How to profit from Taylor Swift’s $1 billion tour

- Stephen McBride

- |

- July 31, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Taylor Swift fans are hardcore.

Three million people queued in the virtual line to buy tickets for the superstar’s upcoming gigs in Buenos Aires.

The concerts are five months away. But “Swifties” are already camping outside the stadium in tents to get front-row seats!

What’s an analyst like me doing talking about a pop singer?

Well, friends, investment ideas often come from the strangest places.

And as I’ll show you, Taylor Swift is at the bleeding edge of an ultra-profitable, disruptive megatrend.

- Records are made to be broken…

Superstar Taylor Swift is performing live shows across America right now.

Her “Eras” tour is hitting crazy numbers.

Swift is selling out 50,000-seat stadiums every other night. And tickets ain’t cheap… $200, on average.

Back-of-the-napkin math shows Swift is raking in roughly $10 million per night.

Multiply that by the 130-odd shows she will perform over the next year, and “Eras” is on track to be the first $1 billion tour.

- “Stephen… what does this have to do with investing?”

I’ll answer that question with a question.

How many hours a day do you spend staring at a screen?

I spend at least 12 hours a day in “cyberspace.” I often talk to colleagues who are half the world away more than I talk to my wife!

And like me, you also probably shop on Amazon… share insights on Twitter… and watch “TV” on YouTube.

Here’s why this matters:

As we spend more and more time online, real-world experiences like concerts and vacations will become increasingly valuable. And it’s sending “experience” stocks to new highs.

The experience boom is why Taylor Swift is raking in $10 million per gig.

It’s also why America has turned into vacation nation.

- I’ve been working with Americans for years. I’ve never seen them take so many vacations.

Over 2.8 million travelers passed through TSA checkpoints across the US on June 30. It was the single busiest day for US airports, ever.

Delta Air Lines (DAL)… United Airlines (UAL)… and American Airlines (AAL) all achieved record revenues last quarter.

Remember when folks predicted cruises would be dead forever during COVID?

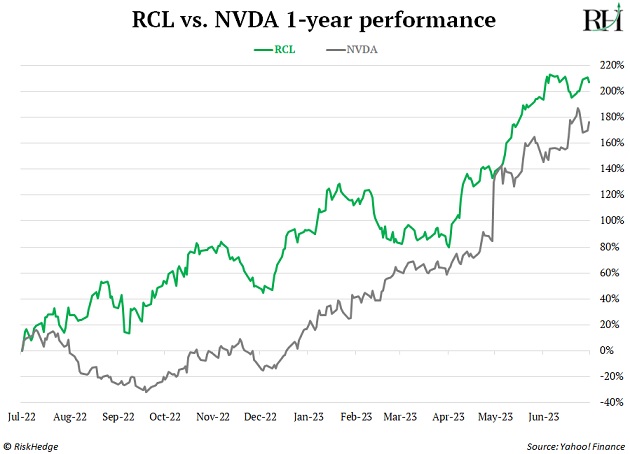

Royal Caribbean Cruises (RCL) is on track to hit record passenger numbers this year. Oops! Its stock has outperformed artificial intelligence chip leader Nvidia (NVDA) over the past year:

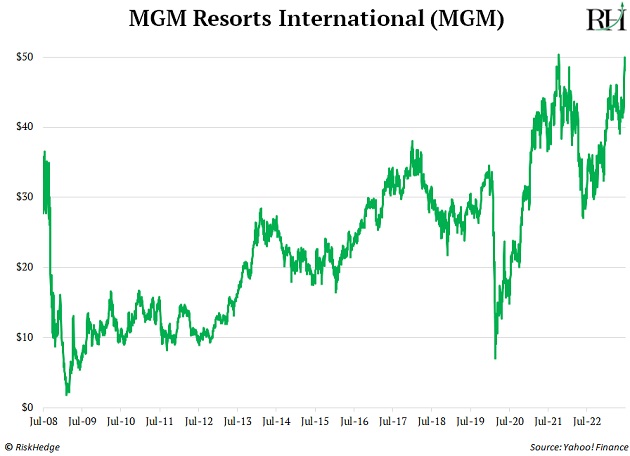

Planning a crazy weekend in Sin City? You’re not alone. Las Vegas’s MGM Resorts International (MGM) has rocketed 50% this year, and is trading at its highest levels since 2021:

This isn’t just post-COVID “revenge travel.” The experience boom started long before a pandemic couped us up for over a year.

Check out this 2019 photo taken at the highest peak in the world.

You’d think the number of people willing to fork out $50,000… spend two months away from family… and risk their lives to climb Mount Everest would be small.

Yet there was a queue to summit Mount Everest!

Source: Project Possible

Source: Project Possible

- Think about what makes you truly happy.

I doubt it’s that new-car smell or a crisp $3,000 suit.

It’s experiences like vacations with your kids and laughing over dinner with friends.

When you spend all day, every day, staring at a screen… it feels great to walk outside and touch some grass. I often joke that some of my colleagues secretly find manual labor refreshing.

As our lives become increasingly digital, experiences—going places and doing things in the real world—will become ever more valuable.

And that means people will spend ever greater amounts of money on those experiences.

There are right ways—and wrong ways—to profit from this trillion-dollar trend.

Here are my top tips for investing in the experience economy.

- Avoid airlines.

America’s “Big Three” airlines are booming right now.

But air travel is—and always has been—a crappy business.

As Warren Buffett quipped: “Investors have poured their money into airlines [...] for 100 years with terrible results. […] It’s been a death trap for investors.”

Buying airline stocks is like frequent flying. It seems glamorous from the outside. But do it, and you’ll soon wish you hadn’t.

- If you buy Live Nation, watch out…

Ticketmaster owner Live Nation Entertainment (LYV) controls roughly 70% of the ticketing and live events market.

Ticketmaster sells over 20 million stubs each month. And it earns a fat fee on each sale. So when a superstar like Taylor Swift tours, Live Nation makes millions of dollars.

But there are several threats to Live Nation’s ticketing stranglehold.

The US Department of Justice is investigating it for monopolistic behavior.

And without getting into the weeds, my research suggests blockchain technology will capture the ticketing market within a few years.

- My #1 experience stock is…

Before the internet, the only way to find the best hotels was to walk into a travel agency.

Then, online disruptor Booking Holdings (BKNG) burst onto the scene.

With a few clicks of a mouse, you could compare any hotel in the world. I use Booking all the time. It’s taken the guesswork out of booking hotels.

Today, Booking is the world’s largest online travel agent. It processes about 35% of global travel sales and earns billions from commissions in the process.

Booking is the biggest winner from the experiences boom. Every vacationer needs somewhere to rest their head.

Booking’s sales recently surpassed their pre-pandemic highs. Its stock took off like a rocket, and it hasn’t looked back:

You may be wondering if “room sharing” pioneer Airbnb (ABNB) is a threat to Booking.

Airbnb’s business has almost doubled since 2019. But our insatiable appetite for travel means both companies can win.

If I could only own one, I’d pick Booking every day of the week. It’s far more profitable… has tens of millions of loyal customers… and its stock is outperforming.

What do you think is the best “experience” stock right now? Let me know at stephen@riskhedge.com.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com