How to see 223% gains in a bear market

- Stephen McBride

- |

- August 29, 2022

- |

- Comments

This article appears courtesy of RiskHedge.

Tripling your money… in this market?

I know, that might sound crazy…

The S&P 500 has fallen 13% since peaking in January. Google and Amazon are down 20% this year. Most stocks are down, not up.

Yet… one of my top holdings in my Disruption Investor advisory just surged to fresh all-time highs.

And it’s not too late to invest in this winner…

Albemarle (ALB) is fueling one of the world’s fastest-growing megatrends—it’s up 223% since my premium readers got in.

I’ll soon explain what Albemarle does and why it still has room to grow, but first—let’s look at the massive industry it’s powering.

I’m talking about the electric vehicle market…

When most folks think electric cars, they think Tesla.

-

Tesla is one of the best-performing stocks over the past decade…

A decade ago, Tesla was a tiny $3 billion company. Now it’s the world’s sixth-largest company, valued at roughly $900 billion. It’s handed investors 15,000% gains since 2012.

Tesla single-handedly made the electric car popular.

In 2015, it sold less than 20,000 battery-powered cars. Tesla shipped over 280,000 electric vehicles (EVs) in the first six months of this year alone!

-

Tesla was the only game in town when it came to high-performance EVs…

Now every automaker is jumping into the race.

Ford’s electric F-150 truck is hitting the roads as we speak. In fact, its EV sales more than doubled over the past year. The first battery-powered Cadillac is expected to hit the roads in the next few months. Mercedes and Toyota announced their plans to go all-electric in the coming years.

In fact, EV sales are going through the roof right now.

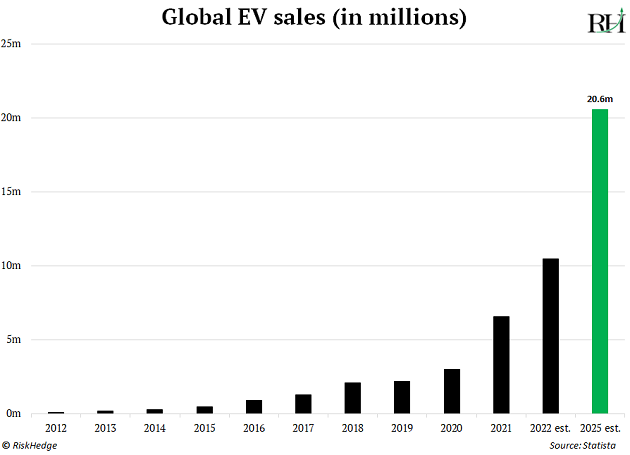

There were only 120,000 electric cars sold worldwide in 2012. Today folks are buying 225,000 battery-powered cars per week, on average.

One in 10 cars sold around the world last year was electric; that’s a 4X jump since 2019. And Bloomberg data shows annual EV sales are on pace to hit 20 million within three years.

We’re entering the “mass adoption” phase for EVs.

Expect blistering growth in the coming year as folks ditch gas guzzlers for battery-powered cars.

-

What’s the best way to make money from this disruption?

Most would say, “Buy Tesla.”

Makes sense, right? Tesla pioneered this industry and still makes the best EVs money can buy.

Others might follow superinvestor Warren Buffett and buy Chinese automaker BYD. It recently dethroned Tesla as the top-selling EV maker.

These folks think they’re investing in the growth of EVs… but really, they’re betting on the success of one or two companies. That’s a risky bet.

However, there’s a simpler way to profit off the EV megatrend...

-

You want to invest in the “white gold” fueling nearly every EV on the road today.

What’s the biggest difference between regular gas guzzlers and electric cars?

It comes down to what’s under the hood.

When you pop the hood on an electric car, you won’t find an engine. They run on batteries, like the one in your smartphone… but 10,000X more powerful.

The battery is by far the most critical part of an EV. It determines how far you can drive before you have to “refuel” at a charging station. Batteries powerful enough to run a car for 300 miles must be able to store huge amounts of energy.

But they also have to be relatively lightweight.

This makes lithium—the world’s lightest metal—the perfect “fuel” for electric cars.

Lithium-ion batteries have been around for decades. They power our wireless earbuds, smartphones, and laptops. But now we’re moving from phone-sized batteries to car-sized batteries.

