The Trump Rally Will Morph

-

John Mauldin

John Mauldin

- |

- December 11, 2016

- |

- Comments

- |

- View PDF

Stock Valuation in the Age of Trump

Over & Under

Tech Bubble Redux

We Are Overdue for a Correction

Something’s Gotta Give

Investing in a Rising-Interest-Rate World

Hands Off the Wheel

Some Thoughts on the Trump Rally

New York and Florida

“Price is what you pay. Value is what you get.”

– Warren Buffett

“There is no safe store of value.”

– Alan Greenspan

“In the short-run, the market is a voting machine – reflecting a voter-registration test that requires only money, not intelligence or emotional stability – but in the long-run, the market is a weighing machine.”

– Attributed to Benjamin Graham by Warren Buffett in a 1993 Berkshire Hathaway letter

The actual quote, from Graham’s 1934 book Security Analysis, is:

In other words, the market is not a weighing machine, in which the value of each issue is registered by an exact and impersonal mechanism, in accordance with its specific qualities. Rather we should say that the market is a voting machine, whereon countless individuals register choices which are partly the product of reason and partly the product of emotion…. Hence the prices of common stocks are not carefully thought out computations, but the resultant of a welter of human reactions. The stock market is a voting machine rather than a weighing machine. It responds to factual data not directly, but only as they affect the decisions of buyers and sellers.

Stock Valuation in the Age of Trump

The presidential transition brings new surprises almost every day. Last week Donald Trump’s spokesman revealed, via an offhand comment, that President-Elect Trump had sold all his publicly traded stocks back in June. That’s months before he won the election and faced conflict-of-interest questions.

Did Trump time his exit right? So far, the answer looks like “no.” The S&P 500 Index is now higher than it was at any point during June. Much of that gain came in the furious post-election Trump rally. Nonetheless, Trump has other concerns now, so being out of stocks is probably the right position for him.

As for the rest of us, we have decisions to make. With market benchmarks touching new all-time highs and both fiscal and monetary policies at a turning point, asset allocation is critical. Do you have too much exposure, or not enough?

In the long run, the answer depends largely on valuations. Today we’ll look at stock valuation several different ways, see what history tells us about the future, and then think about how to react. There are good reasons to think that the Trump rally could morph into the stereotypical and expected Santa Claus rally. Toward the end of the letter, I will comment on why. It’s actually kind of a rational process. And then what? My conclusion is going to be (drum roll, please) that you should currently be long the stock market, but that your asset allocation model should be changed dramatically. I am finishing up a white paper this month that will be ready in January, in which I talk about portfolio construction and asset allocation.

As I look out over the coming years, I am convinced that we’ll see the blowing up of the biggest bubbles in history, including those of government debt and government promises, and not just in the US but all over the world, leading to an eventual global crisis of biblical proportions – although it isn’t clear what the immediate cause of the crisis will be. Right now I am looking at Italy with intense focus.

The structure of your portfolio is going to be the dominant factor that determines whether you will be able to get your assets from where they are today to the other side of the crisis. Passive portfolio construction, which the herd of investors is almost madly rushing into today, is going to be just about the worst, most destructive thing you could do to your portfolio. You will, however, have options.

Before we plunge in, I want to remind you that our Mauldin Economics VIP offer will expire shortly. Your invitation to join us is waiting for you here.

Let’s start with some basics. Stocks are fractional ownership shares of a business. Each share’s value is a function of the entire company’s value. The company, in turn, is worth the present value of its anticipated future profits, relative to other alternatives. We say “anticipated” future profits because we can’t know for sure what they will be. This uncertainty is why stock prices fluctuate. The amount buyers will pay changes as they acquire new information about the company’s circumstances.

(The same basic model holds for shares in hedge funds or bonds or almost any other investment. Your investment represents the potential to participate in a future stream of returns.)

The most common way to measure valuation is with the price-to-earnings ratio (P/E). How much will you pay today for the right to own future earnings? If you expect earnings to be $10 per share per year, and you’re willing to pay $100 for a share, the P/E ratio or “multiple” is 10.

(A brief aside: That number may seem quite high if you’re the owner of a non-public small business. If your business earns $100,000 a year, can you sell it for $1 million? Probably not. You might get 3x earnings or 5x earnings. The difference has to do with the liquidity and capital markets access that go with being a publicly listed company. That’s worth a lot. If there were two otherwise identical businesses and only one was publicly traded, the public one would be worth at least twice as much as the private one. Maybe more. Which is the reason that many private equity funds buy a number of related small businesses until they have scale and then take them public. That’s called a rollup. The act of going from private to public produces a large-multiple return. At least that’s what the private equity investor hopes.)

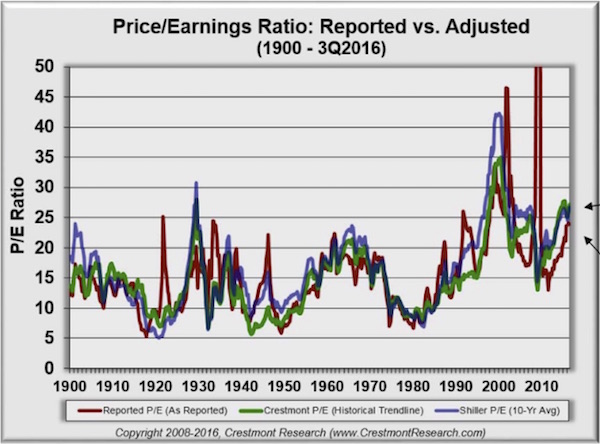

Analysts compile P/E and other indicators from many companies to give us valuation metrics on entire markets and indexes. This is where we get opinions like “The market is overvalued” (or undervalued). You can see overvaluation and undervaluation in this chart from my friend Ed Easterling of Crestmont Research.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The red line is the combined P/E ratio of the S&P 500 as originally reported. The green and blue lines are adjusted Crestmont and Shiller versions, which occasionally diverge. The P/E ratio spent most of the last century between 10 and 25. The times it went below 10 correlate with market bottoms, i.e. “undervaluation,” while the times it spiked over 25 were “overvalued” manic tops.

You might think that the P/E would be a pretty good timing indicator. That’s true for very long periods. The problem is that P/E ratios can stay undervalued or overvalued for years. They can also go to extremes well below 10 and well above 25 and stay there for uncomfortably long spans. Keynes had it right when he said, “The market can stay irrational longer than you can stay solvent.”

Presently, all three P/E versions are near or above 25, indicating overvaluation. This doesn’t mean the end is near – though it could be. But it does suggest that we are not at the beginning of another long-term bull market. The next chart illustrates the past and present trend in a different way.

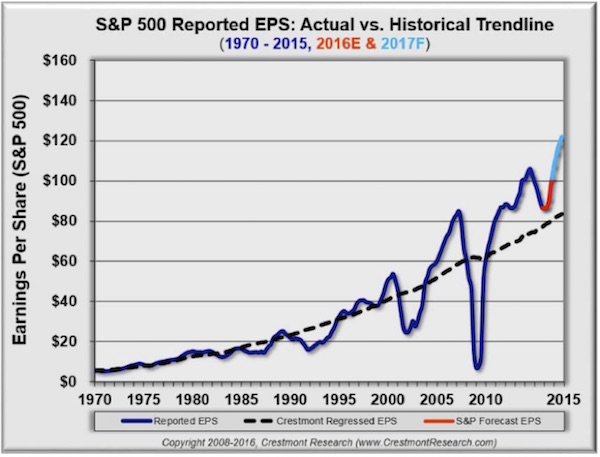

Direct your attention to the dashed line. It’s Ed’s long-term earnings baseline, which he adjusts to reflect the relationship of earnings to economic growth. Reported earnings per share go below the baseline during bear markets and above it in bullish periods. Currently it is way above trend and is projected by S&P and many others on Wall Street to become even more so.

