AI can now remember everything you say

- Stephen McBride

- |

- February 29, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

I’m hosting a live “Ask Me Anything” session tomorrow at 10 am EST for Disruption Investor members. It’s a great chance to ask me anything that’s on your mind, and I’ll do my best to answer all your questions.

If you’re a Disruption Investor member, I hope to see you there. If you’re not and want to join, go here. There will be a replay if you can’t make it live.

Moving on, thanks for all the feedback on Monday’s Jolt. With Google’s (GOOG) stock down 10% in the past month, I think its decision to choose ideology over accuracy is finally catching up with it.

Continue to avoid.

- Did you know this is the biggest election year in history?

I’m not only talking November’s US presidential election.

In 2024, 76 countries with more than four billion people will head to the polls.

Investors, pay attention—because any politician who wants to get re-elected is incentivized to hand out goodies to voters.

It’s already happening in America.

The Biden White House “forgave” $138 billion worth of student loans. And Congress recently passed a $78 billion business and child tax break bill.

I’ve warned a stock market correction is likely coming. The market is ripe for it. While the S&P 500 keeps moving higher, fewer and fewer stocks are rising.

But I expect 2024 to be a great year for stocks overall.

Election year goodies = money injected into the economy. And that typically boosts stock prices.

If markets dip, politicians seeking re-election will be quick to fire up the money printer.

What do India… Germany… France… Indonesia… and Taiwan have in common? They’re all holding elections this year… AND their stock markets are breaking out to new record highs.

Markets are telling us 2024 could be a global election year melt-up.

Invest accordingly.

- Artificial intelligence couldn’t remember what you asked it yesterday or even five minutes ago… until now.

ChatGPT creator OpenAI recently announced chatbots are getting long-term memory.

Say you ask ChatGPT to find the perfect restaurant for you and your wife in NYC. The AI will be able to recall all you past conversations and remember you like sushi… then show you a shortlist of all the best sushi restaurants.

This “recall” ability will accelerate the adoption of AI agents.

These little AIs are going to kill websites. Google.com as we know it today won’t exist in five years.

TODAY: Google serves you up 10 blue links. You must scroll through to find what you want.

TOMORROW: You’ll simply tell your AI agent what you want, and it will do the job.

For example, the idea of manually scrolling through Zillow (Z) will soon seem archaic.

Your AI agent—who knows which neighborhoods you like, how many bedrooms you need, and your price range—will show you the five best options. On command, it’ll contact a realtor and organize viewings for you.

Three big takeaways here:

#1: AI is advancing at a dizzying pace. ChatGPT isn’t even 18 months old. Every month, we’re seeing new breakthroughs that enhance its capabilities. Agents will destroy websites (and chatbots).

#2: Get ready for a wave of disruption. iPhone apps created almost $4 trillion in stock market wealth and a whole new set of winners, like Uber (UBER) and Airbnb (ABNB). AI will create $5 trillion of market cap over the next decade, at the very least.

#3: How we profit is clear. These agents require dense networking equipment and many, many more powerful chips than currently exist. That’s why we’re buying AI infrastructure winners inside Disruption Investor.

- I avoid political talk as much as I can, but an upcoming vote here in Ireland struck a chord with me.

There’s a referendum on giving “single-parent families” the same rights as married couples. Without getting into the legalese, it basically says “one parent is as good as two” for kids.

As someone who was raised by a single mother, I can tell you this is not true. And the facts are on my side.

Kids raised in single-mother homes are about five times more likely to be poor than kids from married homes. And boys raised by only one parent are more likely to go to jail than graduate college.

This research is from University of Maryland economist Melissa Kearney’s new book, The Two-Parent Privilege: How Americans Stopped Getting Married and Started Falling Behind (which I’m reading).

To be clear, I’m not saying single parents should be tarred and feathered. God bless them.

I’m saying kids raised by two parents do FAR better, on average. And to give every child the best possible chance of flourishing, we should promote two-parent households.

It’s funny how politicians who lecture us on why we must fight climate change to “save the kids” also denigrate the family… which is the single best thing for kids.

Make nuclear families (and nuclear energy) great again.

- Today’s dose of optimism…

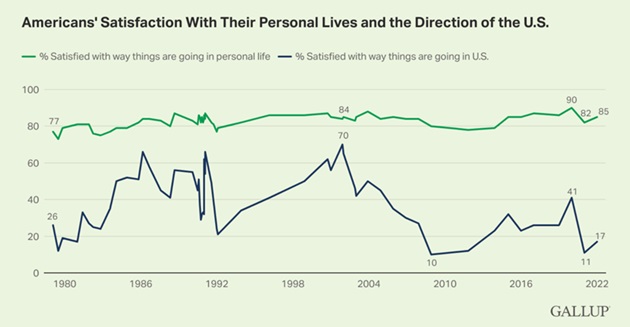

There’s a big gap between how we feel about our own lives and the country.

Data from polling firm Gallup shows Americans' satisfaction with their own lives is at 85%... yet satisfaction with the direction of the country sits at just 17%.

Source: Gallup

I think the news—which is a never-ending feed of the worst things happening on a given day—explains this persistent gap.

We experience mostly good things in our own lives. Hitting targets in work… pursuing passions… going on vacation. So, we feel good.

But open The New York Times, and it’s nothing but death, destruction, and despair. Overdose on news, and you won’t feel like getting out of bed tomorrow.

Ignoring the news is the easiest “cheat code” to living a happier life.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com