Part 2: WTF happened in 2023?

- Stephen McBride

- |

- January 8, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Happy Friday!

On Wednesday, I kicked off a special New Year’s series on why I believe the forces that set the widening wealth gap in motion in 1971 are reversing.

Today, I’m sharing two of the five industries that are reviving American innovation, which I call the “five horsemen of disruption.”

***

Did you know Henry Ford designed a “flying car” in the 1920s?

Imagine this “Ford Flivver” parked in your driveway:

Source: The Old Motor

Source: The Old Motor

Flying cars are the poster child for all the innovations we didn’t get because they got too expensive to make stuff.

To quote PayPal (PYPL) and Palantir (PLTR) co-founder Peter Thiel, "We wanted flying cars, but all we got was 140 characters?" (The former character limit on Twitter was 140 characters.)

Before the 1970s, America pumped out bigger, faster, more powerful machines.

Cheap energy was the key ingredient behind American muscle cars… jet engines that allowed us to cruise across the Atlantic... spaceships… and new power-hungry appliances.

Expensive oil made it risky to innovate new physical products.

So America’s entrepreneurs responded to incentives. Innovators shifted their focus to creations that didn’t need barrels of oil (or millions of workers, as you’ll see in a second).

Cue the digital revolution.

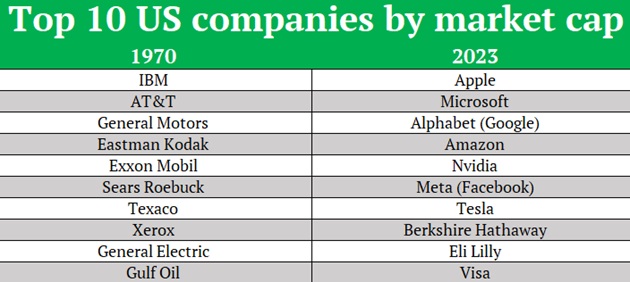

Look at the 10 most valuable US companies in 1970 vs. 2023:

In 1970, we had General Motors (GM), ExxonMobil (XOM), Texaco (CVX), General Electric (GE), Gulf Oil, and Sears.

These are companies that make and sell physical stuff.

Apple (AAPL) and Microsoft (MSFT) were born in the ‘70s. And while the growth of digital technology has been tremendous since the ‘70s, it’s the only significant part of our world that’s advanced.

Look around. Buildings… bridges… highways… they all look the same as they did in 1970. In many parts of the country, they look worse than 50 years ago because maintenance has barely kept up.

America is the wealthiest country in history thanks to its digital innovations. But digital businesses need much less manpower. So those riches were captured by fewer people.

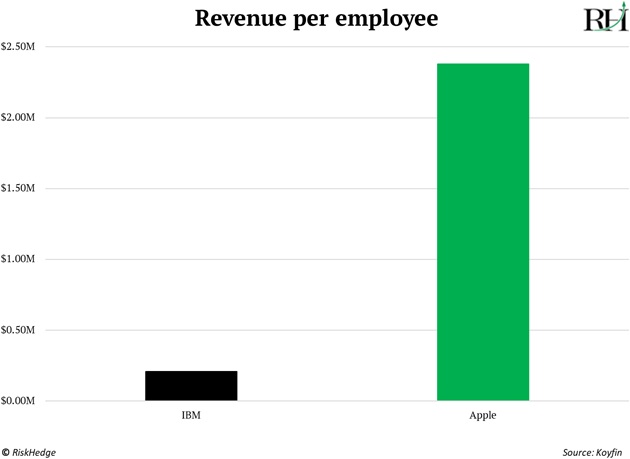

IBM (IBM)—the largest company in 1970—and Apple—the largest company in 2023—both make computers. But when you look at their “revenue per employee,” there’s no comparison. Apple makes 10X more revenue per employee!

In other words: More money is going to fewer people…

As a result, America’s best and brightest gravitated toward the digital world. There were benefits to this. We got genuinely great new inventions like Uber (UBER), Airbnb (ABNB), and streaming.

But I’d argue the drawbacks were bigger.

Since the companies with most of the money attracted most of the talent, many of America’s best and brightest worked at places like Google, where they figured out how to get you to click more ads rather than pushing forward the boundaries of the physical world.