Again, this indicates that the market is at the very least fully valued and more likely overvalued. And again, we can’t rule out its becoming even more overvalued. But at some point, earnings and the baseline will converge again. Knowing when and how they will do so is a different matter.

For another view on valuation, let’s go to Steve Blumenthal of CMG Capital Management. Steve’s On My Radar newsletter is both free and priceless, partly because he subscribes to the very expensive Ned Davis Research (NDR) and shares some of its best analysis.

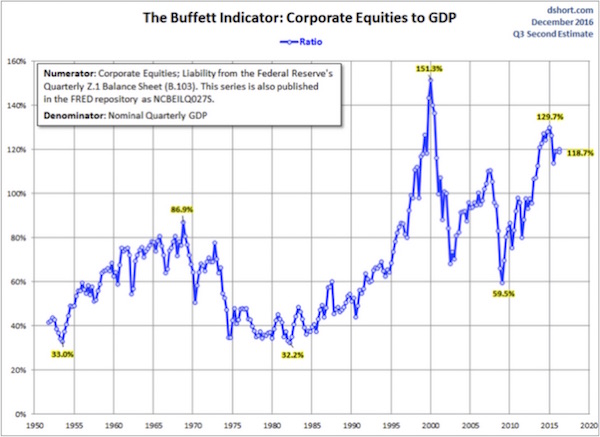

We’ll see something from NDR in a minute. First, I want to highlight what Steve calls the Buffett Indicator, so-called because Warren Buffett once termed it the best single valuation measure he knew. That’s high praise from the Sage of Omaha.

The Buffett Indicator is essentially the market value of all publicly traded securities as a percentage of GDP. Intuitively, it seems odd that the combined value of every public stock would be worth more than the country’s annual production. But sometimes it is. Those periods tend to mark overvaluation, as you can see here.

The low points in the chart coincide with the beginning of long-term bull markets in 1954, 1982, and the present one that began in 2009. Likewise, the high points mark the beginning of painful losing periods.

The interesting thing here is that right now the Buffett Indicator, while down from its late 2014 peak, is still higher than it was before the 2008 financial crisis. That should not be encouraging if you’re a bull. Buffett himself said the 70%–80% area of this indicator was the zone where buying stocks was likely to work out best. Presently we are way above that.

I will add one word of caution regarding this indicator: It assumes that GDP remains a meaningful statistic, even though the economy has changed considerably in recent decades. I’ve written about the quirks and vagaries of GDP before. We still use GDP because we have nothing better, but take it with a grain of salt if you’re using it as part of a timing decision.

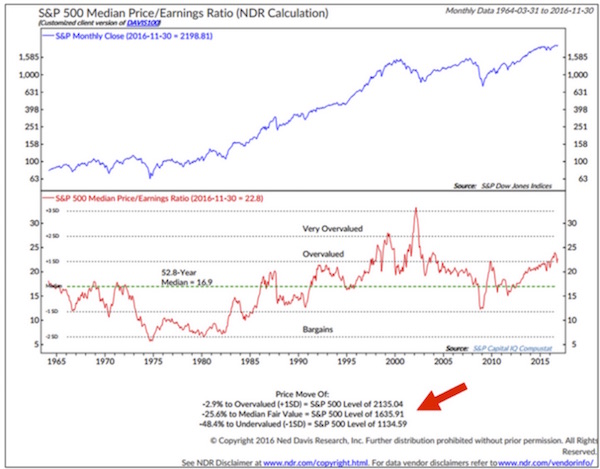

Steve’s next chart is from Ned Davis and shows us the S&P 500 median P/E back to 1964, which is 16.9 (dotted green line). The distance we are above or below the median is a valuation clue.

By this standard, “fair value” of the S&P 500 is 1635.91 (red arrow). We’re well above that now. NDR considers one standard deviation over that level as “overvalued,” which would be 2135.04. At 2259.5 as I write this, we’re getting deeper into overvalued territory.

