My 6-year obsession with the world’s best businesses

- Stephen McBride

- |

- March 26, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

The S&P 500 continues to impress, having notched its 20th record high of the year last week.

Interestingly, tech stocks are no longer leading. Stragglers like industrials and basic materials are leading the pack.

The pros call this “rotation.” While it’s the sign of a healthy market, I still expect a correction soon.

Crypto is also on a tear, with bitcoin (BTC) surging 50% since January.

These price movements can seem random. But really, it’s all part of bitcoin’s all-important “halving” cycle.

We’re 25 days out from the fourth bitcoin halving. More on this Wednesday.

- Elon Musk’s brain chip “already changed my life.”

Elon’s startup Neuralink is building a special chip that allows us to mind-control computers.

And it just let Noland Arbaugh—who’s paralyzed from the shoulders down—play chess using only his thoughts.

Noland simply thinks “pawn to E4”… and the chip in his brain moves the cursor.

Watch the clip here. It gave me chills.

Unfortunately, many Americans have fallen into the trap of cynicism when it comes to new things. Look no further than the media’s reaction to SpaceX’s successful launch of a skyscraper-sized rocket 10 days ago:

Sources: CNN; Texas Monthly; The Verge

C’mon, guys. Look around you.

The wonders of modern life—your refrigerator and HVAC system, the internet, and the device you’re reading this on—were new technologies invented by people.

I’m a big believer in the Stoic idea of negative visualization. Imagine what could go wrong so you appreciate all the wonderful things in life.

Imagine life without these inventions? It would be so much worse. The internet was my ticket out of a rough neighborhood growing up.

We have an obligation to fight for technology. We need to keep pushing the boundaries for folks like Noland Arbaugh.

Let’s make innovation cool again.

- My 6-year obsession with the world’s best businesses.

My first-ever RiskHedge essay back in 2018 made the case for Dutch computer chip giant ASML Holding (ASML).

We’ve made good money investing in chip companies, largely because we recognized that each “sub” industry is dominated by one or two giants:

- ASML has a total monopoly on the latest and greatest chip machines.

- Only two companies can actually make these cutting-edge chips.

- Nvidia (NVDA) dominates the artificial intelligence (AI) chip market.

- The chip design market is controlled by two firms.

These companies can charge customers whatever they want because they’re the only game in town. This allows them to rake in growing profits year after year.

Why are they the only game in town? Because making modern chips is hands down the most complicated, costly, and expensive manufacturing process there is.

For example, ASML machines “etch” little switches into chips with a precision equivalent to shooting an arrow from Earth and hitting an apple on the moon.

Taiwan Semiconductor (TSM) makes transistors that are 500,000 times smaller than a millimeter.

Software is competitive because two college dropouts can write code in their parents’ garage to create the next Facebook (META).

With chipmaking? “Barrier to entry” doesn’t begin to describe it. We’re talking Great-Wall-of-China levels of difficulty here.

That’s why we continue to invest in the world’s top chip companies in Disruption Investor.

- Picture this: You tear open your monthly electricity bill...

AMOUNT DUE: $1.

This could’ve been real if we hadn’t let special interests and environmentalists crush the cleanest, safest, most abundant source of energy—nuclear power.

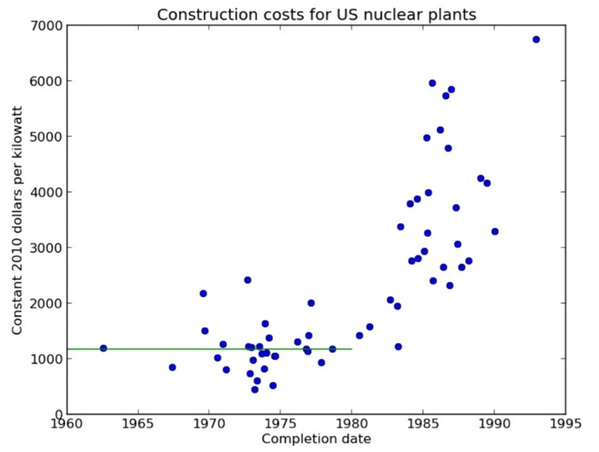

America was building nuclear reactors by the dozen in the ![]() 60s and '70s. And they were producing energy almost “too cheap to meter.”

60s and '70s. And they were producing energy almost “too cheap to meter.”

Then the Department of Energy began regulating nuclear power in the late '70s… and the dream of cheap, safe, clean energy went up in smoke.

As this chart from “Where’s My Flying Car?” shows (great book, would highly recommend), power plant construction costs ballooned and made nuclear much more expensive:

Source: Where’s My Flying Car?

Today, AI is like nuclear was 50 years ago.

It’s a breakthrough new technology bureaucrats are trying wrap their dirty tentacles around.

A US government-commissioned report published last week recommends setting up a new federal AI agency. Among other things, the report says we should make it illegal to train AI models more powerful than the current state-of-the-art ones.

This is so wrong, I don’t know where to start.

Imagine trying to limit internet speeds in the mid-'90s. “We shouldn’t have internet faster than dial-up.”

AI can transform America. It can create personalized tutors that turn our kids into straight-A students. It can develop lifesaving drugs at warp speed (and already is).

But if we let the bureaucrats in, they’ll strangle AI in its crib. And these life-changing innovations will become fantasies, just like $1 energy bills.

Right now, we have a small window to keep AI open. A crackdown, like with nuclear, would be very hard to undo.

I’m doing my part by talking about the upside of AI. We’re also putting our money where our mouths are by continuing to invest in the AI infrastructure winners in Disruption Investor.

(Rational) optimists decide the future.

Watch your inbox for a special edition of The Jolt on Wednesday.

Stephen McBride

Chief Analyst, RiskHedge

PS: My friend and resource industry veteran Marin Katusa just posed a great question.

“Would you rather own 30 ounces of gold or 1 bitcoin?”

Both recently hit all-time highs.

If you chose bitcoin, stay tuned because I’ll have a lot more to say over the next two weeks as we approach the “halving... ”

If you chose gold, you may be interested in this special deal from our friends at Hard Assets Alliance. They’ve made buying gold extremely simple… whether you're a beginner or someone who's bought gold for years. And their network of wholesale dealers ensures you always get the best possible price.

Use this link to get 12 months of free storage.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com