Can AI fix America’s most broken industry?

- Stephen McBride

- |

- March 13, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Introducing RiskHedge’s new “disruption grading system”… THIS industry ranks #1 “ripest for disruption”... And AI is set to upend it in three specific ways...

- What makes an industry ripe for disruption?

My team and I wanted a reliable way to calculate just how “disruptable” an industry really is...

So, we created RiskHedge’s disruption grading system.

In short, it measures the price you pay for something compared to what you get. Too big a gap means an industry is ripe for disruption.

Take cable TV, for example. From 1998 to 2013, the price of cable TV more than doubled. Yet TV didn’t change all that much.

You still watched the news on NBC or Fox…

Maybe you tuned in to see 60 Minutes… Survivor… or Who Wants to Be a Millionaire…

Or caught a game on ESPN.

Yet cable companies like Comcast (CMCSA) kept hiking prices year after year. And when prices surge without much improvement in quality, it attracts disruptors like a moth to a flame.

Of course, Netflix (NFLX) came along and wiped the floor with cable companies. From the time it IPO’d in 2002 to 2021, NFLX soared for peak gains of 60,330%.

Last year, Americans spent more time streaming than watching cable for the first time ever. And Netflix now has more subscribers than the largest five cable companies combined.

- Healthcare is the mother of all disruptable industries.

RiskHedge’s disruption grading system ranks industries on a scale… from vulnerable, to stable.

The higher an industry’s score, the more likely it’ll be turned on its head.

Before Netflix knocked cable companies off their perch, they had a disruption score of 130.

Prior to disruptor Uber (UBER) sinking the taxi industry, taxis had a score of 230.

And get this… today, healthcare has a disruption score of 450!

Healthcare is sticking its chin out, practically BEGGING innovative start-ups to uppercut it.

Why?

Because costs have spiralled out of control.

Americans forked out $1.2 trillion in healthcare premiums last year. They now spend more on healthcare than anything except housing.

In fact, healthcare-related expenses are now the #1 cause of personal bankruptcy. The surest way to go broke in America today is to get sick.

And despite paying through their teeth for insurance… only one in six folks are happy with their health coverage, according to a Gallup poll.

There’s a Grand Canyon-sized gap between the price you pay for healthcare and the coverage you get. That’s why healthcare is ripe for a major disruption.

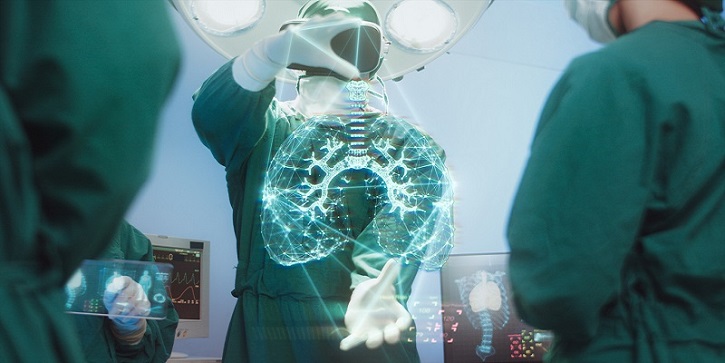

- Artificial intelligence (AI) will transform this broken industry.

Everyone has been talking about AI since chatbot ChatGPT burst onto the scene in November.

AI is an “all-purpose” disruption, like the internet. It can be used for many things.

Ever notice how Apple Photos automatically organizes pictures of family members on your smartphone? That’s AI.

Another example is Gmail’s autocomplete feature, which will finish your sentences.

These features may sound simple, but they showcase AI’s superpower.

AI can sort through mind-bending amounts of data. It then “learns” to find patterns within that data which allow it to make important predictions.

This allows it to accomplish tasks that would take humans much longer—sometimes years or even decades—to complete.

AI’s superpower will upend healthcare over the next decade. And here are the three main ways it’ll happen...

AI will become a master cancer detector.

Cancer is the #2 killer in America. It was responsible for 600,000 deaths last year.

Catching the disease early has proven to be an effective way of beating it. But today, detecting tumors is a manual, time-consuming process.

