From the desk of John Mauldin:

Dear Reader,

Whether you’re an individual investor looking for top-shelf research and actionable recommendations to help you build a better portfolio, or an investment professional on the hunt for idea generation and expert analysis you can take to your clients, you face a complex and increasingly challenging investing landscape.

Long gone is the 60% stocks/40% bonds asset allocation model that guided our parents’ generation when it came to building wealth for the future in the financial markets.

Today, we live in what I call an age of transformation.

Two transformations, actually, are at war right now all around us, and they're reshaping the investing landscape.

They’re both, as you’ll see, unprecedented in human history.

First, the financial world is beset by sovereign debt in nearly all corners.

Central bankers exacerbate this debt bomb by expanding central bank balance sheets, pressing interest rates to the floor, and trying to quantitatively ease the global economy back to widespread prosperity.

That’s the first historically unprecedented transformation occurring all around us right now.

When I write about how central bankers are actively making the global recovery from the Great Recession worse, I call it the “Muddle Through” recovery. You may have seen my recent Thoughts from the Frontline piece on this on Saturday, May 24.

Explaining what this debt transformation looks like and showing how it affects savers and investors worldwide was the focus of the first part of my recent presentation at the Strategic Investment Conference (SIC) in San Diego.

You see, I’ve been thinking so much about this Age of Transformation and feel so strongly about how important it is that later in this letter, I’m going to disclose to you an idea I’ve never written before.

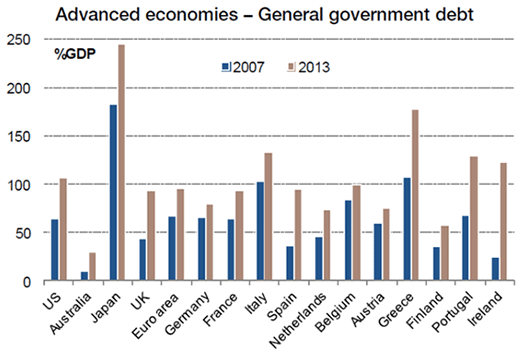

First, here are two charts that distill quite well what the global debt transformation looks like.

Here’s total debt to GDP from 2007-2013 in select economies:

As you can see, nearly every major Western country has taken on substantially more debt.

And here are total central bank assets for major jurisdictions from 2006 through March of this year:

Two things are clear from these charts.

The toxic mix of debt and expanding central bank balance sheets is, to put it mildly, unsustainable and counterproductive for recovery and growth.

When I describe a “Code Red” financial world, to use the title of my latest book written with friend and collaborator Jonathan Tepper, this is the scenario I’m describing.

There are countless other prognosticators, hedge fund managers, and elite-level thinkers (many of whom I count as personal friends) who have been ringing this warning bell for years.

You read me, presumably, and hopefully also participate in the research and advisory products offered by my Mauldin Economics team because you want to know what happens next.

What I mean is, regardless of your position - an individual or an institutional investor - you want Mauldin Economics to help you identify and act on global trends as they develop or, in the best case, before they break out.

You want the idea generation, the boots-on-the-ground insight, the analysis, and the actionable advice to not only survive the transformational age of debt explosion, but actively turn it to your advantage and prosper from it.

If you invest for yourself, you want the reasoned analysis followed by the action to take.

If you are a financial industry professional, you want ideas that can send your own research in a direction of your choosing so you can better serve your clients.

Mauldin Economics takes both goals seriously. Everything we do is shot through with a diligent, responsible attempt to serve both the individual and the professional.

That’s why today, in this note, I want to officially codify the message and the mission of the advisory services I publish at Mauldin Economics.

The Mission of Mauldin Economics

Everything - and by that I mean every research note, every recommendation, every dollar spent on travel to get to the bottom of a trend or an idea that my team subsequently reports back to you - is centered on two goals:

First, I seek to use every research avenue possible to deliver to my team the sharpest macro perspective I can. Then they take my macro analysis and generate well thought out, unbiased investing ideas and actionable recommendation content.

Second, we strive to be humble enough, forward-thinking enough, and disciplined enough to step back from the big picture of the debt transformation and show you what comes next.

What comes next is the second historically unprecedented transformation of our time; it was the focus of the latter part of my presentation at SIC.

The second transformation, as you can probably guess because you know my enthusiasms and interests, is tech progress.

How the tech transformation, in other words, blossoms in the face of the unprecedented global debt transformation will quite literally, determine the path of humanity going forward.

As I’m about to show you, this struggle is cause for relief and celebration, not panic and dread.

And it’s the unique, you-heard-it-here-first position of the Mauldin Economics team and me that the power of the tech transformation currently underway will overwhelm and eradicate the debt transformation.

