Meet Hercules and Robin

- Stephen McBride

- |

- October 16, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Good morning… We’re up before the enemy on the first day of Q3 earnings season.

And we’re off to a strong start. Three of Wall Street’s big banks—JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C)—all beat earnings this morning.

When the banks are doing well, America is usually doing well. I’m bullish.

Here’s what I’m thinking…

- Will Nvidia save the stock market again?

Last Friday, I told you strong earnings from corporate America would send stocks roaring higher into the end of the year.

We got our first taste of earnings this morning, and I’m doubling down on this call.

Remember how markets were teetering in May? Three regional banks had failed… the S&P 500 was limping along like a wounded dog, and Wall Street was betting against stocks.

Then AI chip leader Nvidia (NVDA) blew our faces off with the greatest earnings report of all time.

The mood flipped on a dime, sending the S&P 500 ripping higher through the summer:

Our work suggests another earnings-driven rally is locked, loaded, and ready to fire.

This time, the big upside surprise will come from one of two places...

#1: NVIDIA: Nvidia’s earnings will blow everyone away (again). A friend of mine, an executive at one of Asia’s top AI companies, just messaged me: “Working on a deal today and was informed Nvidia chips have a 52-week lead time. Crazy!”

#2: Retailers, restaurants, and travel: Americans continue to spend dollars like they’re printed from thin air. Oh wait, they are. These stocks are expected to have the highest growth of any sector this quarter.

If you’re looking to pick up some pre-earnings bargains, remember to focus on great businesses profiting from disruption. That’s our game plan in Disruption Investor. (Sorry—new member enrollment is currently closed, for reasons you’ll soon find out.)

- Cyberattacks scare the hell out of me.

Some teenager half the world away can drain your bank account at the click of a button.

Far more money has been stolen by kids behind keyboards than gangsters with guns.

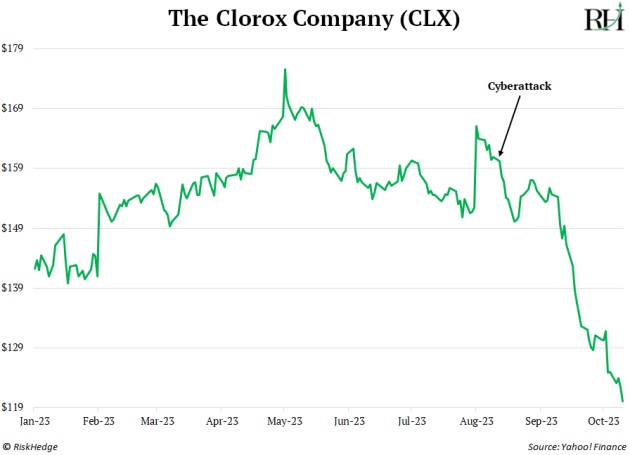

The world’s biggest and supposedly safest companies are not immune. Bleach maker Clorox (CLX) got hacked recently. Some of its factories were forced to shut down, costing up to $400 million in lost sales this quarter. Ouch!

Here’s what Clorox shareholders thought of the news…

Casino operator MGM Resorts International (MGM) is another recent cyber victim. Hackers crippled its computer systems, which will dent profits by $100 million.

Cyberattacks are a huge problem with no permanent solution.

But I’ll go back to the line I live by: “Pessimists sound smart; optimists make money.”

Instead of dwelling on how hackers can light a portfolio on fire, we bet on savvy entrepreneurs fighting back. Thanks to the stock market, we can piggyback on their successes by investing in their companies.

That’s why we own one of America’s fastest-growing cybersecurity companies in Disruption Investor.

Its stock jumped 80% this year, and there’s plenty of upside left.

- American factories are being reinvented…

Hercules can carry up to 3,000 lbs. on its back while traveling the length of 10 football fields.

Robin handles around 10 million packages every single day.

These aren’t cute superhero nicknames.

They’re two of Amazon’s (AMZN) top-performing robots.

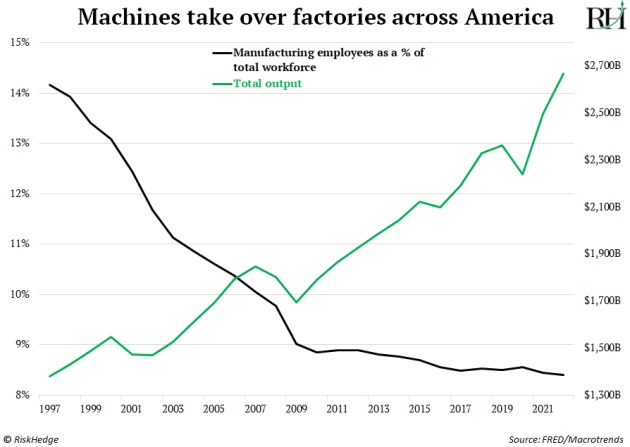

Machines are transforming factories across America.