So that’s the situation today. A handful of dominant tech companies are wildly profitable because they produce software, games, apps, and other digital things. These things require little energy and manpower—by far the two biggest input costs for most businesses—compared to making physical “stuff.”

America finds itself in an odd place. It’s the richest country in history. It has the richest, most successful companies in history (there’s no close second).

Yet most of America also looks like it’s stuck 50 years in the past. And many Americans are deeply unsatisfied and feel like they’ve been left behind.

But just like 1973… 2023 will be viewed as a major turning point for America.

Future generations will ask, “WTF happened in 2023?”

Except they’ll wonder why things started rapidly improving.

I shared this chart with you on Wednesday: It shows construction spending on new American factories.

After being stuck in the mud for all of modern history, it’s spiked to new highs and shows no sign of slowing down:

Source: FRED

Source: FRED

We’re building stuff again.

Guys like Elon Musk have revived the American spirit of imagining big, bold, brash innovations.

There are five industries driving this innovation shift.

I call them the “five horsemen of disruption.”

I’ll discuss two of these industries today. To learn about the other three, make sure to read Monday’s issue of The Jolt.

- The energy revolution… better late than never.

I already showed you how expensive energy suppresses real innovation.

Good news: Two types of better, cheaper, cleaner energy are coming.

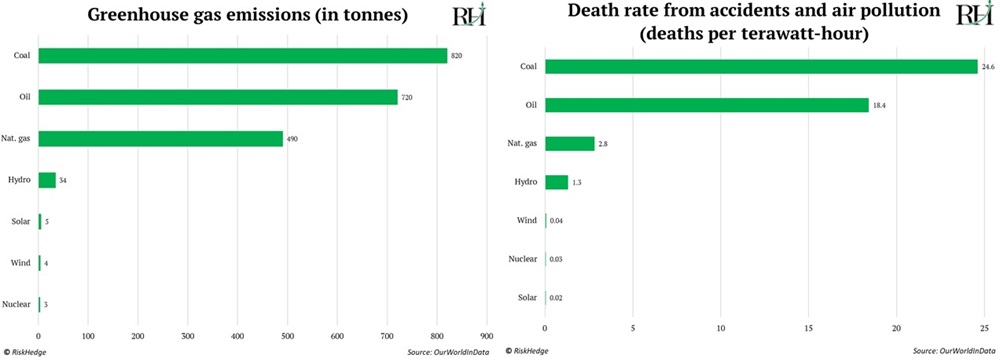

First, nuclear. Nuclear is indisputably the cleanest AND safest energy source in the world, as these charts show:

America made a horrible decision turning its back on nuclear decades ago. Well, better late than never. 2023 was the beginning of a nuclear renaissance.

Not only did we get the first-ever plant restart, but America’s first new nuclear unit in over 30 years is now up and running in Georgia.

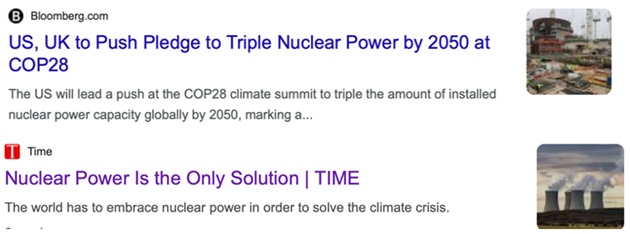

Bureaucrats spent decades hating on atomic energy. Now they’re doing a complete U-turn, as these recent headlines show:

Source: Google

Source: Google

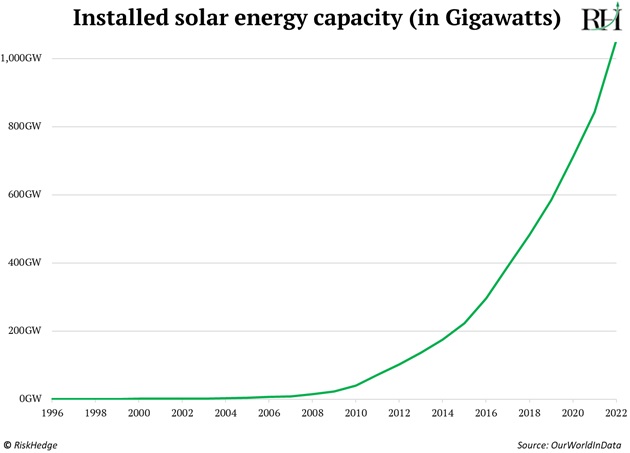

And don’t sleep on solar, which is one of the fastest-growing technologies ever.

