No Dollar Shortage

-

Jared Dillian

Jared Dillian

- |

- June 17, 2021

- |

- Comments

Editor’s Note: Longtime readers of The 10th Man might recall Jared Dillian predicting rising inflation last July, long before everyone else was talking about it.

He said, “the deflation trade was toast.” And he was right.

Inflation has already reached 5%, and people are coming to expect rising prices.

Today, we’re sharing one of Jared’s early essays on inflation, first published on July 30, 2020. It’s filled with critical insight on how we got here and what you can do to protect your money now.

No Dollar Shortage

A while back, there was a convoluted theory going around Twitter about how there was a dollar shortage. I didn’t understand the theory, no matter how hard I tried.

These people seemed pretty sure that the dollar would get stronger. This was around the beginning of the coronavirus pandemic, and we were staring down the barrel of epic levels of money printing, so it didn’t seem possible that the dollar would appreciate.

I kept quiet on it, though, because I don’t talk about things I don’t understand.

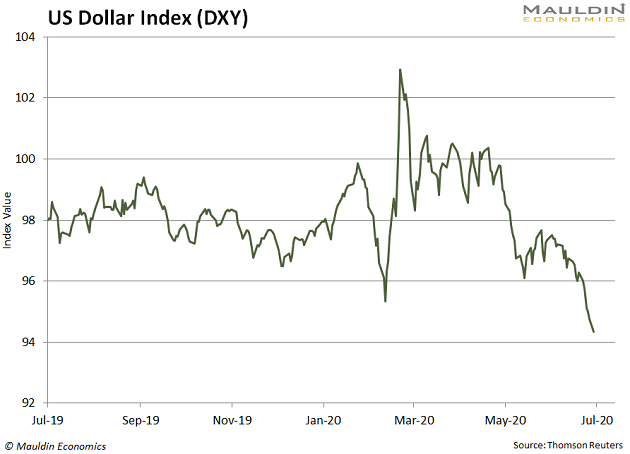

I think FX trading is less about tangible things like flows and more about intangible things like confidence. Our maniacal attempts to reflate the economy in the wake of COVID-19 have undermined confidence in the dollar.

The Narrative

It’s fun to watch the narrative shift in real time. We have been living in a long USD regime off and on since about 2013, and we have just shifted to a weak USD regime.

A few months ago, we were talking about dollar shortages; a few months from now, we will be talking about how the dollar is a threat to the global financial system.

Here is a chart of the dollar index, if you had any doubt:

A currency is a medium of exchange, a unit of account, and a store of value. We are concerned with the last part.

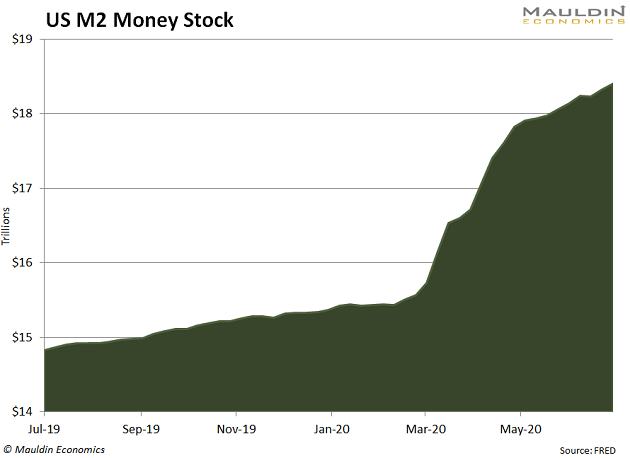

Of course, we’ve had quantitative easing before, so that’s not new. What’s new is the unprecedented level of fiscal stimulus, which is ongoing, and likely to get much bigger.

This presents us with a bit of a problem.

As the federal government goes further and further into debt, the assumption right now is that the Fed will end up buying all of it, as part of Yield Curve Control, or MMT, or whatever. We are, more or less, at the direct monetization phase, and the government has learned that it can issue more and more debt without consequence, which is to say, without interest rates rising.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

There are two possible scenarios here:

- The Fed buys all the debt with printed money, and we become Japan (or worse).

- Inflation begins to rise, which spooks Treasury bond holders, who sell and overwhelm the Fed’s efforts to control the yield curve.

It is the second scenario that I am worried about.

Inflation

A lot of people (myself included) were worried about inflation in 2008. There were a lot of inflation trades back then—some worked, some didn’t. But we never got inflation.

There’s a reason to think things are different this time.

Last time, we had inflation in asset prices (but nothing else), which caused all sorts of inequality and led to some of the civil unrest that we are seeing today.

This time, we are getting a fiscal response as well as a monetary response, in the form of the stimulus checks and the additional unemployment benefits, as well as the PPP loans. This money is going to people who have a higher marginal propensity to consume. Sorry for the economist-speak—that means they are more likely to spend the money, which will push up prices.

I’m pretty sure we will get inflation this time around.

The Fed has been jawboning interest rates lower for a few months, threatening to do Yield Curve Control, and then not doing it. If they do it, they will probably only do it in short maturities, out to three or five years.

This leaves the potential for the yield curve to steepen dramatically, with 30-year bonds being most sensitive to a rise in inflation expectations.

The rates market has been downright somnolent in recent weeks, but that could change if inflation begins to rise rapidly. I’ve seen some claims that inflation could rise as high as 4% in 2021.

Of course, this is essentially what the Fed wants, so they’re not likely to do anything about it. They want inflation to overshoot the 2% target, perhaps by a lot.

It’s hard to say what level of inflation would actually compel the Fed to tighten policy. Perhaps there is no level. Hence, the decline in the dollar.

Protection

There is always gold.

Gold, of course, is in a bull market, making new all-time highs. Luke Gromen commented the other day that everyone seems to think that everyone is bullish on gold, yet nobody has more than a 1–2% position in it (present company excepted, of course).

Anyway, we will talk more about how to protect against inflation in due time.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

These sorts of things only happen every seven years or so. The deflation trade is toast. Better get some butter and jam.

Jared Dillian

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian