How to find the 2% “superstar” stocks

- Stephen McBride

- |

- October 2, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Happy Friday!

The S&P 500 is having a rough September, as usual. It’s fallen 4% in the past month. But stocks are up today as I type in the early hours.

Many folks are blaming the looming US government shutdown for the drop.

Here’s what I’m thinking…

- What Washington’s shutdown means for your money.

Yawn.

When it comes to government shutdowns, we’ve “been here, done that” so many times.

This is politicians being politicians. It’s all theater. No different than the new show on Broadway (just far worse acting).

Here’s the important part: Stocks usually RISE when the government closes!

Take two of the most recent—and longest—shutdowns in history.

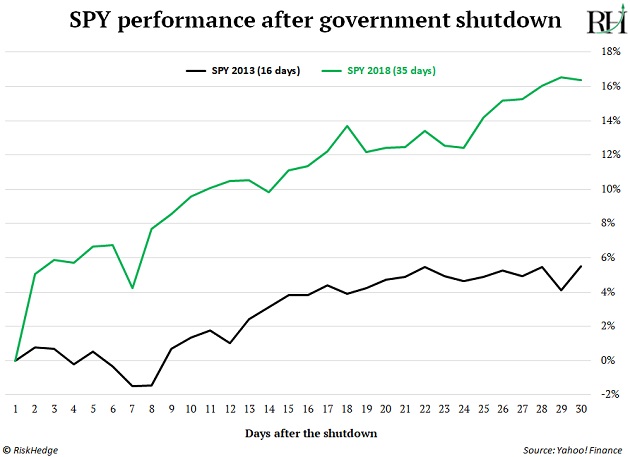

The S&P 500 went up during the 2018 and 2013 closures... and was much higher one month later:

The government will likely shut down on Sunday. But I expect the whole debacle to be resolved in a day or two. Even if it drags on longer, there’s no need to panic, as the above chart shows.

There are legitimate reasons to be cautious right now (like inflation potentially reaccelerating). Bureaucrats taking a few days off work isn’t one of them.

- This sell-off is still perfectly normal.

It’s the final trading day of September, and as I warned you two weeks ago, it’s been a rough month to own stocks.

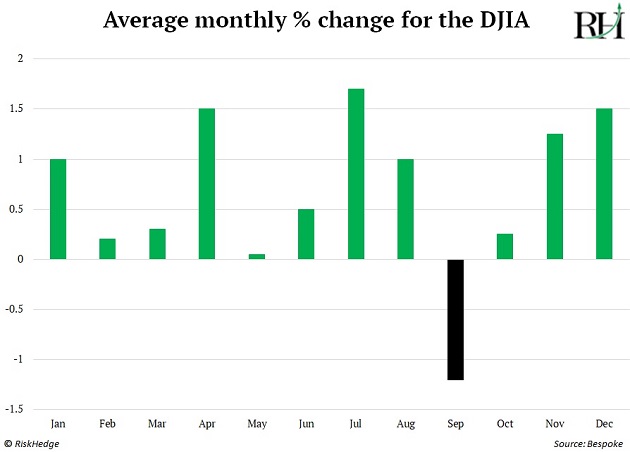

September is the only month in which stocks have averaged a decline over the past 100 years, as this chart shows:

I’ve been writing RiskHedge research since 2018. The S&P 500 has had more than 15 pullbacks of 5% over this period.

This is just another routine 5% pullback. And just like all the other times, I’m here to guide you through whatever the markets throw our way.

Bottom line: Don’t read too much into this seasonal stock market weakness.

If markets go off-script, I’ll be the first to tell you about it. But unless that happens, this sell-off is just short-term noise.

- PROOF: You must invest in disruptive megatrends

I get up “before the enemy” on weekends to squeeze in a couple quiet hours of research.

In this case, my kids are the “enemy.” Saturdays and Sundays are family time. The only way I’m working is if I finish before their day starts.

Last weekend I read a great paper by Michael Mauboussin, who’s one of the top financial writers of our generation. I recommend checking out his book, More Than You Know.

My big takeaway from his new paper, Birth, Death, and Wealth Creation, is that you MUST invest in great businesses profiting from disruptive megatrends.

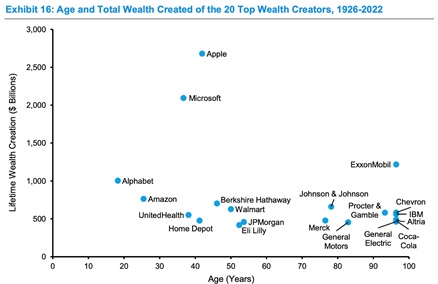

US companies created $55 trillion worth of wealth for shareholders over the past century. But just 2% of stocks accounted for $50 trillion—91%—of those gains!

And those superstar stocks—the companies that created the most wealth—all had one thing in common. They all spearheaded a world-changing trend. (The only exception was ExxonMobil).

Source: Morgan Stanley

Source: Morgan Stanley

Apple (AAPL) handed us smartphones… Microsoft (MSFT) put a PC in every home… Google (GOOG) invented internet ads… and Amazon (AMZN) made buying stuff online “the norm.”

These four superstar stocks (0.01% of all stocks) handed investors almost $7 trillion in profits!

This is further proof the surest way to get rich in the stock market is to invest in companies spearheading fast-growing trends. That’s why it’s a pillar of our framework in Disruption Investor.

Of course, all the existing tech giants are old news. Our research suggests their best days are behind them, and I wouldn’t buy any of them today.

We’re on a mission to unearth the new megawinners… up-and-comers set to be the “next” Apple or Amazon and make investors rich.

- Say “hello” to your new “robo-mechanic.”

ChatGPT’s latest upgrade just dropped, and it’s even more mind-blowing than I imagined.

Get ready to hear a lot more about “multimodal” artificial intelligence (AI). That’s tech-speak for ChatGPT can now see, hear, and speak. And the new features are AMAZING.

The AI chatbot can now understand images. I can take a picture of my bike brakes and ask it, “How do I change the brake pads?”… and it’ll walk me through step by step.

ChatGPT will also be able to tell you why your grill won’t start... or how to fix that leaky tap. No more scrambling to ring a plumber at 9 pm on a Sunday!

If my grandfather were alive to use multimodal AI, he’d think it was magic.

And yet… this is the WORST artificial intelligence is ever going to be.

Imagine what AI tools like ChatGPT will be capable of a few years from now. They’ll change almost everything about our daily lives.

Just like I can use AI to fix my bike... companies are using it to boost sales and slash costs. It’s creating massive winners and losers in the stock market. And my goal is to put you on the right side of this disruption.

- Today’s dose of optimism...

No matter how busy I am, or how late it is, I never skip bedtime stories with my two young kids.

Watching TV is easier. Giving them the iPad is easier. Sometimes I feel like putting them straight to bed.

But I’m determined to make them love reading books.

Almost all the most successful people in history are ferocious readers.

Super-investor Warren Buffett once said, “The advice I would give is to read everything in sight. And to start very young.”

His business partner, Charlie Munger (who we talked about on Monday) said, “In my whole life, I have known no wise people… who didn’t read all the time.”

To get your kids to read, you have to be a reader. Make sure to have shelves full of books at home… let them see you read… and never skip bedtime stories.

Have a great weekend, and I’ll talk to you on Monday!

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com