Medical imaging disruptor Paige.AI built an AI system that could revolutionize cancer diagnosis. Paige.AI fed millions of real-life medical images into its system and trained it to detect early signs of tumors.

The AI tested itself by scanning 12,000 medical images for potential tumors. It had never seen these images before, yet was able to “achieve near perfect accuracy.”

After announcing these results, Paige.AI was granted “Breakthrough Designation” by the FDA, the first ever for an AI in cancer diagnosis.

Microsoft Research recently built an AI to examine tumor images from MRI machines and CT scans.

This process is currently done by hand and can take up to four hours. Microsoft’s AI reduced the task to minutes! This one breakthrough can save thousands of lives each year, while simultaneously slashing costs.

AI will speed up new drug development.

It can take up to 15 years to get a new drug approved and on pharmacy shelves. Doing so costs anywhere from a few hundred million dollars up to several billion dollars.

And there are thousands of diseases with countless potential drug targets.

This is where AI comes in.

Remember, AI can “ingest” mind-bending amounts of medical data. It then connects the dots between various papers and databases to offer new ideas that would take us mere mortals a lifetime to discover.

There are currently 19 drugs developed by AI drug companies in clinical trials. That’s up from zero just three years ago.

Biotech company Absci (ABSI) recently announced it designed new antibodies using AI. It said this breakthrough could speed up its time to clinical trial by more than two years.

AI can help firms “speedrun” the time it takes to develop new drugs, and dramatically cut costs.

AI will solve the “paperwork problem.”

I spent a lot of time visiting my late grandmother in the hospital last year.

I was shocked at how much time doctors and nurses spent filling out paperwork. Everything they do must be documented. (Think your job is stressful? Try being a nurse for one day!)

Walking into a hospital is like being time-warped back to the 1970s.

A recent study in the Annals of Internal Medicine found for every hour doctors see patients, they spend nearly two hours on paperwork.

The ever-increasing administrative burden is a huge contributor to rising healthcare costs. The number of healthcare administrators surged 35X faster than the number of doctors since 1970.

More secretaries filling out paperwork; fewer doctors treating patients.

A little-known company called Health Catalyst (HCAT) is working to solve healthcare’s “paperwork problem.”

Its AI platform collects and makes sense of trillions of pieces of healthcare data from hundreds of sources.

In fact, Texas Children’s Hospital used HealthCat’s tech to reduce wait times for new patients… add 53,000 appointments annually… and boost annual revenue by $8.3 million.

Mark my words: AI is coming for America’s most broken industry. We’ll see more changes to healthcare over the coming decade than we have in our lifetimes.

Are you excited for AI, or do you think it’s all empty promises? Write me at stephen@riskhedge.com.

Stephen McBride

Chief Analyst, RiskHedge

In the mailbag…

We received several comments on our RiskHedge Report about America finally reaching an electric vehicle (EV) tipping point:

My concerns with EVs include the instability and defenseless nature of our electric grid. We are one good cyberattack away from major outages. I realize an outage would take out gas pumps as well.

However, in general, I feel the EV fan club thinks electricity comes out of thin air and doesn’t have any conception that our total power needs require some expenditure of fuel, be it gas, coal, nuclear, etc. Renewables are not sufficient at this time to replace fossil fuels and cover the additional future power requirements our society will have. —Marcus

In regard to buying Tesla (TSLA) to profit from the EV boom, another reader said:

I have owned ALB for several years and made a lot of money. But I wouldn’t rule out TSLA as a good bet going forward. [It is] way ahead of the legacy automakers, including supply chain and engineering. The start-ups will only be selling a few thousand vehicles each year, and they are expensive.

Admittedly, Kia/Hyundai and the Europeans are coming along, but like the US are hampered by their dealerships. At some point, TSLA will produce a cheaper model, and nobody will be able to touch [its] margins. China will be [its] main competitor. —Larry

And lastly, on making the switch to EVs:

Not yet, Chris. I too am waiting for the infrastructure and much faster charging on the road… and I love my Alpha. —David

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com