As a share of the overall workforce, manufacturing jobs have never been a smaller slice of the pie. Yet America cranked out more stuff than ever last year, as this chart shows:

This was made possible by robots. Lots and lots of robots.

Amazon employs roughly 750,000 “Hercules and Robins” in its factories.

America’s largest employer—Walmart (WMT)—is automating its warehouses with Symbotic (SYM) machines. Symbotic’s stock has surged 237% since January.

Robotics are going to drive a big wedge between the haves and have-nots.

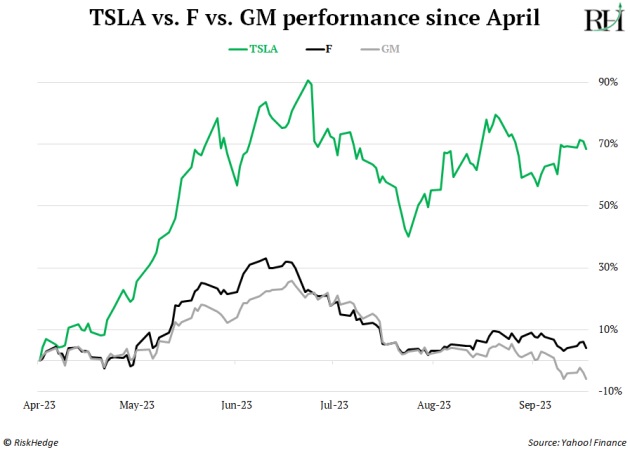

Compare Tesla (TSLA) to its Detroit rivals, General Motors (GM) and Ford (F). Here’s what the inside of a Tesla factory looks like…

Source: Tesla

Meanwhile, GM and Ford plants are idle due to striking workers.

Tesla’s shareholders are sitting back and laughing at Ford and GM:

This is the big divide I’m talking about, and it’s only going to grow.

My job is to put you on the right side of this trend.

- Feedback Friday… your questions and comments.

I’ve gotten tons of great questions and comments from Jolt readers.

Let me answer a few.

(If you want to see more—or less—of this, let me know at stephen@riskhedge.com.)

Rob says: “As one who spent two decades in the military, I love what you say about exercise. The other thing I find really beneficial is fasting—not the intermittent kind, but real fasting. Like for a week or so.”

I remember about 15 years ago, a health craze broke out surrounding the “Mediterranean diet.” People thought eating plates of olive oil and bread would get you looking like a young Leo DiCaprio.

Turns out, it had nothing to do with the food and everything to do with the fasting. Many people who live in Mediterranean countries fast for 180 days a year, for religious reasons.

These folks also climb a lot of stairs and steep hills, which helps. I’m a big fan of fasting, although I don’t practice it as I train hard five days a week and need fuel.

Rob, you’re a better man than me if you can fast for a week!

Bradley asks: “Hey man, love the emails and priceless knowledge. I've been reading for a long time. My question isn't a market question. What I want to know is, ‘What's your Fran time?’”

Bradley, I laughed out loud when I read your note.

“Fran” is a CrossFit workout where you have to do 21-15-9 reps of barbell thrusters (95 lbs. for men) and pull-ups. It’s a pain-cave workout! I’ve completed it in under two minutes, which isn’t bad given I’m over 6 ft. and weigh 200 lbs.

Joe says: “In this period where it seems negativity is abundant, your Jolt email provides an appreciated burst of positivity with tidbits to think about. Thanks!”

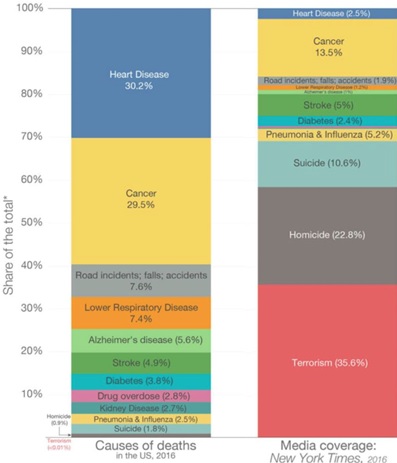

Thanks for the kind words, Joe. The easiest thing we can all do to become a little bit more optimistic is to turn off the news.

The more news you consume, the less well-informed you become.

Want to know more about the world AND be happier? Turn off the news. This chart, which compares the leading causes of death against media headlines, sums it up nicely:

Source: Bill Gates on Twitter/X

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com