Could the market get more overvalued? Absolutely. It did in the tech bubble. And for reasons I will outline later, price-to-earnings could be dramatically reshaped in the near future. So again, the present level doesn’t necessarily mark a top, but it does suggest caution… and possibly a lot of caution, depending on the political winds or the whims of the new Republican leadership. Optimism, deserved or not, about the US situation aside, Europe’s or China’s having a serious crisis could throw the world into a global recession that would mean a recession in the US. A serious bear market, which is always the result of a recession, will not simply push the S&P 500 back down to fair value; the S&P will keep falling into undervalued territory, which NDR marks at 1134.59. That’s around a 50% drop from the current level. Gulp.

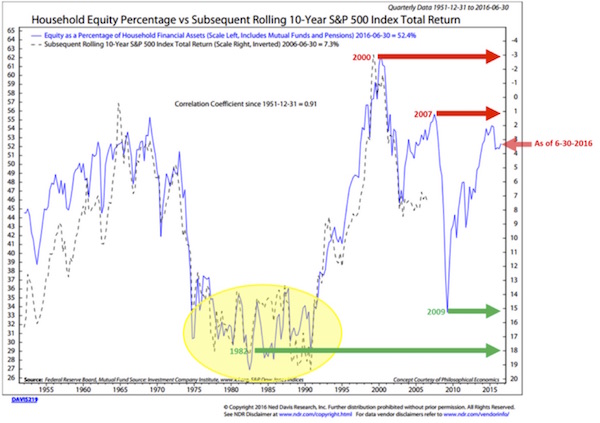

Steve’s next NDR chart takes some explaining. It shows the percentage of household financial assets invested in stocks (blue line) versus the S&P 500 total return for the following 10 years (dotted line). Notice that the right axis is inverted and the dotted line tracks pretty close to the solid blue one. The correlation is 0.91, which is extraordinarily high. What the chart shows us is that a higher percentage of household assets in equities points to a lower annualized return over the next 10 years.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Note the green arrow at the 2009 low. It points off to the right scale just below 15. That suggests that someone who bought stocks at that low point and holds them until 2019 will realize a roughly 15% annualized return.

That’s the good news. The bad news is that the red arrow at 6-30-2016 means that the 10 years ending 6-30-2026 should produce a 3.25% annual gain. That’s not awful, of course, but it is nowhere near the 7% or more that many pensions and insurance companies think they can earn on their portfolios – and since we all know that bonds earn less than equities do, they are really hoping to get closer to 10% on their equity portfolios. It’s therefore a problem for everyone, stock investor or not. Your taxes may have to make up the difference.

(Sidebar: Speaking of pensions, I’m extraordinarily distressed about the Dallas Police and Fire Pension Board fund disaster that has been recently revealed … after I bought my home in Dallas. To completely make up the funding shortfall could require a doubling of my already high property taxes. When people talk about Texas being a low-tax state, that’s because they typically don’t pay attention to property taxes, which are much higher here than in most other states.)

We Are Overdue for a Correction

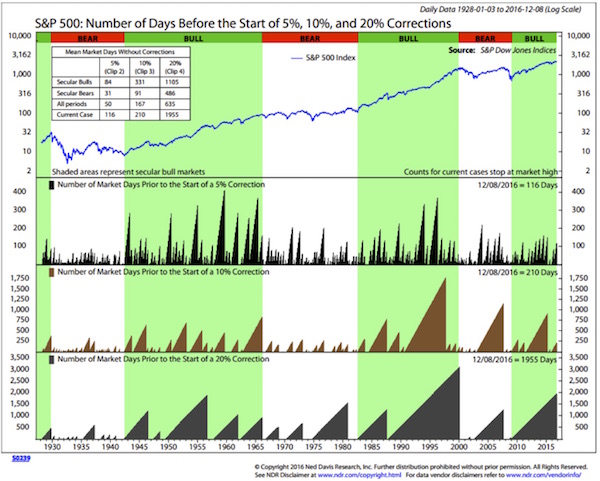

Since I’m blatantly borrowing from my friend Steve Blumenthal, let me show yet another piece of good research that he included in yesterday’s letter. Bottom line: We are way overdue for a correction. Again, our situation is not the worst it’s ever been, but we are beginning to bump up against historical lines in the sand. Here’s the chart, which shows the number of days before the start of 5%, 10%, and 20% corrections.

Here is how you read this chart:

The top section shows the history of the S&P 500 Index from 1928 to present.

The next three sections show the number of days prior to the start of 5%, 10%, and 20% corrections. Think of this as a study of history. It is normal to get corrections in the markets. Let me note that Ned Davis thinks a secular bull market began in 2009. I think history is going to show that not to be the case. I think we are still in a very long-term secular bear, although there has been a clear cyclical bull market since 2009. I think the next global recession (hopefully not a depression) will potentially give us a vicious bear market that will mark the end of this secular bear. However, that is neither here nor there as far as the data Ned Davis presents.

You can see that it has been 116 days since we had a 5% correction. Since 1928, the average number of days before a 5% correction occurred was 50. In secular bull periods the average number of days was 84. In secular bear periods the average number of days was 31.

Note that we have been 210 days without a 10% correction. Since 1928, the average number of days before a 10% correction occurred was 167. In secular bull periods the average number of days was 331, while in secular bear periods the average number of days was 91. (This is where the difference between being in a secular or a cyclical bull market becomes pertinent.)

It has been 1955 days since we suffered a 20% correction. Since 1928, the average number of days before a 20% correction occurred was 635. In secular bull periods the average number of days was 1105. In secular bear periods the average number of days was 486.

The current case of 1955 days without a 20% correction is more than three times the average of 635 days (for the whole period from 1-3-1928 to 12-8-2016).

For this record number of days, let us all join hands and exclaim, “Thank you, Fed, BOJ, and ECB!”

So far, we have seen compelling evidence from several sources and methodologies that US stocks are overvalued. Yet just in the last month we saw investors react to the US election by bidding the benchmarks up to new all-time highs. This implies they expect even higher prices next year. Can it happen?

Louis Gave of Gavekal took on that question in a lengthy and masterful presentation last week titled “Something’s Gotta Give” (article is behind paywall). He had more questions than answers. The prime question, says Louis, is whether the US economy is a “coiled spring” ready to bounce higher based on the new political environment. We know changes are coming. Are they the kinds of changes that will help the economy, and therefore corporate earnings, grow enough to justify sharply increased stock prices in an already overvalued stock market?

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Louis doesn’t have a firm answer, but I think it’s fair to say he is dubious. I’ll share with you just two of his 63 slides.

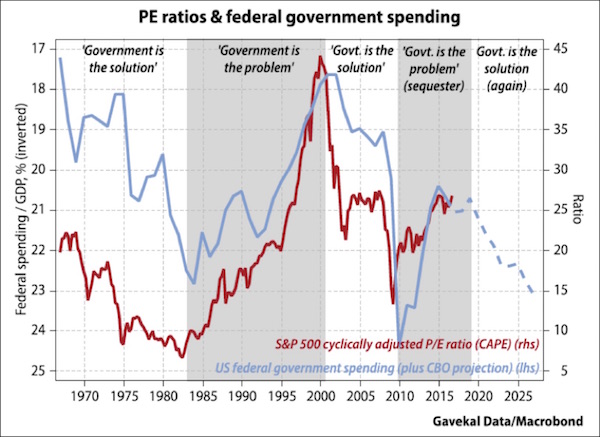

The first one concerns government spending. Part of the present rally comes from expectations that Trump and the Republican Congress will launch an infrastructure stimulus program and also raise defense spending. That’s not a sure thing. Even if it were, Louis points out that higher government spending historically correlates with lower P/E ratios.

Some people will dispute this. You can argue that the higher spending is a response to the lower growth that caused the low P/E ratio. But if you believe that government is by nature less efficient than the private sector, then higher government spending will mean more capital misallocation, which is not good for stock valuations.

