Introducing Neverland… where we’ll crush Wall Street

- Stephen McBride

- |

- March 22, 2021

- |

- Comments

This article appears courtesy of RiskHedge.

Welcome to “Neverland”…

In Neverland, stocks soar 400% in months... then tank 30% in weeks.

In Neverland, stocks swing from bull market… to bear market… and back to bull market again... in the span of a few months.

In Neverland, some ordinary investors lose their shirts… while other ordinary investors make a fortune.

In Neverland, you may find yourself thinking: Why doesn’t the world make sense anymore?

Today, I’ll show you exactly what’s going on…

And more importantly, how you can come out on top, financially.

- This time last year, the world changed forever.

Trump suspended flights from Europe. The NBA cancelled its season. Then came the news actor Tom Hanks caught COVID… all within a few hours.

I never thought I’d see pubs closed on St. Patrick’s Day in Ireland. Yet, they’ve been shut down in back-to-back years…

But that’s just the beginning…

- Dozens of "things that never happened before" have happened recently.

Right before COVID struck, America’s economy was cruising. In February 2020, unemployment hit its lowest levels in over 50 years.

Then just a few weeks later, the number of Americans out of work hit its highest peak since the Great Depression.

Government shutdowns crippled large parts of the economy.

For example, almost 20 million Americans work in bars, hotels, and restaurants.

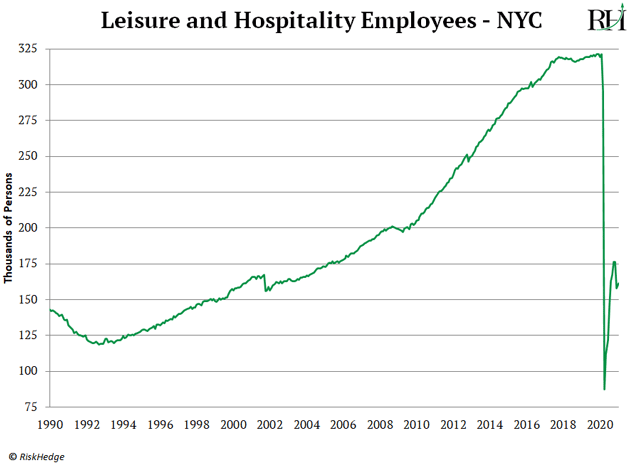

Look at the waterfall decline in New York City’s leisure workers in 2020. It’s totally unprecedented:

- Now we’re about to run the largest experiment ever.

Something else just happened for the first time in American history.

As you know, tens of millions of workers were laid off during COVID. When folks lose their jobs, they usually can’t save much money.

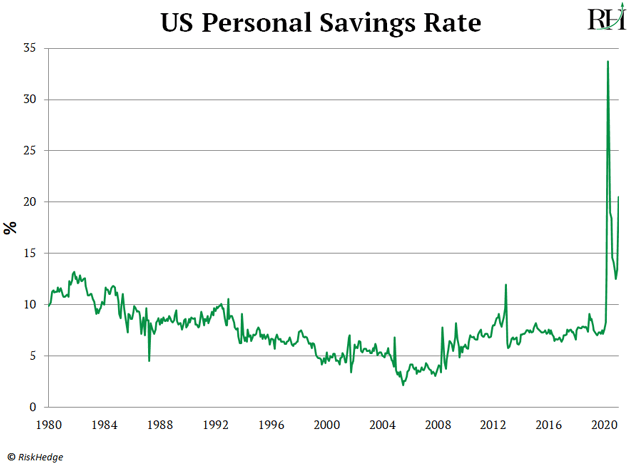

But COVID was unlike any downturn ever. It was the only recession in history where the personal savings rate hit an all-time high. With everyone stuck at home, nobody was spending on vacations, restaurants, gas, or movies…

As you can see, Americans are saving more money than ever before... and by a long shot:

In fact, they saved $1.8 trillion more than they would have if COVID never happened, according to research from Oxford Economics.

- Governments play a key role in “Neverland” too.