Below is the first chart I used to make this point during my SIC presentation:

This chart, while somewhat rudimentary, shows how we think of progress and ability over time.

The orange line demonstrates a linear trend. One advance leads to another.

Fire leads to the ability to cook food. Cooking food leads to increased protein consumption. People become stronger. The problem is, that’s not how tech progress works. It isn’t linear.

Tech progress compounds. It builds upon itself exponentially.

That’s the green line in the chart above.

Fire leads to cooking food, which leads to increased protein consumption, which leads to organized hunting parties, which leads to the creation of communities, which leads to trade, bartering, and free time because we’re not all constantly hungry and foraging for food.

Free time leads to leisure pursuits like making better spears, which leads to more successful hunting parties, which fuels more and more and more innovation.

And pretty soon… Gutenberg invents the printing press. A young engineer named Henry Ford starts tinkering with the internal combustion engine. Neil Armstrong, speaking over a crackling radio, says: “That’s one small step for man, one giant leap for mankind.”

You get the point.

Today, the two warring transformations, the debt transformation and the tech progress transformation have pushed global society to an “adapt or perish” moment.

The sooner you adapt to the imminent and, quite frankly, profoundly life-improving implications of the tech transformation, the better.

Mauldin Economics is uniquely positioned to help you and your portfolio prepare for and benefit from the ramifications of the debt transformation and the eventual success and spread of the tech transformation.

In the Yield Shark income-investing advisory letter, for example, the Mauldin Economics team sends you what it considers to be stable and growing dividend stocks that can serve as cornerstones to an any-weather portfolio.

Here’s why dividend stocks are a necessary component to any portfolio - individual or institutional. Take a look at S&P 500 growth overlaid with NYSE margin debt since 1994:

If you’re buying the S&P broadly, in other words, you’re buying escalating margin debt.

Unless, of course, you target strong, responsibly managed firms with economic moats that protect the business. These are the exact types of companies the Yield Shark team researches.

The team then recommends dividend stocks in broad categories such as “high current income” and “international income,” sending you monthly issues laying out the investment case and providing strict buy-level guidance.

Of 17 current open positions in Yield Shark, 14 are in positive territory. As I write this, the biggest “loser” is 2.61% in total return terms, with dividend income included.

Speaking of income, in the “high current income” category of the portfolio, you can benefit from yields in the 6-7% range, which is great yield in any environment.

My point is that sooner or later, margin debt in the S&P will pivot and decline swiftly. This is going to be part of a wide market correction. You want dividend income in your pocket between now and then, making for fresh capital you can deploy elsewhere.

In short, Yield Shark could help you collect extra income simply by holding healthy, strong-moat companies. Of course, my opinion isn’t what counts. Your opinion is what matters - and I always welcome your input and comments.

What I want you to understand about Yield Shark is that it’s built on a defensive stance - basically, how can you best respond to and benefit from the fallout of the debt transformation.

Yield Shark’s sister advisory service, Just One Trade, comes at the age of transformation issue from the opposite side: from the tech transformation angle.

Just One Trade, as you may well know, is a faster-moving, more sophisticated trading service than Yield Shark. Where Yield Shark is typically long only, with a goal of collecting income and capital appreciation, Just One Trade seeks to leverage trading opportunities in shorter time frames (sometimes just a few weeks.)

Just One Trade also - and this is new - selectively uses options to maximize gain potential while cutting down on cost of speculation.

Currently, Just One Trade holds one of the world’s leading exploiters of lithium; a tech-important alkali metal used in lithium ion batteries.

Just One Trade also holds a major tech-focused defense contractor and a major pharma company, as well as one of the leading auto manufacturers in the world.

Plus, the portfolio includes one of the biggest robotics innovators on earth today.

While not solely a tech-focused letter, Just One Trade positions both the individual and the institutional investor for the tech transformation’s imminent response to the debt transformation.

I said during my SIC presentation, for example, that the next car I buy will more than likely be battery powered. You also know how strongly I feel about near-term advances in robotics and pharma-tech.

Here’s the picture I used to describe just how quickly tech progress is moving right now in a variety of electronic hardware-driven disciplines, many of which are leveraged by Just One Trade:

What this means is that in our lifetimes, the calculations per second available via computer technology has increased so quickly that we’re only a few years away from computers functioning on the level of the human brain.

Take a moment to think about that. Had I written the paragraph above in a note to you twenty years ago, you would’ve laughed at me. Today, you take it as a given.

Technology this powerful, this fast-moving, will make everything about how we travel in cars, visit a robotic-assisted doctor, take medicine personalized to our own DNA, even how we protect our country, more efficient and easier.