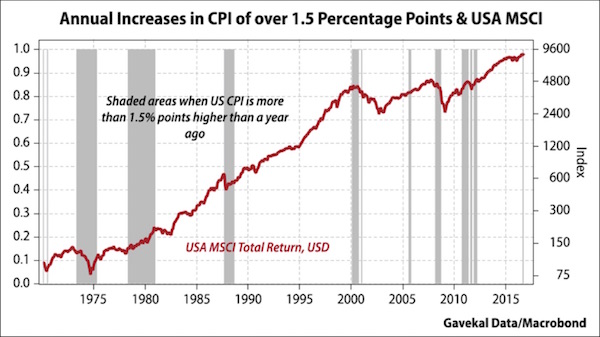

A second justification for the current rally is that new policies and perhaps delayed Federal Reserve tightening will mean higher inflation. People say this will be positive for stocks. With this chart Louis again says, “Not so fast”:

The vertical shaded areas are periods of rising inflation. Other than 1979–81, we see stocks falling in those periods, not rising. Louis says this is because inflation misallocates resources. Companies have to hold more inventory, spend more on payroll and benefits, and otherwise take their eyes off more important goals.

Of course, the Trump administration will do more than just raise spending. Trump intends to reduce taxes, roll back excessive regulation, and otherwise make the US more business-friendly. He will go about it differently than other Republicans would. His intervention in the Carrier outsourcing indicates that this is not going to be a conventional GOP White House. We’ll see how well his approach works, and whether other changes can outweigh the drag caused by higher spending and inflation.

Investing in a Rising-Interest-Rate World

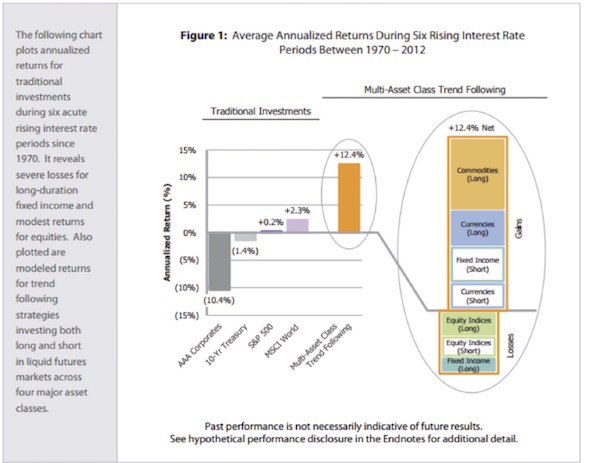

My friends at Welton Investment put out very thoughtful and useful papers, and I always make a point to read them. They are chock-full of useful charts and historical insights. In the latest one they offer some cautions to the recent euphoria of the Trump Rally (see more later). It turns out that equity returns are not all that durable in rising-interest-rate environments. Of course, one could argue that a 25-basis-point increase from already low rates every six months or so does not really correspond to any historical interest-rate increase cycle, but that’s a topic for another letter. Here is a chart that shows average returns during the last six rising-interest-rate environments:

Interestingly, global equities somewhat outperformed US equities during such periods. But what the chart tells us is that we really have to begin to look outside the traditional asset-diversification strategies to find potential for returns.

We see little evidence to suggest that a new bull market is at hand, but that does not mean we are at the top. Markets can stay in overvalued territory longer and move higher than anyone expects. Having now lived through several cycles, I don’t presently see the kind of euphoria that accompanied previous tops. I meet lots of people who are wary of this market, just as I am. The top is more likely to happen when we skeptics throw in the towel and start buying.

My own view is that we are in a trader’s market. It “wants” to go up, so the underlying trend is bullish, but we also see volatility rising. We also see other asset classes, like Treasury bonds, getting whacked while stocks move higher. It seems clear a lot of investors are confused.

When you’re lost and confused, the best idea is often to take your hands off the wheel and let someone else drive. Yet millions are simply taking their hands off the wheel and hoping the car goes the right way. That’s what a passive indexing strategy does for you. You buy a collection of stocks or bonds on the belief they will go up. Maybe they will. And maybe you will end up in the ditch. Personally, I think we are moving into an era where active investing is going to be necessary to keep us on the road to success.