In response to COVID, governments have “stimulated” the economy like never before.

According to Reuters, governments pumped out over $15 trillion in stimulus in the last year alone.

Just last week the Biden administration threw another $1.9 trillion into the mix. You likely know a lot of this money is being wired directly into Americans’ bank accounts in the form of stimulus checks and tax credits.

This latest financial bazooka hands a middle class family of four roughly $12,000!

You can debate if it’s good or bad.

The point is nothing like this has EVER happened before.

Not even close.

We’re living in Neverland.

Just as the US government is handing out big wads of cash, America is reopening.

Restaurants, hotels and airlines have essentially been on life support for a whole year. For example, TSA passenger numbers collapsed 90% during COVID.

Now they’re set to “reopen”... and experience demand like they’ve never seen before. Passengers will be packed like sardines in airports this summer. (Good luck getting a reservation at your favorite restaurant.)

- Stocks are also doing things they've never done before.

The COVID crash sunk US stocks into their fastest bear market ever.

Last March, it took the S&P 500 only 22 trading days to crash 30% from its record high.

That had never happened before.

Then stocks turned right around and launched into their fastest recovery in history. They hit record highs less than five months after collapsing.

That had never happened before.

But the “nevers” don’t stop there.

As you know, tech stocks have had a rough time lately.

But did you know that names like Zoom… Teladoc… and DocuSign collapsed more over the past month than during the COVID crash?

Investors have now experienced two 40%+ drops in many tech stocks in the past 12 months.

Never happened before.

Meanwhile, many folks are making more money than they ever dreamed of.

I’ve been a casual observer on Reddit’s WallStreetBets message board for the past year. This is where investors banded together to drive GameStop’s (GME) struggling stock price up over 700% in less than a week.

Based on screenshots uploaded by members, many of their brokerage accounts have multiplied 5X to 10X over the past year.

Many say they’ve used the gains to put down payments on houses and to pay off student loans.

- With all the “nevers” happening in the real world… the unprecedented behavior in stocks starts to make a little more sense.

In fact, it would be weirder if stocks were behaving normally!

Most investors are confused right now. If that’s you, it’s not your fault. This is Neverland, after all.

Everything investors thought they knew has been disrupted.

But I want you to know that you don’t have to sit back, watch the craziness unfold, and “hope for the best.”

- The truth is Neverland is handing ordinary investors a once-in-a-generation profit opportunity.

That’s because, in Neverland, Wall Street is working from an obsolete playbook.

As you know, Wall Street has ruled the markets for the past hundred years. Rich bankers and hedge fund managers have all the “inside” connections and knowledge. They have super-fast computers that make trades faster than you can blink.

In a “normal” market… it’s pretty much impossible to compete with them.

Their advantages were too big, too entrenched.

But in Neverland, where we find ourselves today, the playing field has been levelled.

In Neverland, you are just as experienced as a seasoned team of Goldman Sachs bankers.

Make no mistake: This new world of “nevers” has disrupted the status quo, catching many folks off guard. Especially Wall Street.

- In Neverland, you have only two choices:

You can panic.

Sadly, this is the path most folks will unknowingly choose.

It’s hard to keep a cool head when the world you thought you knew is being fundamentally disrupted.

Or, you can come with me on path two...

And potentially make more money investing in Neverland in the next year or two than most folks see in 20 years.

- On March 29, at a special event titled America’s Final Tech Panic, I’ll show you exactly what to do.

And I’ll keep it simple. My research shows there’s ONE MOVE you should make with your money today. Just one move… that can set you up to amass lasting wealth in the months ahead.

This will be—hands down—our most important event of the year. As you’ve seen, there’s a lot at stake. And I’ll show you exactly where to park your money today to come out on top of the wildest stock market we've seen in 11 years…

I’ll even give you my #1 stock to own in 2021 no matter where the markets go. This is unlike anything we’ve ever done at RiskHedge. So I hope you can join me. To lock in your spot (we expect more than 10,000 registrants), go here now.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com