Big stakes, short week: Do you own the right stocks?

- Keith Fitz-Gerald

- |

- May 30, 2023

- |

- Comments

This article appears courtesy of Keith Fitz-Gerald Research.

Howdy!

I’ve been as emphatic as I have been consistent the past few weeks:

-

The markets would take off like a rocket when there’s a deal, so the time to buy would be ahead of that. Anybody who didn’t would be left fighting for table scraps.

-

That Big Tech would be THE play, especially names like NVDA, AAPL, and TSLA.

Hopefully, you paid attention.

Watch for a head fake or two, though.

Some profit taking wouldn’t be unexpected if the FOMO buyers start chasing profits (which would be typical today) during a holiday-shortened week. I could also envision one more set of political histrionics and some volatility ahead of a deal.

Either way, stay frosty!

Here’s my playbook.

Deal

And just like that...

-

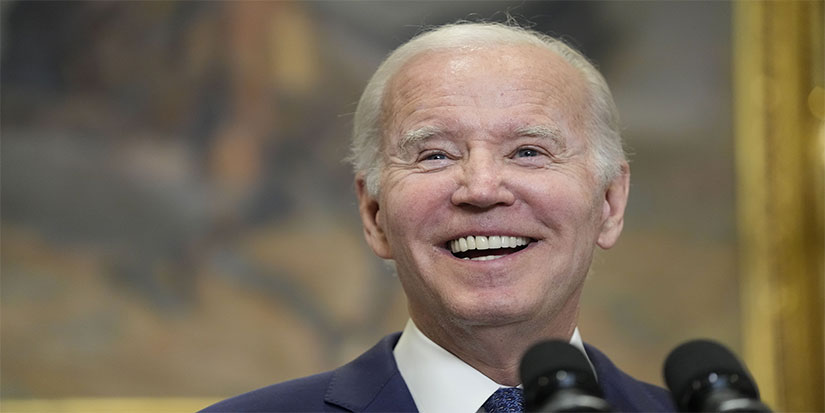

Stock futures rose after the Biden administration and Republican lawmakers reached a tentative deal on raising the US debt ceiling, reducing concerns of a default.

-

S&P 500 futures increased by 0.6%, Nasdaq-100 futures climbed 1.3%, while Dow Jones Industrial Average futures remained flat.

-

The deal is likely to pass Congress, averting a default, and comes just before the “X date” on June 5 when the Treasury Department signaled a potential default.

I hope you’re on board.

Contrary to what many people believe, you don’t have to be a gazillionaire to make a lot of money in the markets.

You just have to be consistently “in to win.”

End of story.

“NVDA to a trillion and beyond”

If I had a penny for every armchair QB who’s called me out the past few weeks...

...NVDA is expensive

...Markets don’t rally until single-digit P/E ratios

...Big Tech is like 1999

…You’ll be sorry

Blah, blah, blah—and no, I won’t.

NVDA surged further in premarket trading, edging closer to the remarkable $1 trillion market value milestone. The stock has experienced a robust 3.7% gain as it maintains its upward trajectory following the release of its exceptional earnings report last Wednesday.

My guess is it’ll hit that mark before you read this.

Seems to me that I’m gonna need to break out my victory dance again, which, of course, is owed to the late, great James Brown.

Investing Lesson: NVDA is yet another painful lesson for the short-and-distort crowd and permabears. Just because something’s run up a lot doesn’t mean it’s ripe for a fall or a reversal.

CA State Farm to homeowners: “Tough thit”

According to an article on FOX Business News, insurer State Farm says “Nuh-uh” to property owners in California. No new applications for property insurance will be accepted from now on. (Read)

The reason cited: “historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market.”

In other words, mix a weakening economy, sky-high home values (the highest in the nation), and a state basically built on a fault line, and insurers won’t touch it with a 10-foot pole.

Call me crazy... but gross mismanagement of CA’s biggest cities might have something to do with it.

They just can’t say.

Remember: Money is like water in that it will always flow to where it’s treated best and away from where it’s treated worst.

Better, hotter, faster

How many times have you ordered fast food only to find it’s melted and become a soggy mess by the time you’re ready to eat it?

That could be a thing of the past shortly.

McDonald’s and Chick-fil-A are gonna track consumers using geofencing tech on their apps to cut down on wait times. (Read)

Investing Takeaway: Companies that integrate tech for the benefit of their consumers will enjoy long, successful growth. Those that don’t, won’t.

Invest accordingly.

Read this if you own European Banks

Many investors like to buy baskets of stocks via ETFs, mutual funds, or the like. Not surprisingly, they’ve got more than a few European Banks in their portfolios.

Think twice.

The European Central Bank (ECB) has cautioned that the leading banks in the euro zone could face negative consequences if their financial clients—including funds, insurers, and clearing houses—were to withdraw their deposits or encounter financial difficulties. The ECB’s study specifically examined the potential spillover risks arising from shadow banks, such as non-bank financial institutions. (Read)

Sounds familiar.

I warned about the same thing prior to the Global Financial Crisis of 2008/2009.

Hmmm.

Bottom Line

The only easy day was yesterday.

—USN SEALs

Speaking of which, I hope you had a great Memorial Day and that you took a moment to remember those who paid the ultimate price for our freedom. If you didn’t and you’d like to do something about it, please consider donating to the USN SEAL Foundation, one of my favourite charities. (Learn More)

Now and as always, let’s MAKE it a great day.

You got this—I promise!

Keith

PS: If you’re liking what you’re reading in the 5 with Fitz, you may enjoy a subscription to One Bar Ahead®, my premium monthly investing journal. We’ve been tracking stocks like NVDA for months and have had the good fortune of being ahead of what’s happening now. The June issue comes out Friday, along with fresh research, a new recommendation, and more. There’s still time to sign up if you’re interested. Upgrade to Paid

This article appears courtesy of Keith Fitz-Gerald Research. Keith Fitz-Gerald Research publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at keithfitz-gerald.com