Off to Nashville

- Stephen McBride

- |

- June 3, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Stephen here... I’m at the Dublin airport, about to board a plane to Nashville.

I’m passing today’s Jolt off to Executive Editor Chris Reilly. Talk to you Monday.

***

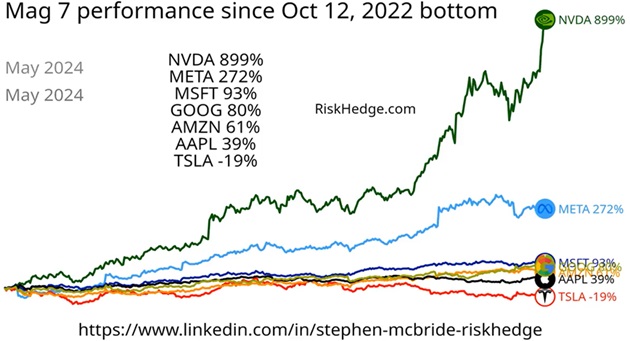

- Nvidia (NVDA)… wow. How high can this thing go?

The artificial intelligence (AI) chip king has been on a tear this year (+128%)—after surging 239% last year—with no sign of slowing down.

Crushed earnings (again). Smashed through a record high...

And look at this: Since the October 2022 market bottom, it’s made the group of big, high-performing tech stocks known as the “Mag 7” look more like “Mag 1 and the other 6”...

Source: RiskHedge

Congrats if you bought Nvidia off Stephen’s original recommendation back in 2018.

Fun fact:

Nvidia just announced a 10-for-1 stock split—set for June 7.

Its last stock split was a 4-for-1 back in 2021.

That means for every NVDA share you bought back when Stephen first recommended it... you’ll soon have 40 shares. 4,000 for every 100... and so on.

Of course, stock splits are just noise. It doesn’t make the stock any cheaper. But another split shows just how much the stock’s run up over the years... and it’ll make the price appear more attractive for new investors.

|

Stephen’s guidance hasn’t changed.

If you’re sitting on big gains in Nvidia, take some profits. If you haven’t taken profits yet, your stake is worth 5X, 10X, or more on your original investment depending on when you bought in. That’s a lot of money concentrated in one stock.

Stephen recommended Disruption Investor members sell half their position earlier this year.

Taking profits accomplishes two things: 1) it reduces risk and 2) lets you continue to profit from NVDA’s once-in-a-decade ascent.

If you don’t have a position, don’t overthink it. As Stephen says, we’re in the middle of the largest buildout in history (artificial intelligence). “Own the winners when the music is playing.”

- Of course, you’re also wondering when the music’s going to stop.

When will this AI boom inevitably crash?

After all, NVDA isn’t the only AI stock up big. Many other AI stocks have soared, like Super Micro Computer (SMCI)—up 920%. Justin Spittler’s members have had a great time trading it inside RiskHedge Live.

Stephen says the AI boom has at least one year left to run, maybe more. Stephen:

The AI infrastructure boom kicked off last May when Nvidia reported a blowout quarter that will go down in the history books. But the trend of AI transforming our largest and most important industries is a decade-long shift. In other words, we’re incredibly early.

The latest quarterly earnings from the biggest AI companies tell us there’s no slowdown in sight. And as long as companies are finding new ways to boost their businesses with this tech, the spending will continue.

Stephen says you’ll see countless headlines in the coming months calling for the end of the AI boom.

Ignore them and follow the money. The unfathomable, recording-setting sums of money being invested into AI infrastructure by the richest companies in the history of planet Earth:

The AI buildout is the largest infrastructure project ever. This year alone, Microsoft (MSFT), Amazon (AMZN), Google (GOOG), and Facebook (META) will spend more than $170 billion building data centers.

Over the next 3–4 years, companies will spend more money on chips and servers than the US government spent putting a man on the moon or building America’s highways.

Also...

- Don’t forget there will be big losers from AI.

Take giant software company Salesforce (CRM). It plummeted 20% yesterday after missing revenue expectations for the first time in nearly 20 years.

If you tuned into Stephen’s Trillion Dollar AI Investment Portfolio event last November, you might recall Salesforce was one of the five stocks Stephen said to avoid.

The company is in trouble because AI can easily automate most of what it does.

Startup Inflection AI, for example, can generate natural language content for lots of purposes, including sales and marketing. Stephen and Chris Wood say it could disrupt Salesforce by creating better, faster, cheaper customer relationship tools.

Don’t buy the dip in Salesforce. It’s a “sitting duck” that has a lot to lose as AI transforms its whole industry.

Chris Reilly

Executive Editor, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com