by blinking at the TV. Its goal is to help paralyzed people walk and blind people to see.

Here’s how it works. The neurons in your brain “fire” in similar ways when you think about moving your legs, whether you physically move them or not.

Same for speech. When you think a word, your brain lights up as if you actually said that word out loud.

Neuralink built a chip about the size of a quarter that slides in just under the skull. It can “read” your mind and then speak for you or move a limb, for example.

Separately, a group of Swiss doctors already achieved this. They put a chip in a paralyzed guy’s brain, and now he can walk by simply thinking about moving his legs.

Read that sentence again and tell me you’re not a techno-optimist.

Neuralink isn’t the latest must-have gadget. It’s an experimental new technology that will help people who can’t yet be helped.

And if it works, watch how fast attitudes change.

Not long ago, people viewed organ transplants as some Frankenstein experiment. As for putting something in your body, 3 million Americans have a pacemaker in their chest.

But don’t expect to read a positive news story about Neuralink anytime soon with Elon running the show.

Funny how media coverage of Musk suddenly nosedived when he started pushing back against politically correct nonsense. The attacks really ramped up when Elon bought Twitter and blew the whistle on censorship.

Forget all that. Neuralink is curing the uncurable.

Future’s bright.

- Prepare for a stock market correction

The S&P 500 has surged 15% since November 1. That’s roughly two years’ worth of average gains squeezed into three months.

Markets got too hot, and I think we’re due for a pullback.

Looking at how stocks tend to perform throughout the year has always been part of my analysis.

This “seasonality” helped us make a lot of money last year. Now, it’s telling us to be a little cautious.

Going back to 1950, February has historically been the second-worst month for stocks. Along with September, it’s the only month in which stocks have averaged a loss.

So it would be perfectly normal to see markets pull back here.

The second thing giving me pause is something my friend JC Parets of All Star Charts brought to my attention in New York City last week.

While the S&P 500 continues to flirt with new highs, the list of individual stocks hitting all-time highs peaked seven weeks ago. This behavior typically precedes a broader market drop.

Let’s remember the S&P 500 was up 12 of the last 13 weeks. It hit record highs earlier this week.

Again, it’s totally normal—even healthy—for stocks to take a breather here.

What I’m doing: continuing to own only great businesses profiting from disruptive megatrends inside Disruption Investor. We’re long-term investors and don’t try to trade every 10% market move.

- Today’s dose of optimism…

Former US presidential candidate John Kerry made some interesting comments at The World Economic Forum in Davos recently.

“2023 ... was literally the most disruptive, climate-disrupted, most climate consequential, negative year in human history.”

John Kerry is either lying or hasn’t looked at the facts.

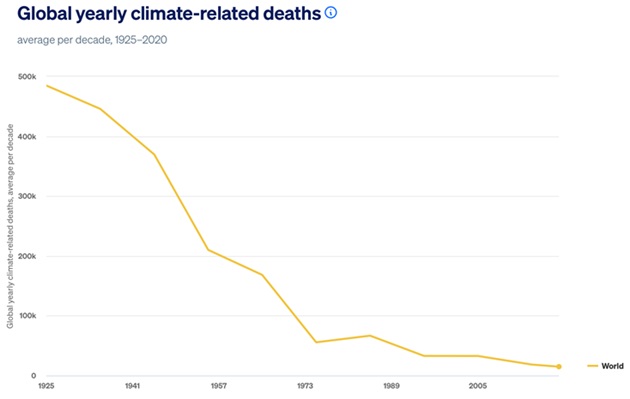

Someone send him this chart, which shows climate-related deaths collapsing to near-zero:

Source: humanprogress.org

Major narrative violation for the climate doomers.

Technology and capitalism… which are often blamed for ruining our climate… are the driving forces behind this one-way trend.

Mother Nature continues to hand out heat waves, cold snaps, hurricanes, and flash floods. In fact, according to John Kerry, 2023 was the hottest year on record.

But technological innovation is the reason Mother Nature no longer claims hundreds of thousands of lives each year.

Extreme heat… we invented air conditioning.

Extreme cold… we created indoor heating and insulation.

Deadly floods… we devised dams, canals, and expert drainage systems.

Hurricanes, earthquakes, and tsunamis… we contrived early warning systems for evacuations.

Droughts… we pioneered new farming methods that allow us to grow crops year-round.

Dirty energy like coal burning our lungs… we masterminded “capture” tools that enable us to remove 95%+ of the deadly toxins.

Technology—not politicians or penance—will solve climate change.

I’ll talk with you Monday. Have a great weekend.Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com