Exclusively from Mauldin Economics...

Exclusively from Mauldin Economics...

As I detail in this free special report, you can earn yields of as much as 10.4% through investing in the Peer-to-Peer Lending (P2P) industry. Compare that to the 1.2% banks now offer in one-year certificates of deposit... or the S&P 500’s 2.1% average dividend yield.

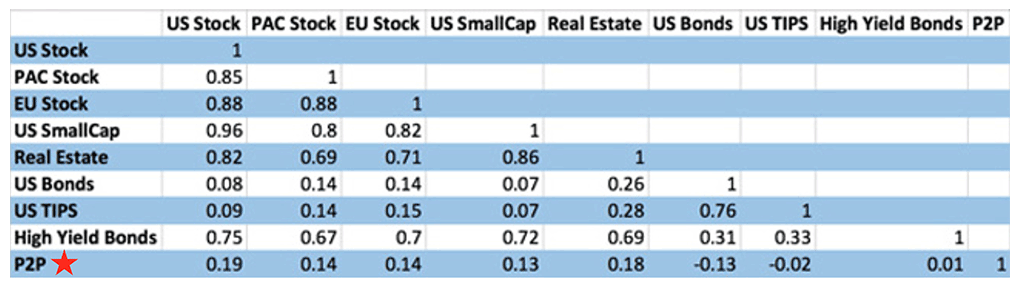

And those returns feature very little “correlation” to traditional stock and bond markets. Your revenue stream can keep flowing even through wild market gyrations or big interest rate moves.

The grid below shows the beta of other investment sectors, including P2P, compared to the US stock market. An investment with a “beta” of 1 would exactly track the US stock market’s volatility. You can see P2P’s low, low beta at just 0.19.

This exciting development is so dramatic that even the world’s largest money managers now use this same method to earn market-beating yields.

Inside the special report, you’ll learn:

There are no strings attached and nothing to buy when you request your free report today.

Patrick Watson

Senior Economic Analyst & Editor

Mauldin Economics