Take Tesla’s Model S, for example. There are roughly 140 lbs. of lithium inside its battery. And Tesla is no longer the only game in town. Every automaker is “going electric.”

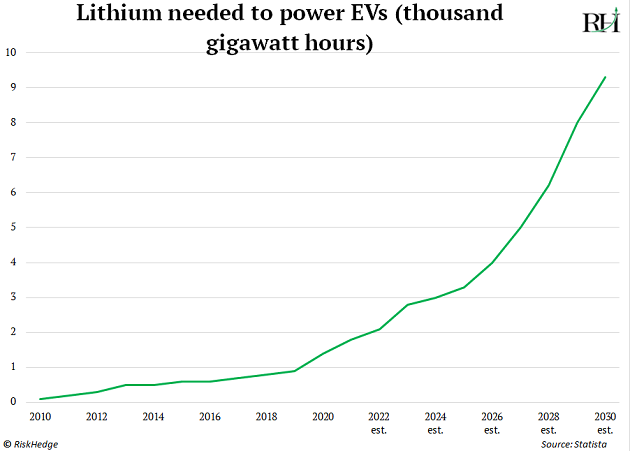

We’re going to need boatloads of lithium.

In fact, by 2030, electric vehicles will need as much lithium as 250 billion iPhone batteries. That’s a 14X spike compared to all the lithium the world uses today!

-

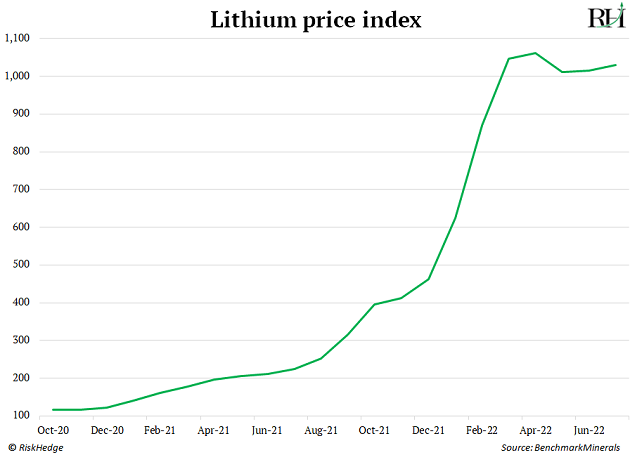

Surging demand for lithium is sending prices through the roof.

The cost of a ton of lithium jumped nine-fold over the past two years.

When asked about lithium in a recent interview, Tesla CEO Elon Musk said, “I’d like to once again urge entrepreneurs to enter the lithium business. You can’t lose—it’s a license to print money.”

This is great for the world’s largest lithium producer, Albemarle (ALB).

We’ve owned Albemarle in our Disruption Investor portfolio for a while. And I’ve recommended it a handful of times here in the RiskHedge Report, most recently in January.

As I mentioned, it’s one of the few stocks hitting fresh all-time highs today.

- Albemarle controls over a quarter of the market and owns the purest lithium mines on the planet.

Carmakers like GM, Ford, and Tesla need boatloads of battery-grade lithium. Albemarle will be their prime supplier. It sold over $1.4 billion worth of battery-grade lithium to electric car makers in the first half of 2022.

In fact, Albemarle’s lithium sales nearly tripled over the past year. And it’s on track to achieve record earnings this year.

Disruption Investor members tripled their money in Albemarle since my original recommendation in 2019, accounting for our Free Ride. And if you don’t already own the stock, it’s not too late to jump in.

Remember, we’re just entering the “mass adoption” phase for EVs. Today, battery-powered cars are roughly where smartphones were back in 2010. A decade ago, one in 10 people owned a smartphone. In 2022, one in 10 cars sold is an EV.

Expect EV’s share to grow rapidly over the coming years. As the disruptor fueling every automaker’s electric dreams, Albemarle stands to make a killing.

It’s a great time to buy ALB if you’re a long-term investor.

Stephen McBride

Editor — Disruption Investor

P.S. Did you catch my latest presentation? I got on camera to pull back the curtain on the biggest change to the investing landscape of the last 88 years.

Simply put, I believe this is the most important issue affecting you and your money today.

And I’ve laid out all the details here. Including how you can protect yourself today... and the #1 play to unlock surprising gains…

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com