In the last six months alone, $225 billion was spent rolling out solar energy. My math suggests the only tech deployed at a faster clip was railroads in the 1800s.

In 2023, investments in solar beat out investments in oil for the first time. The amount of “sun power” installed around the world is going parabolic:

This will bring back something we haven’t seen in many decades—cheaper energy!

That alone has the potential to drive productivity growth to levels not seen since the 1960s.

And we must talk about electric vehicles (EVs), which are enjoying rocket-ship growth.

EV sales topped 14 million in 2023, doubling in just two years.

Tesla’s (TSLA) Model Y was the best-selling car in the world last year. No, not the best-selling electric car. The best-selling car. Period.

EVs will win because they’re better than gas guzzlers. There are only 20 moving parts in an EV engine compared to roughly 2,000 in today’s traditional motors.

- The AI age has arrived.

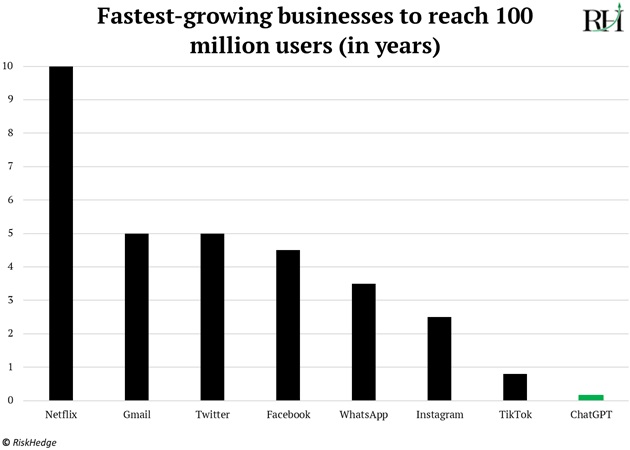

2023 was ChatGPT’s year.

It gained 100 million users in just two months, making it the fastest-growing product ever:

Artificial intelligence (AI) will move the needle for America by transforming our two most broken industries: healthcare and education.

It can take up to 15 years and several billion dollars to get a new drug approved and on pharmacy shelves.

AI solves this problem by analyzing mind-bending amounts of medical data. It then offers new ideas that would take us mere mortals a lifetime to discover.

AI systems are already dreaming up new drugs nobody has ever thought of, in a fraction of the time. There are currently 19 drugs developed by AI companies in clinical trials, up from zero three years ago.

Marc Andreessen—the venture capitalist who predicted the software revolution—recently said when describing this new era of AI, “Every child will have an AI tutor that is infinitely patient, infinitely knowledgeable, infinitely helpful.”

That era arrived in 2023.

New AI learning tools like Synthesis and Khanmigo look INCREDIBLE! The “magic” here is these AIs can learn the best way to teach each individual child.

They’ll know their strengths and weaknesses. They’ll be able to tailor lessons to each kid’s needs. “Stephen struggles with math, is a visual learner, and is sharpest in the morning. Design tomorrow’s lesson with these inputs.”

AI can already teach middle and high school kids. How long before it takes you through an entire four-year business degree… for FREE?

AI will steamroll education and build it back better. Future’s bright.

But AI’s single biggest impact will come from getting “physical.”

That includes self-driving cars, which drove a record number of miles in US cities in 2023. And autonomous drones, which recently got cleared to make long-range deliveries without someone watching from the ground (game-changer).

And above all else… I think AI robotics will revive “Made in the USA.”

If American factories automate, we could make stuff cheaper than China.

If THAT happens (it’s already started), take your idea of what’s possible and multiply it by 100X. This could create trillions of dollars in wealth for America—and the companies behind it.

We’re already invested in the robotics revolution in Disruption Investor. And we’ll continue to look for more stocks to add from this sector as automation becomes a bigger part of our lives.

On Monday, I’ll show you three more industries that will reshape the American economy… and create more opportunities to generate wealth than ever before.

Stay tuned.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com