Amazon goes nuclear

- Stephen McBride

- |

- May 14, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Artificial intelligence (AI) remains underhyped.

It’s easy to forget ChatGPT is barely 18 months old. Many investors are too quick to write off the surge in AI stocks as a “bubble.”

Look at the numbers, and you’ll see the huge move up in names like Nvidia (NVDA) is more than justified.

Nvidia’s earnings are growing even faster than its stock price. It’s trading near its lowest valuation in three years.

We’re only in the second or third inning for AI stocks. If you’re not invested, you’re missing out.

- As a Jolt reader, you know all about the AI chip shortage and the profit surge it’s caused for a handful of companies.

Soon, you’ll hear about another AI-related shortage:

Electricity.

AI’s thirst for energy is off the charts.

AI models like ChatGPT are powered by tens of thousands of energy-hungry computer chips inside vast data centers. These systems generate so much heat, they need specialized vents and fans humming 24/7 to keep cool.

And AI’s energy needs are only going one way: Up.

The latest ChatGPT uses roughly 100,000,000X more “compute” compared to cutting-edge models a decade ago.

|

Microsoft (MSFT) has a data center the size of 10 NFL football fields here in Dublin. Huge, right?

It’s a baby compared to the AI data centers being built today. We’re talking about buildings that will use as much energy as 1 million homes.

Electricity isn’t what you think of when you hear “fast-growing megatrend.” But powering AI will be one of the most important investing trends of the next decade.

Soon, you’ll read about the AI energy shortage in every newspaper in America. People will freak out about ChatGPT stealing their electricity.

I only see one solution here—nuclear power.

Remember, nuclear is the cleanest and safest source of energy in the world. It’s also the most robust and is highly reliable, which makes it perfect for data centers that need 24/7 uninterrupted power… and lots of it.

All the leading AI companies know nuclear is the only solution to AI’s insatiable need for energy.

That’s why Amazon (AMZN) just bought a nuclear plant in Pennsylvania. And Microsoft announced it plans to build a fleet of nuclear reactors to power its data centers.

Nuclear power has been out in the cold for the past 50 years. Regulators basically made it illegal to build new power plants in America.

But now nuclear has powerful, deep-pocketed new friends: Big tech.

Mark my words: AI will fuel a nuclear renaissance in America.

This renaissance will cause demand for the “fuel” powering nuclear plants—uranium—to spike. In fact, uranium prices are breaking out to 15-year highs as I type.

Uranium miners like Cameco (CCJ) are going higher—much higher.

We’re also investing in companies making data centers more efficient in Disruption Investor.

- Biotech giant Regeneron (REGN) gave two deaf kids a single shot in their ears.

Now, they can both hear perfectly for the first time ever.

Incredible.

These are early stage trials, so I don’t want to get ahead of myself. But this could potentially transform the lives of some 30 million kids who were born deaf.

And it’s all thanks to gene therapy, or CRISPR.

Gene editing allows doctors to “cut” out bad genes that cause disease and replace them with healthy genes. The first-ever gene editing therapy was approved in America and the UK late last year.

This is an important milestone. Once the first treatment is approved, it opens the floodgates for further innovation. Scientists all over the world will see this and think, “Game on: Now, I can use gene therapy to tackle my disease of choice.”

We’re launching an all-out assault on disease…

Multiple cancer-killing vaccines… eyedrops to cure blindness… and AI to design new life-savings drugs.

As I’ve been saying, biotech is the next transformational trend.

I regret that we’ve been in a mini “dark age” for innovation over the past 15 years.

The 2010s were all about building cool apps. Listen, I love Uber (UBER), Airbnb (ABNB), and WhatsApp. But they’re “meh” compared to this biotech revolution.

Investors must pay attention to this industry… but be careful which stocks you own.

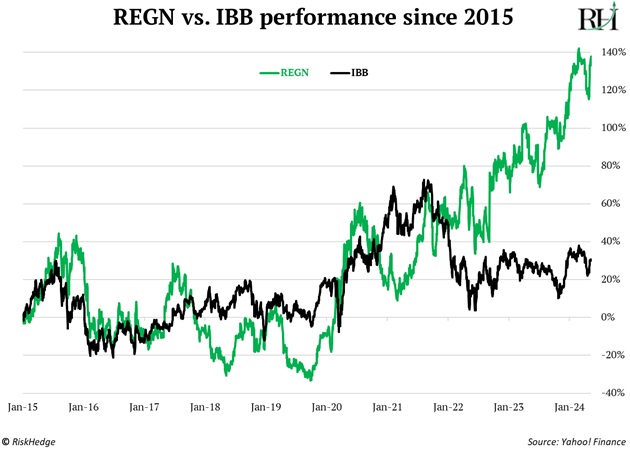

Look at the iShares Biotechnology ETF (IBB). It’s been flat for the past nine years. Meanwhile, winners like Regeneron have been printing money:

We own two world-class biotech businesses in the Disruption Investor portfolio. Both can double in the next year.

- Today’s dose of optimism…

Ignoring the news was my 2024 New Year’s resolution. I’ve stuck to it.

The news is a never-ending feed of the worst things happening on a given day. The media makes money selling fear, stoking conflict, and making everyone a little depressed.

Funny story: A friend knows the editor of one of the UK’s most popular online news sites. It decided to report only positive news for a week. The outcome?

It lost 70% of its readers.

Most people are addicted to bad news.

But you have a choice. You can tune out all the negativities.

Instead, go outside and touch some grass. Go to the gym. Learn to cook like a chef. Spend time with your family. Read a book, or 10.

All these activities are better for you than reading the news.

I’ll see you Wednesday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com