How Joe Biden Helped Us Collect 180%+ Profits

- Stephen McBride

- |

- August 16, 2021

- |

- Comments

This article appears courtesy of RiskHedge.

Did you hear Joe Biden’s big announcement?

He recently signed an executive order for half of all new car sales in America to be electric by 2030.

This is great news for electric automakers like Tesla, right?

Just as gas-guzzling cars made early Ford and GM shareholders rich, the transition to electric vehicles will do the same for a new class of electric vehicle (EV) stocks.

But I don’t recommend buying Tesla, or any other automaker, today.

There’s an even more lucrative way to profit from the coming electric car boom. One that will help you make money no matter who wins the EV race.

This stock has already handed Disruption Investor members 183% gains. And my research shows it could triple from here as electric cars go mainstream.

-

Did you know EV sales are smashing all kinds of records?

Three million new battery-powered cars were sold last year, a 41% jump over 2019.

That’s even more impressive when you consider sales of gas guzzlers fell 16%. This momentum has continued into 2021, with sales in the first quarter quadrupling.

There are now a record 10 million electric cars driving on the world’s roads.

Elon Musk’s Tesla has been the only game in town when it comes to high-performance electric vehicles. It’s also been one of the best-performing stocks over the past two years, handing out 1,400% gains.

Now the old guard is finally jumping into the ring.

Ford’s electric F-150 truck goes on sale next year. The first battery-powered Cadillac is expected to hit the roads in 2022, as well. GM will debut a rechargeable Hummer later this year. And get this… Mercedes-Benz announced it’s going all-electric by 2030.

So which auto stock should you buy?

Tesla?

Ford… Toyota… GM?

The answer is none of them.

-

You want to own the disruptor fueling most of the EVs driving on American roads today…

When you pop the hood on an electric car, you won’t find an engine.

They run on batteries, like the one in your smartphone… only 10,000X more powerful.

The battery is by far the most critical part of an EV. It determines how far you can drive before you have to “refuel” at a charging station.

A decade ago, most EVs couldn’t travel 70 miles before you had to plug them into a socket. And it took up to eight hours to fully charge.

Today high-end EVs like Tesla’s Model S go well over 300 miles before you have to plug them in. And Tesla’s new superchargers can fill the battery up to 85% in under an hour!

In short, big breakthroughs in battery technology are the reason there are now 10 million EVs driving on the world’s roads.

-

One critical metal made these achievements possible.

Batteries powerful enough to run a car for 300 miles must be able to store huge amounts of energy. But they also have to be relatively lightweight.

There’s always a tradeoff between size and power with batteries. It would be great if your cell phone held enough power to last a whole month. But the battery would be the size of your fridge.

This tradeoff made lithium—the world’s lightest metal—the perfect “fuel” for electric cars.

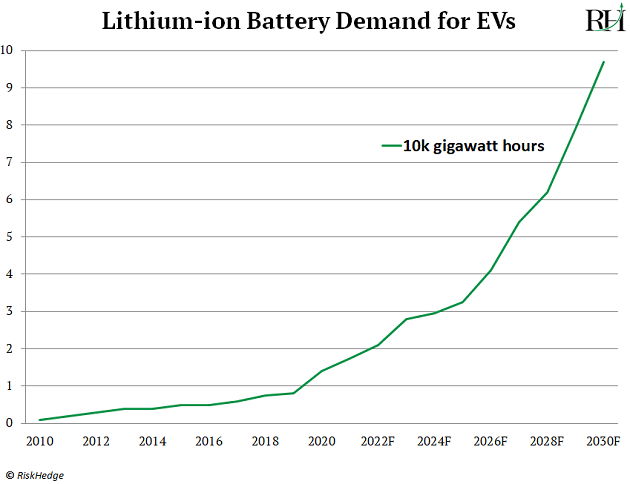

Lithium-ion batteries have been around for decades. They power our wireless earbuds, smartphones, and laptops. But now, we’re moving from phone-sized batteries to car-sized batteries.

Take Tesla’s Model S, for example. There are roughly 140 lbs of lithium inside its battery.

Remember, so far, Tesla has been all alone in the high-performance electric car arena. Soon, every automaker on the planet will join in. We’re already seeing it happen with Ford, GM, and Toyota. And they’ll all need to buy boatloads of lithium.

In fact, by 2030, electric vehicles will need as much lithium as 250 billion iPhone batteries. That’s a 14X spike compared to all the lithium the world uses today!

Source: BloombergNEF

These projections are likely too conservative given Biden’s new plan for electric cars to make up half of all new car sales in just nine years.

Europe recently announced it wants to ban gas guzzlers by 2035 too.

In short, we’re going to need a lot more lithium…

-

Albemarle (ALB), the world’s largest producer of lithium, jumped 10% the day Biden signed his executive order.

Longtime readers know Albemarle is one of my favorite disruptor stocks. The company controls 25% of the lithium market and owns the purest lithium mines on the planet.

Remember… carmakers like GM, Ford, and Tesla are going to need truckloads of battery-grade lithium over the coming decade. Albemarle will be their prime supplier.

According to top analysis firm Benchmark Mineral Intelligence, lithium demand will outstrip supply by 200,000 tons over the next four years. Lithium prices have already doubled this year, surging to their highest levels since late 2018.

Albemarle is building two new lithium processing plants, which will double its output by the end of next year. It’s also ramping up operations at its Nevada mine, the only source of US lithium in production today.

Disruption Investor subscribers are sitting on a 183% gain in ALB after accounting for our “free ride.” (A free ride is a strategy I use when one of my stocks shoots up 100%+. The idea is you sell enough of a winning trade to recoup your original stake… and let the rest “ride for free.”)

These gains show the power of owning great disruptive businesses. Regular RiskHedge readers know disruptors regularly invent the future and transform whole industries.

Albemarle practically invented the market for battery-grade lithium. This has allowed it to rapidly grow sales and capture all the upside for itself and shareholders. Investing in great disruptors allows you to sit back and collect profits as they change the world.

Albemarle is the #1 way to profit as EVs take over our roads. As I’ve mentioned before, Tesla makes the best electric cars on the market. But picking a winner in the auto industry is extremely hard.

By owning Albemarle, we don’t have to back a horse in this race. We’ll make money whether Tesla, Ford, or GM comes out on top.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com