These are the topics Just One Trade seeks to leverage in its model portfolio - that tech progress, as you’ll remember, is exponential, not linear.

Exponential progress is explained best at Mauldin Economics, I think, by my friend Patrick Cox.

His Transformational Technology Alert letter, which is a letter I’ve been wanting to publish for years and only in the last year have I had the chance to release to you, already has over 1,000 readers.

Patrick’s letter, as the name implies, focuses on the publicly traded companies that will transform how you and I go about our daily lives.

For example, some of Patrick’s model portfolio companies are working on ways to stop or even reverse biological aging. That’s another of those sentences you should pause to re-read.

And one of Patrick’s most fascinating findings is that what you and I call Moore’s law, the capacity for processors to essentially double in computational capability every 18 months has an inversely correlated cousin when it comes to costs.

For example…

As you can see, it cost $100 million to get your genome sequenced in 2001. By this time next year, you’ll be able to get your entire genetic map sent to your email for $100.

Costs falling as tech capability increases isn’t just seen in genomic sciences.

Solar power is undergoing a similarly radical transformation. In solar power, it’s called the Swanson effect, and it shows costs of silicon photovoltaic cells. Take a look:

Compare those two charts - and look at the falling costs for miraculous technologies.

The companies best leveraging the interplay between falling costs of research and development and the exponential increase in knowledge and understanding are the companies that make up Patrick’s portfolio.

These are early-stage companies. Their stocks can be volatile. Some won’t make it. And some could change the world.

Patrick’s also a natural storyteller, and with each letter he sends, I’m fascinated by his attention to detail and ability to get to the bottom of complex scientific concepts.

The tech transformation - beyond biotech and energy ideas like solar - is also blossoming due to better conventional resource exploitation, some of it happening outside the US.

That’s why World Money Analyst, the international investing advisory from Kevin Brekke and his global stable of boots-on-the-ground experts, holds a major Brazilian natural resources play…

As well as a Commonwealth of Independent States-based construction supply company, a uranium play, and one of the largest gold and silver producers in the world.

Plus, there are technology plays in World Money Analyst delivering access to the biggest money migration of our lifetimes. That is to say, the explosion of inflows to developing economies.

Here’s a chart from my SIC presentation on cumulative capital inflows to emerging markets since 1995:

As citizens in developing economies gain disposable income, connect to the Internet, buy cellphones, become more sophisticated in terms of banking and finance, eat better, and travel more, World Money Analyst is there to give you localized, well-researched ways to benefit.

Expanding technological prowess, in other words, makes it easier for both individual and professional investors to look beyond conventional borders to the best opportunities on major global exchanges.

From an “idea generation” standpoint, Mauldin Economics’ World Money Analyst has unparalleled ability to give you in-depth, well-researched avenues to either take action or perform more of your own research on the biggest global trends in place right now.

I’m consistently impressed with Kevin’s ability to build cohesive, enlightening macro investment cases using reports from his team of experts spread all over the globe.

I know this letter is running long, and I haven’t even mentioned Grant Williams and his Bull’s Eye Investor letter.

From media and communications companies to REITs and global producers of hard assets, Grant’s letter positions you to benefit from the ongoing struggle I’ve described many times above between the debt transformation and the tech transformation.

And then there’s Over My Shoulder, my personal email alert service, which delivers the most insightful research I receive and read each week. The volume of reports I read in a week is almost overwhelming. I have to read it all to keep my edge, but you don’t. That’s why I filter through the noise and send you only the pieces I find most compelling.

In sum, it is my personal goal and mission to prove to you that Mauldin Economics has you covered now and going forward into the thrilling and challenging age of transformation.

Whether you’re an individual investor or a RIA, CFP®, or a broker, Mauldin Economics wants to help you adapt to a changing world and benefit from it.

Which leads me to say something I mentioned at the beginning that I’ve never said before.

If you subscribed to everything Mauldin Economics publishes, you’d pay $5,216 a year.

Today I’d like to offer you a full year of every letter and advisory mentioned above for just $1,995.

That’s a 61.7% discount. In fact, if you already subscribe to a letter from Mauldin Economics, you’ll pay even less than $1,995. I’ll explain how this works in a moment.

What I’ve attempted to do in the letter above is stress just how complex I think today’s investing climate is, and demonstrate with confidence how Mauldin Economics delivers useful strategies and ideas if you’re an individual investor or if you’re a professional advisor, trader, or analyst.

The debt transformation at battle right now with the tech transformation holds both promise and potential pitfalls for the global economy.

