Our absurdist idea… coming true?

- Stephen McBride

- |

- February 20, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

US stocks continue to march higher, led by Nvidia (NVDA).

The artificial intelligence (AI) chip kingpin is now worth more than Google (GOOG) and Amazon (AMZN)!

When the AI boom kicked off in late 2022, we jotted down a few “absurd” ideas we thought were possible, in order to stretch our minds.

Nvidia becoming America’s most valuable company topped our list.

We didn’t publish it because it sounded nuts.

But here we are. Nvidia has vaulted to the #3 spot, and I think it could take Microsoft’s (MSFT) crown before all is said and done.

NVDA’s meteoric rise has shown once again that great businesses profiting from disruption can go higher than you can possibly imagine.

(If you’re thinking about buying NVDA here, tread cautiously. Any stock that’s rocketed 400% in a little over a year is bound to retrace eventually. Disruption Investor members know what to do.)

Let’s get after it…

- AI’s latest "holy crap" moment.

Last August, I said we’d soon be watching Oscar-winning films produced by a machine.

This future is on our doorstep.

OpenAI just released Sora, an AI tool that can create hyper-realistic videos from a few lines of text. Check out this example from OpenAI’s website:

A stylish woman walks down a Tokyo street filled with warm, glowing, neon and animated city signage. She wears a black leather jacket, a long red dress, and black boots, and carries a black purse. She wears sunglasses and red lipstick. She walks confidently and casually. The street is damp and reflective, creating a mirror effect of the colorful lights.

Source: OpenAI

Watching these AI-generated clips is a “holy crap” moment. The world just changed.

It’s only a matter of time before we have AIs that dream up a brand-new movie idea in seconds… and then tailor-make it just for you.

I’ll be able to type, “Make me a new Tarantino-style thriller starring a young Denzel Washington, set in 1950s LA…”

… and watch the movie that evening.

This will also transform education. Why read about ancient Greece from a dull textbook when teachers can show you what it was like with photorealistic videos that only take 10 seconds to make? Game-changer.

Hollywood is in real trouble.

Movie execs are essentially trying to ban AI in filmmaking, as they’re worried about machines taking all the jobs.

Listen up, Hollywood: You can’t put the genie back in the bottle.

As AI expert Zvi Mowshowitz told me, “Any industry that doesn’t use AI is finished. You either adopt it or die.”

If Hollywood doesn’t change, it will get steamrolled by some AI startup that can make 10X more movies for 10% of the cost.

AI can also pull us out of this doom loop of endless superhero sequels.

Studios no longer make money from DVD sales. Without that cash stream, they’re choosing to only make films they know will sell at the box office.

But AI slashes the cost and time it takes to make a film. This should allow studios to take more creative risks and usher in a new golden era of creativity.

- RiskHedge reader John wrote me asking…

“I’d love to see you comment on the real underlying reasons that electric vehicles (EVs) are struggling to hit a growth curve inflection in the US. And as investors, are EVs investable?”

Americans bought a record 1.2 million battery-powered cars last year. That’s 50% growth—impressive given we’re talking about cars.

Technological breakthroughs don’t happen overnight. Adoption often takes decades.

The fax machine was invented in the 1870s. It didn’t become commercialized until the 1970s.

The cost of EVs has come WAY down. You can now buy a Tesla Model Y (the best-selling car in the world in 2023) for under $50,000.

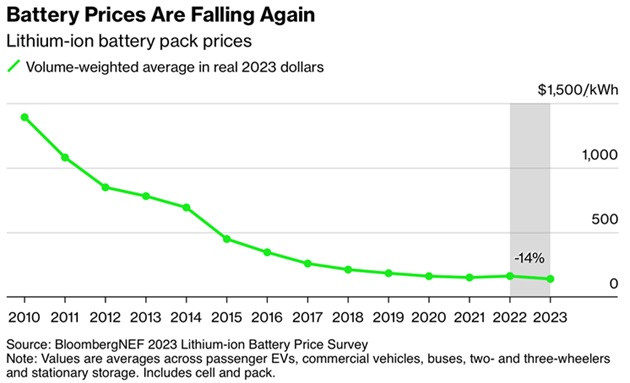

We can thank rapidly falling battery costs (down 90% since 2010) for this:

Source: Bloomberg

Entrepreneurs around the world continue to find new ways to make batteries better… faster… and cheaper.

If this trend continues (I think it will), five years from now, EVs will be far cheaper than their gas-guzzling cousins.

Besides cost, the best thing for EV adoption is… more people buying EVs.

Buying a battery-powered car is still a little weird. Charging your engine feels strange. But when all your neighbors have their cars plugged in at night, then you’ll want one too.

“Are EVs investable?”

We doubled our money on lithium producer Albemarle (ALB). But unfortunately, there are no great businesses in the EV space today. They’re more suited to trading.

I’m watching and waiting for “China’s Tesla,” BYD (BYDDY), to bottom.

Avoid it for now.

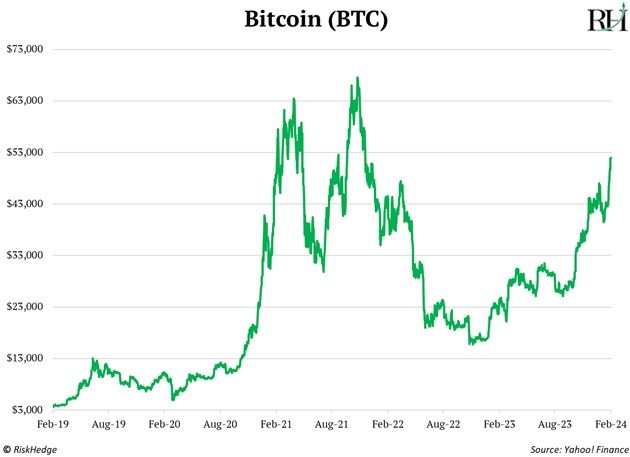

- Bitcoin marches past $50,000 for the first time since 2021…

This comes on the back of the first bitcoin (BTC) ETFs being approved a few weeks ago:

Look at that chart. It’s going to all-time highs. My work suggests bitcoin can hit $150,000 by the end of the year.

I’m shocked by how many smart, savvy finance pros still think this asset class is nothing more than a bunch of worthless “cryptocurrencies.”

I view crypto as a “test” for investors. As the facts change, are you capable of changing your mind? Sadly, many people flunk.

As I’ve said from Day 1, digital money is only one use of this incredible new technology. Blockchain represents a whole new way to launch and operate a business. It’s created an entirely new asset class: crypto businesses.

That’s why I founded our crypto advisory, RiskHedge Venture. We only buy crypto businesses with real products producing real revenues.

And yes, our portfolio is outperforming bitcoin this year. If you’re crypto curious, you can get more details here.

- Today’s dose of optimism…

Back in 2017, President Obama had this to say to a group of young British leaders:

If you had to choose one moment in history in which you could be born, and you didn’t know ahead of time who you were going to be—what nationality, what gender, what race, whether you’d be rich or poor, what faith you’d be born into—you wouldn’t choose 100 years ago. You’d choose right now.

He went on to say the world has never been “healthier, wealthier, better educated, or in many ways more tolerant, or less violent, than it is today.”

Obama nailed it. The world is far from perfect. We have lots of problems. But there’s never been a better time to be alive.

Leave the whining to the doomers and seize the opportunities we’re being given.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com