3 Obvious Reasons You Should Invest In Peer-to-Peer Loans In 2017

- Stephen McBride

- |

- September 5, 2017

- |

- Comments

This article appears courtesy of RiskHedge.

By Stephen McBride, Mauldin Economics

Thanks to the Fed’s zero interest rate policy, the inflation-adjusted yields banks offer on FDIC-insured certificates of deposit and savings accounts have been close to negative for years.

However, a quiet revolution has been going on for some time now that has the potential to fundamentally change this dynamic. The revolution that is upending the banking business is called Peer-to-Peer (P2P) Lending.

Using processes and algorithms honed over the past decade, P2P platforms allow individuals to take the place of banks in making personal and even corporate loans.

And to do so with a great deal of certainty on the risks versus the returns.

It’s surprisingly easy to “be the bank”

Here’s what you need to know:

- You start by deciding which P2P lending platform(s) you wish to work with. They all offer the same service, but with somewhat different business models. For my account, I chose Lending Club, the most popular. The entire process of applying to make loans through the platform took just a few minutes. As you’ll need to link your bank account to your Lending Club account, you can save time by having your bank account number and the bank’s routing number handy. (You can find a detailed comparison of the most popular P2P lending platforms in our free report.)

- In the account-opening process, you’ll be asked to fund your account. While you can add to your account at any time, you want to be sure to start off with a decent amount—probably a minimum of $2,500—as that allows you to diversify your lending across a large number of loans.

- Establish a maximum loan size. Typically, you’ll limit your loan size to $25. Thus, if your Lending Club portfolio is $5,000, you’ll ultimately “be the bank” to 200 borrowers. That provides you with important diversification against the risk of potential loan defaults.