In a world where there is a quite real potential for the correlation among all diversified asset classes to become extremely close, high volatility is certain to be the rule rather than the exception. I think now is the time to diversify among trading strategies rather than settle for passive asset allocation.

Whatever you do, now is no time to put all your eggs in one basket. If you use active managers, have several who don’t just do the same thing at the same time. If you’re indexing, put at least a small slice in some strategy that isn’t always long.

Between the high level of stock market valuation, economic uncertainty, and all the various flash points we’ve discussed this year, I think we may be in for a rough ride in 2017. Buckle up.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Some Thoughts on the Trump Rally

At first glance, strictly from the point of view of the short-term impact they will have on the markets, what’s not to like about the proposed Trump/Ryan/Republican tax proposals? Woody Brock and I had a significant exchange during dinner Thursday night and agreed that the proposed corporate tax reduction will really have a far greater impact than any of the proposed personal income tax cuts. Trump is proposing a top corporate tax rate of 15%, and the Ryan plan essentially calls for 20%. Sounds like there’s room for the Art of the Deal to find a way forward.

The problem is that the devil is in the details. Our hosts Thursday night were very worried about some of the ancillary proposals that come with the plans of Trump or Ryan or Texas Congressman Kevin Brady, who is chairman of the congressional Ways and Means Committee, which is actually in charge of tax legislation. (Newt Gingrich has told me that current Ohio Governor John Kasich, who was chair of Ways and Means when Newt was Speaker, was personally responsible for shepherding his tax proposals through and was the most important part of the entire process.)

Brady’s proposal includes a VAT-like tax along with a significantly reduced or eliminated corporate tax. It is possible that under his proposal an import duty would be levied on raw materials entering the country. That’s not clear. You can read more about the issue in this weekend’s Wall Street Journal here. The main point is that they are still working on the details.

A 15% tax cut combined with a VAT of some sort could – but not necessarily would – be extraordinarily beneficial to the profits of US corporations. Some of Ryan’s proposals, which include a significant reduction in dividend and capital gains taxes, would also be bullish. Some of the major proposals (even from Ryan) include a maximum tax of 25% on pass-through corporation income, which is the bulk of small-business income. That would be massively bullish for corporate profits.

Yes, the devil is in the details, and when you begin to get into the weeds of some of these proposals you can lose your bullish euphoria quickly. Has the market gotten ahead of itself? I don’t know. Because I don’t know what is going to come out of the hodgepodge of tax and spending proposals we are seeing.

Understand something. The people in the congressional Republican leadership are tough individuals with strong beliefs about how taxes and revenue should be generated. This is a different group than we saw during the Bush II administration. The post-Gingrich era was not one of the Republican Party’s finer moments. (Some of us think it was a major embarrassment.)

A 20% tax/tariff on raw-material inputs would be massively inflationary. The United States simply doesn’t have the raw materials that it needs in order to produce the enormous variety of products that it does. The resources are simply not here. For instance, we don’t have the right types of crude oil for all of our needs; and even if Trump opens up federal lands and makes it easier to drill for oil, it will take years – as in multiple years, longer than his first term – to get to the place where we are producing anywhere close to the amounts and types of crude that we actually need, if we ever can. Further, many of our refineries are designed to take the rather heavier crudes that come from foreign imports rather than our own light crudes. We are talking multiple tens of billions, if not hundreds of billions, of dollars that will be needed for retooling our own refineries to process lighter crudes. That cost will have to be passed on, or companies will go out of business and tens of thousands of jobs will be lost.

Where would we get enough lumber for building if we start taxing Canadian timber at the border? Off the top of my head I can come up with a dozen critical raw inputs that would be significantly more costly if we put a 20% tariff on them. Put that in your inflationary pipe and smoke it. And then try to trade around that! I am not even going to offer you a chart of what happens to equities during periods of rising inflation, other than to say that it’s really ugly.

