3 money-making areas to focus on in real estate

- Justin Spittler

- |

- November 8, 2021

- |

- Comments

Sweat was dripping off my forehead.

It must have been 95 degrees out, and it wasn’t even 10 am yet.

And yet, there I was… measuring the outside of a warehouse in rural Louisiana.

Before I became a full-time trader and analyst, I was a commercial real estate appraiser in New Orleans.

It was a great learning experience. But I wouldn’t call it my dream job.

-

Measuring buildings wasn’t the only thing I disliked about the job…

Getting information was also a huge chore.

If I wanted to learn about a recent sale or property listing, I’d have to call an agent.

If I wanted to look at property sale records, that often meant phoning the local clerk of court.

In short, the job involved a ton of tedious work.

And there was no central database for land sales. Every county was different.

The real estate industry was behind the times. It had resisted innovation… until recently.

-

Finally… the much-needed digitization of real estate is happening…

Today, I’ll tell you about three ways to play the next wave of the digitization of real estate.

But let’s first look at how much the industry has evolved.

Buying a house isn’t what it used to be…

In the old days, you’d have to schedule a viewing for a house or hope that your schedule aligned with an open house.

You’d have to deal with a realtor, the property owner’s realtor, and the property owner.

Later in the process, lawyers would get involved, as well as title insurers and surveyors. Fees were steep, and they added up quickly.

In short, the process was extremely outdated and frustrating.

Thankfully, that’s no longer the case…

-

So-called “iBuying” has made buying and selling a home EASY…

Opendoor Technologies (OPEN) is an internet “realtor” that will buy your house sight unseen. No open houses, negotiation, or waiting months for a buyer to come up with the money.

Type your address into Opendoor’s website, submit a few photos, and it will make you a cash offer in a couple of days.

Opendoor bought and sold 20,000 homes online last year alone.

A decade ago, this would sound crazy. But iBuying is part of the new normal thanks to technological advances in the real estate market.

Pictures of a house can only do so much. They can show you what a house looks like, but they can’t show you what it feels like. It’s why seeing a house in person used to be necessary… but virtual reality is changing that…

Zillow (Z), an iBuying pioneer, now conducts 3D home tours. These tours let you see the actual dimensions of the property. It’s like going to an open house on the internet.

Source: Zillow

Listings with the 3D tour option get an average of 37% more views than listings without the 3D option. They also sold 14% faster. Anyone can download the Zillow 3D Home app to create their own virtual tours and capitalize on this disruption.

It’s no surprise Zillow stock went on a tear last year, surging 938%.

Lately, Zillow has been struggling due to the failure of its Zillow Offers arm. In short, Zillow used iBuying to buy houses it believed were undervalued, sight unseen. The goal was to flip them for a profit.

That turned out to be much more difficult than the company anticipated. Earlier this week, Zillow announced the closure of this division of its business.

Although it hasn’t all been smooth sailing for iBuyers, the usage of new technologies to evaluate and buy homes is only going to grow.

Fellow iBuying pioneer Redfin (RDFN) says 63% of its homebuyers last year made an offer on a home without seeing it in person. The company also saw a 563% increase in 3D walkthroughs during 2020.

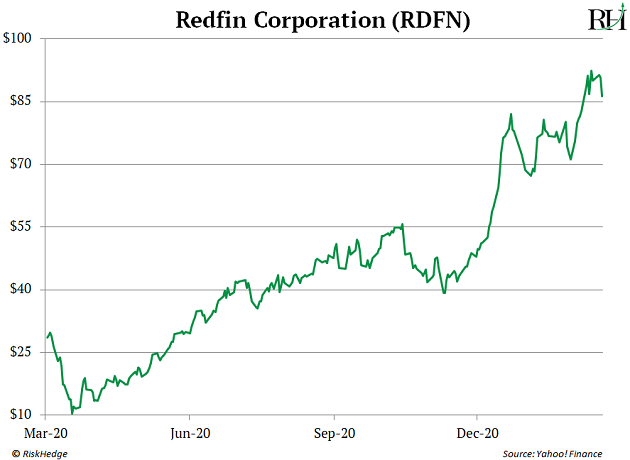

Redfin’s share price surged over 700% from March 2020 to February of this year. That’s more than 5X what the S&P 500 returned over the same period! Lately, the stock has cooled off.

These were tremendous gains for the two iBuying pioneers. But they’re only a taste of what’s yet to come.

-

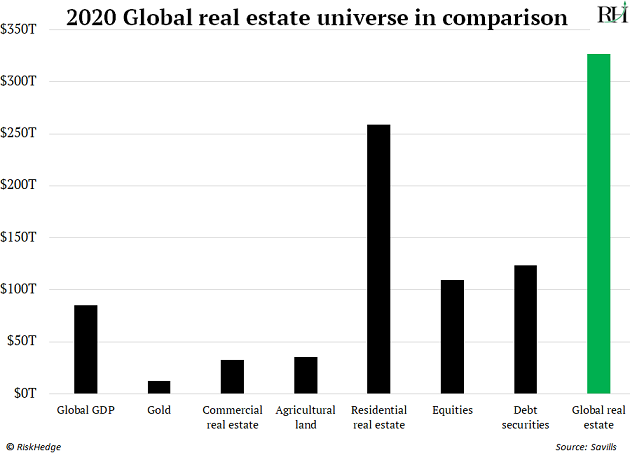

Real estate is the world’s largest market…

According to Savills, the global real estate market is worth $326.5 trillion. That’s more than 3X as big as the global stock market and more than twice as large as the global debt market.

Just four years ago, global real estate was valued at $228 trillion. Since then, it’s increased by almost $100 trillion.

However, I still see plenty of room for growth. Especially in these three areas…

Big Data: Companies like Zillow, Trulia, and Redfin are collecting huge amounts of data every time a home sells on their platforms. They are learning about home prices but also gaining insights into traffic patterns, demographics, and other key metrics of their customers.

Making sense of this data will help these companies maximize their profit potential.

VR/AR: Virtual reality and augmented reality will make the online search and home buying experience even more exciting and accessible. According to a survey by the National Association of Realtors, nearly half of all potential homebuyers search for properties on the internet first.

Realtors can create virtual reality tours of properties that potential buyers can experience from the comfort of their own homes. This will also help long-distance buyers tour properties they can’t physically visit.

Blockchain: Blockchain is a completely new way of record keeping. Instead of a bank controlling the database, it’s run on a network of computers. Transactions are verified by thousands of individuals across the world. Blockchain lets us securely record who owns what without a central authority for the first time ever.

With all the middlemen, fees, outdated practices, and piles of paperwork, the process of buying a house can often take months. In the not-so-distant future, through the blockchain, you’ll be able to qualify for a loan, complete a title search, and close on a house in just one day—all without the involvement of costly middlemen.

I’ll have more to say about how to cash in on the digitization of real estate soon.

Justin Spittler

Chief Trader, RiskHedge

|