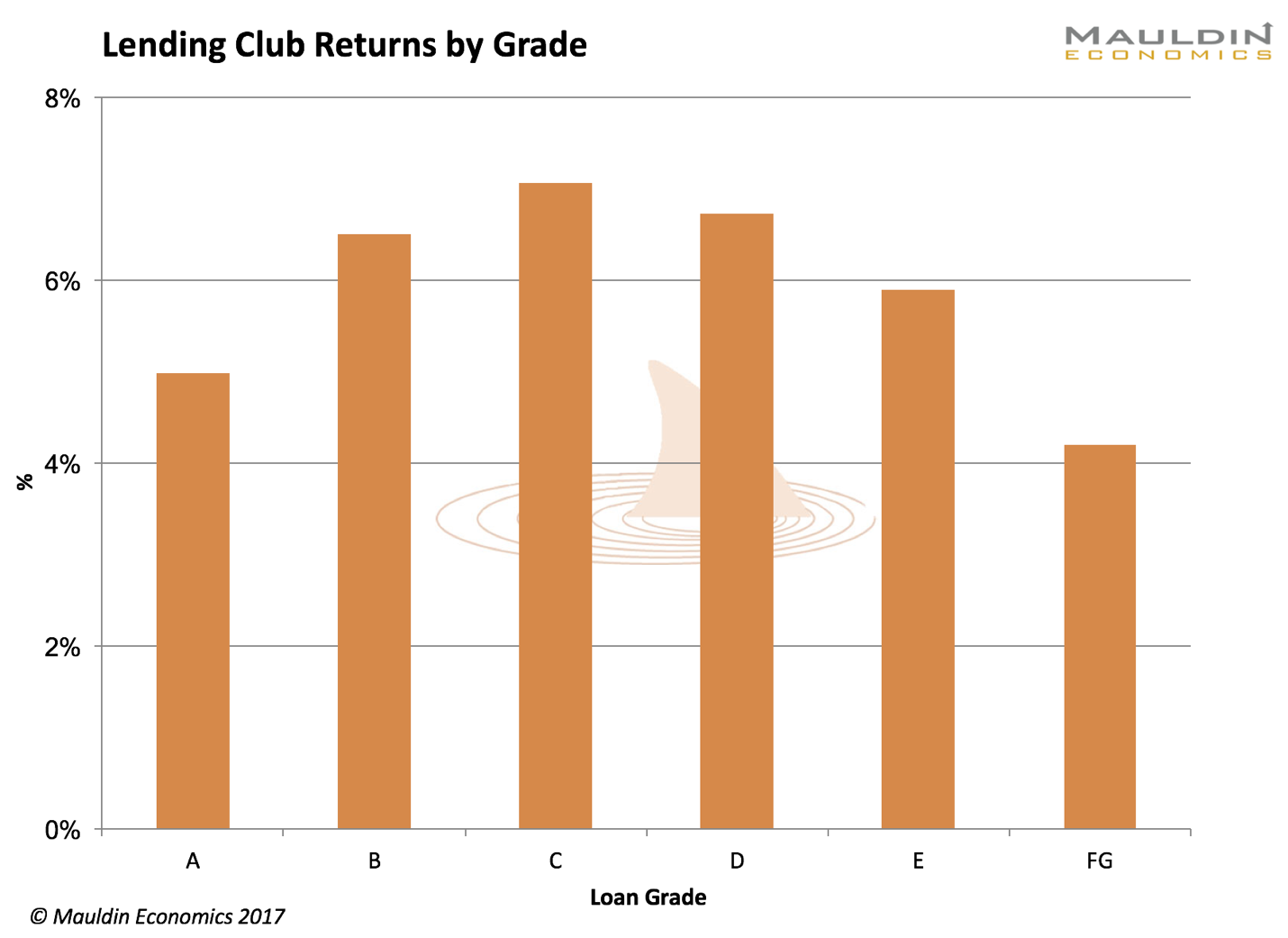

- Establish whom you want to lend to. In the case of Lending Club, borrowers are screened based on credit rating and other criteria found effective over the years in identifying default risk. Once a borrower is screened, they are slotted into one of six categories ranging from A, the highest quality, to FG, the lowest. You then decide which categories you wish to lend to.

Most lenders spread their loans across a variety of rankings—with the bulk in the highest-quality ratings (lowest default risk) and some in the lower quality, where yields can top 20% to offset the higher risk.

By blending your portfolio, you can achieve a very stable—and largely predictable—return well above what you will earn in other income investments.

400% bigger returns than your average deposit rate

You can see the returns net of defaults in the chart here, which is part of a new research report we have been working on entitled, The New Asset Class That Helps Investors Earn 7% Yields in a 2.5% World.

Source: Lending Club

Thus, even taking the very conservative approach of investing in the highest-quality loans, you can still earn four times the 1.25% rate now available with the average one-year bank CD.

A low correlation with the stock market

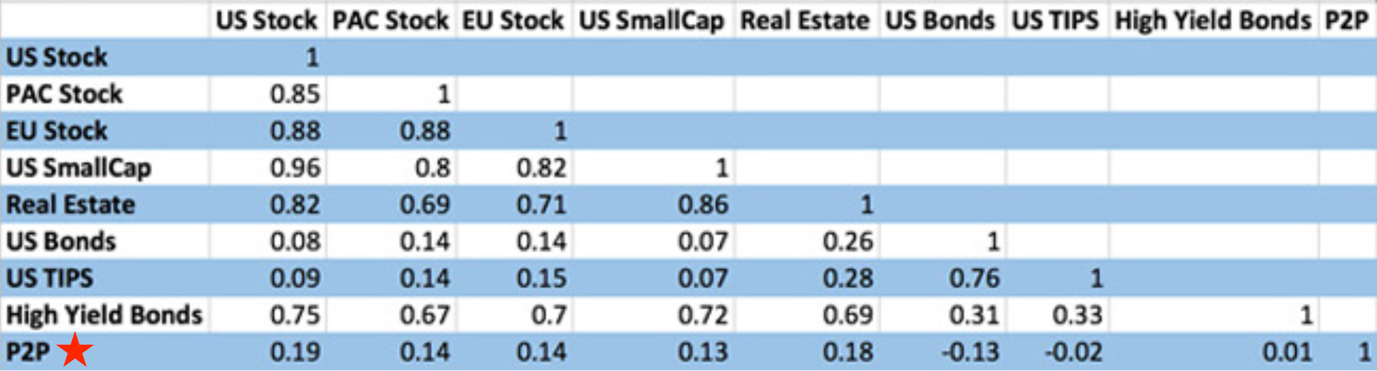

One of the big advantages of P2P lending is that it has a very low correlation to traditional stock and bond markets; 0.18 to US stocks and 0.08 with US bonds (see the table below).

(As a reference, an investment that is perfectly correlated to the S&P 500 is said to have a correlation of “1.” If the S&P went up or down 5%, so would that investment.)

That provides a healthy buffer against possible market volatility in the months and years ahead. Though broad markets may rise or fall, soar or crash, you still collect the interest on your highly diversified portfolio of small loans.

Take action now

There’s a lot more to the topic of P2P lending. Various platforms have somewhat different approaches to screening borrowers, automating loan generation, collecting from late payers, and more.

There are also add-on services you can use to improve your overall returns while better managing your risk.

Rather than sitting on the sidelines remembering the days when your bank CDs provided a solid return on your money, thanks to the revolutionary advances in marketplace lending, you can once again put your money to work.

And you no longer need to befriend your banker, you can just be the bank.

Free Report: The New Asset Class Helping Investors Earn 7% Yields in a 2.5% World

While the Fed may be raising interest rates, the reality is we still live in a low-yield world. This report will show you how to start earning market-beating yields in as little as 30 days... and simultaneously reduce your portfolio’s risk exposure.

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com