AI saved this little boy’s life

- Stephen McBride

- |

- September 25, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Good morning!

Ex-US Navy SEAL Jocko Willink has a phrase I live by: “Up before the enemy.”

I’m out of bed by 5:30 am six days a week.

Everyone gets the same 24 hours a day. The earlier you rise, the more you can squeeze out of those hours. And I’m way more productive in the morning.

Get up before the enemy… win the day.

The S&P 500 is still reeling from Wednesday’s Fed meeting. After a rip-roaring first seven months of the year, US stocks have flatlined.

Here’s what I’m thinking…

- Interest rates are spiking; buy these stocks.

Rates are breaking out to eye-popping new highs.

Here’s a chart of the US 10-Year Treasury yield spiking to levels not seen since George W. Bush was president:

Source: TradingView

Rising rates are spooking investors. But as I showed you on Saturday, there’s no need to worry. The S&P 500 typically rises when rates do, contrary to popular belief.

Folks are asking me: “What stocks should we favor now that rates are surging?”

My answer: Buy great businesses profiting from disruptive megatrends, and the rest will take care of itself.

That’s what my colleague Chris Wood and I do in our flagship advisory, Disruption Investor.

- AI just saved a little boy’s life!

I just read an incredible story about a four-year-old kid who saw 17 doctors over three years for chronic pain. His strange mix of symptoms stumped all of them.

Then Alex’s mother asked ChatGPT.

After telling the AI chatbot (which is free and available to everyone) what was wrong with her son, it suggested he had tethered-cord syndrome.

A human neurosurgeon confirmed ChatGPT’s diagnosis. Alex had surgery and is expected to make a full recovery.

Whoa, how incredible is this?

Thanks to AI, everyone is now carrying around an expert doctor in their pocket.

This is only the beginning of the AI healthcare revolution.

As usual, Nvidia (NVDA) is a clear-cut winner. Its chips power ChatGPT and all the world’s best AI systems.

Another one of our Disruption Investor holdings is using AI to get medicines to patients faster.

- Should you buy 2023’s hottest IPOs?

Two hot tech IPOs debuted in the last week.

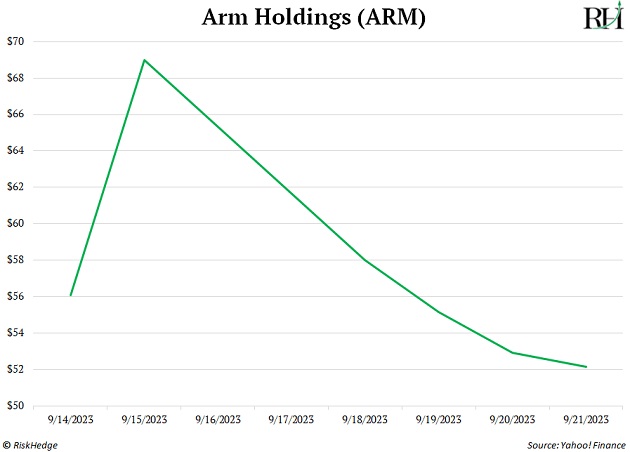

First up was Arm Holdings (ARM). Over 99% of smartphones run on chips designed by Arm.

Sounds compelling… until you remember smartphone growth is so last decade. Sales topped out five years ago!

ARM initially burst out of the gates, then faded fast. It’s trading below its IPO price:

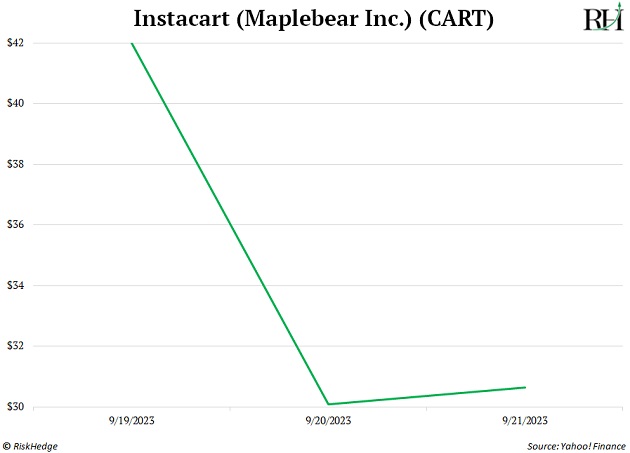

Then there’s “grocery tech” company Instacart (CART). Through its smartphone app, you can get people to shop for you and drop your groceries at your door (for a significant mark-up).

Same deal: CART rallied initially, then quickly plunged below its IPO price:

If you’re tempted to catch these falling knives, please don’t.

I was a young, dumb investor once and can tell you piling into hot IPOs isn’t how you get rich. Investing in great businesses profiting from disruptive megatrends is a far better strategy.

Arm is in a “has been” industry.

And Instacart is in one of the toughest businesses on Earth.

Even Walmart (WMT), the best grocer in the game, struggles to eke out a few points of profit!

Avoid both.

- Your dose of optimism—because there’s more to life than investing…

It was great being in Singapore last week, but I did miss one thing: fitness.

My days were jam-packed with work, meetings, and side events, which left scant time for exercise.

I snuck a few breezy 5K runs in, but I missed really pushing myself in the gym every day. I’m used to doing CrossFit and going hard!

One of my favorite quotes is from Ed Thorpe’s autobiography, A Man for All Markets. It’s: “I think each hour spent on fitness is one day less that I’ll spend in a hospital.”

Whether you’re 18 or 80, exercise is essential. You won’t only look better, you’ll also feel more alive.

Stay fit. Your mind and your money will thank you.

Let’s get after it and have a great day.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com