Computer vision is like investing in the internet in the ‘90s

- Stephen McBride

- |

- May 24, 2021

- |

- Comments

This article appears courtesy of RiskHedge.

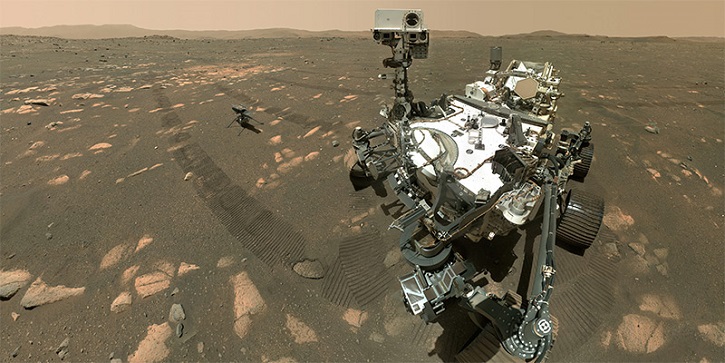

Did you hear that NASA put a self-driving car on Mars?

Its Perseverance rover has been cruising around the red planet since February, and unlike previous space robots, this one features a big technological breakthrough:

It drives itself!

Prior versions of the rover had to constantly stop and take static photographs to figure out where to go.

It’s no wonder the furthest any rover had traveled in one day is 700 feet.

But Perseverance can “see” where it’s going in real-time.

Now it spends its days poking around a dried-up river bed looking for signs of alien life.

-

A world-changing disruption made this breakthrough possible.

I’m talking about computer vision.

Computer vision is the kind of disruption that only comes around once a generation.

Computers have long been able to count numbers and read text. But they could never master vision. In fact, in 2010, about the only thing a computer could do with a pile of photos was sort them by size.

But as longtime RiskHedge readers know, this is all changing.

A few years ago, researchers rewired the way computers see, handing computers the gift of sight. It marked the first time in history a machine could identify objects better than a human, giving machines a new superpower.

In short, computer vision can transform every camera lens into a pair of eyes that can understand what it sees.

-

Think of computer vision like the internet.

Both are essentially platforms that innovators use to build world-changing disruptions.

The thing is… it takes years to figure out how to use these transformational inventions.

The internet was first created in the 1970s. But tech geniuses didn’t build the tools that disrupted the world until the ‘90s.

The big breakthrough in computer vision happened in 2012. But tech companies are just now starting to harness it.

Google used it to put self-driving cars on American roads. In fact, Waymo has now driven over 25 million fully driverless miles on US roads. These incredible achievements are possible because of its computer vision system.

Waymo’s latest robotaxi is fitted with 29 special cameras that allow the car’s centralized brain to see in a 360° view.

It can spot stop signs from over 1,600 feet away. It’s learned how to react when traffic lights change color… and what to do on the fly when it approaches road work.

Amazon is using computer vision–powered cameras to get rid of rotten fruits and vegetables in its checkout-free stores.

Computer vision is even helping healthcare disruptors create devices that diagnose skin cancer more accurately than top dermatologists.

-

Nobody was talking about this game-changing disruption until recently.

Computer vision was mostly stuck inside university research departments.

The only people I could find to discuss it were computer science nerds from Stanford and MIT.

Now everyone—from the New York Times to Facebook—is talking about it:

More importantly, ordinary folks can invest in computer vision for the first time ever.

Most people don’t appreciate how long it often takes for a breakthrough technology to become a viable business.

Remember, the technologies behind the internet were mostly invented in the ‘70s. Yet even by the early ‘90s, there were very few internet stocks.

In fact, the dot-com boom didn’t get started until Netscape’s IPO in 1995, which marked the starting line for the greatest boom in American history.

Over the next few years, a slew of new disruptors burst onto the scene. Amazon went public in 1997… the same year Netflix sprang up. Google was founded in a suburban Menlo Park garage a year later. In fact, over 2,500 companies went public between 1993 and 1998.

Investors made huge gains over the next five years as the internet swept across America.

- Computer vision is right where the internet was in the 1990s.

This flourishing internet ecosystem in the ‘90s was a tell that the internet was going to be huge.

Computer vision is following the same path. It’s a groundbreaking new disruption about to have its breakout moment.

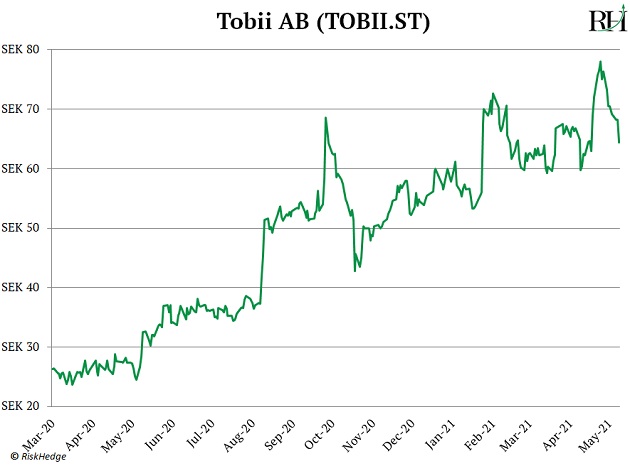

For example, I recommended eye-tracking pioneer Tobii (TOBII.ST) to Disruption Investor subscribers in March 2020. Members have doubled their money, and we just took a free ride on this position a couple of weeks ago:

For a long time, Tobii was one of the only computer vision stocks on the market.

Now, a slew of computer vision–related companies are going public. For example, in the past 12 months, LIDAR (Light Detection and Ranging) disruptors like Velodyne (VLDR), Luminar (LAZR), and Aeva (AEVA) hit the stock market. LIDAR technology helps self-driving cars see… and can detect even the smallest detail, like a leaf blowing in the wind.

And they’re not the only computer vision companies coming onto the scene…

Evolv Technology announced it was going public in March. Evolv uses computer vision cameras to screen folks walking into stadiums and schools for security.

And this is just a little taste of where we’re headed. Dozens of other vision-related firms are slated to IPO in the coming years.

-

But above all else, this is the computer vision IPO I believe has the most upside...

In short, our team has found the perfect new way to profit off computer vision technology… one I can almost guarantee you haven’t heard about—yet.

If you’re interested in learning more, including how to use the weird time-sensitive ticker associated with this play, go here.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com