The age we’re entering is more challenging (and packed with opportunity) than any you or I have witnessed in our lifetimes.

I take it as my duty, and frankly, my honor, to assist you any way I can.

One way I can assist you is by removing barriers. Cost is a barrier. I’m blowing it away today, right now. I call the idea outlined below Mauldin Economics VIP.

Introducing

Mauldin Economics VIP

Just like the name “VIP” implies, for one low yearly price, you get unlimited access to all our subscription-based research.

$1,995 grants you a full year of:

$1,995 grants you a full year of:

-

Yield Shark - including all issues, alerts, updates, and reports - normally $199 a year.

-

Just One Trade - including all issues, alerts, updates, and reports - normally $2,495 a year.

-

Transformational Technology Alert, plus all issues, alerts, updates, and reports - normally $1,995 a year.

-

World Money Analyst - plus all the same benefits mentioned above - normally $179 a year.

-

Bull’s Eye Investor - again, with a full year of all the same benefits, normally $199 a year.

-

My Over My Shoulder email analysis and alerting service - normally $149 a year.

To provide more, however, for that $1,995 yearly price, I also insisted on the inclusion of several other complimentary VIP benefits for you. These benefits include:

If you are among the first 500 to respond to this note from me today, I’ll send you a signed and personalized copy of my new book with Jonathan Tepper, Code Red.

-

I will also include you as a “VIP tester” on all new newsletters and advisories we test and release in the next year.

We’re working on one new letter right now - very timely given the record highs in the S&P. Tentatively, the plan is to launch this advanced trading service this fall. The team thinks it should be a high-priced service. You will get this new service at no cost.

-

Of course, you’ll continue to receive complimentary subscriptions to my letters, Thoughts from the Frontline and Outside the Box.

-

And you’ll receive Grant Williams’ Things That Make You Go Hmmm… and Patrick Cox’s daily Tech Digest.

-

You will also get a short, actions-only email re-cap on Fridays outlining all the investing moves made by all our publications that week.

This way, if you’re on the road, you can check these quick Friday emails for a fast, easy-to-read list of all the actions recommended in Mauldin Economics letters that week.

Right now, I’m calling this for-VIPs-only Friday email Mauldin Economics Week in Review.

- Plus, I will send you a link to watch my entire “Investing in An Age of Transformation” presentation from this year’s SIC in San Diego. I had so much fun giving the talk, and I think it’s a strong primer on where we are today, and where we’re headed tomorrow. You can start watching the presentation in full about five minutes after you reply to this letter.

Now here are four important details to help you make the right decision for your situation.

First, if you already subscribe to any Mauldin Economics publication or multiple publications, my team is prepared to credit the remaining months of those subscriptions to your Mauldin Economics VIP price, so you pay less than $1,995 if you respond today.

In short, anything you already subscribe to is deducted from the $1,995 fee to get everything for the next year. The only way you’d pay the full $1,995 is if you don’t currently have any paid subscriptions, but even paying $1,995 is still a 61.7% discount off normal retail.

Second, $1,995 a year for all the newsletters we publish is locked in for however many years you choose to be a Mauldin Economics VIP. Next year, if the added-up value of everything we publish is $9,500 instead of $5,216, you’ll still only pay $1,995.

Third, just like everything else Mauldin Economics publishes, you can reply today and try Mauldin Economics VIP for 90 days without risk. If at the end of 90 days you decide you want to go back to individual subscriptions like you used to have, you can do that. There’s no pressure on you.

Fourth, and finally, Mauldin Economics VIP is open to you right now. Very soon, however, my team will close this offer.

If you want in, you should reply right now. I can foresee VIP being something the team opens up for a short time once or twice per year. At all other times, this offer will not be available to anyone.

Finally, I’d like to thank you for reading Mauldin Economics and relying on my team and me to help guide you through a challenging and exciting time in market history.

The debt transformation has folks worried and wondering what comes next. The tech transformation has folks confused, excited, and also wondering what might come next.

I’m proud and pleased to present Mauldin Economics as the unique solution to investing in the age of transformation - whether you’re a private individual investor or market professional.

And today, for the first time ever, when you become a Mauldin Economics VIP, you can read everything we publish for the next year for one low price.

Your excited to live in the age of transformation analyst,

John Mauldin

![]()

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use.

Unauthorized Disclosure Prohibited

The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com.

Disclaimers

The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Thoughts from the Frontline Audio, Outside the Box, Over My Shoulder, World Money Analyst, Bull’s Eye Investor, Things That Make You Go Hmmm…, Just One Trade, Transformational Technology Alert, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC.

Affiliate Notice

Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service.

Copyright © 2014 Mauldin Economics, LLC