That being said, there are parts of the Brady corporate/VAT tax plan that are very appealing at first blush – assuming of course that somebody figures out that raw material inputs have to be dealt with in a different manner. And the whole situation becomes more complex because of currency adjustments. And then you throw in a stronger dollar, and it gets more complex yet.

However, the Brady plan would offer strong incentives to foreign corporations to establish plants in the United States to produce whatever they normally sell here, which would create US jobs. That’s assuming that other countries don’t modify their own tax proposals in a kind of tax bidding war. It may be time to dust off our game theory papers!

At the end of the day, call me a skeptical optimist. I know that a few oxen are going to get gored in the tax-reform process –you can’t make everyone happy. But the opportunity is here to radically reshape the entire tax process. I think that most everyone can agree that our current tax system is thoroughly dysfunctional and is far overdue for an overhaul.

Maybe, just maybe, the market is getting it right. A radical restructuring of business taxes could be an enormous boost to corporate profits, which would change the entire price-to-earnings equation in a positive manner. Which is why you need to be long today, but you need to be long with a strategy that says that when the facts change, you change, and that you have a clear eye on a direct path to the exit if and when you need it. The market is a voting machine, and every twist and turn will change its sentiment. So it’s wise to stay on your toes. Restructuring the tax system the wrong way would be devastating.

Trump and his talented team, along with Ryan, McConnell, Brady, and all the rest of the players, need to be very circumspect in how they talk about the details of their plans in public before they get them hashed out among themselves. Markets hate uncertainty, and we could see the entire bull market blow up before we know half the details if stuff starts getting leaked that could be interpreted as damaging (though that might not really be the case). These people are big boys and girls and understand that danger. Let’s hope their staffs, which are the usual source of leaks, understand it as well. (Let me take a moment here to be hypocritical and say that if any staff members want to leak discuss things with me, please feel free to call. I really am trying to keep up with what the heck is going on and might have an idea or two to offer. And I actually get the concept of “off the record.”)

More on what your investment strategy should look like will be coming your way in future letters and white papers early next year. Stay tuned.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Before I finish up this week, a final heads-up on a service I’m extremely proud of, Mauldin Economics VIP. VIP members get access to six premier publications from our team of analysts, as well as other discounts and offers throughout the year. If ever there was an excuse for self-gifting in the holiday season, this is it.

Subscribing to the publications included in VIP membership would cost $6,662 for a full year, but we’ve knocked 63% off that (with an even bigger discount for two-year membership).

You can learn more and sign up for Mauldin Economics VIP right here. It’s available through December 13 – but then the doors will be closed for at least another six months.

As I write, I am literally on a train from Washington DC to New York for a series of meetings and a special Friends of Fermentation celebration with Art Cashin and the gang, and then I’ll head on down to Atlanta for a Galectin Therapeutics board meeting. After the Galectin gathering I'll be home for the holidays, and then I’ll be at the Inside ETFs Conference in Hollywood, Florida, January 22–25. If you are in the industry and coming to that conference, make a point to meet with me. I will be making some big announcements at the conference. Then I'll be at the Orlando Money Show February 8–11 at the Omni in Orlando. Registration is free.

I had dinner last night with my really good friends Neil Howe (of Fourth Turning fame) and Steve Moore. You know we talked politics and the future, but I also tried to frame the question of economic policy in terms of how do we help middle-class America? I am more and more becoming convinced that not just the Trump election but also the outcome of the Brexit and Italian referenda represent a pushback from the middle class. People feel they have lost control of their economic lives and are looking for ways to find work with meaning. They’re not looking for handouts or for welfare; they want jobs and value and a way to feel good about themselves, that they are contributing to society.

We can certainly bring a some jobs back to the US with the growing phenomenon of the “re-shoring” of American companies, and certainly the policies outlined above would accelerate that trend; but re-shoring is not going to produce the multiple millions of jobs that have gone away due to increased technological productivity, and that is going to continue to be a problem. We are going to have to figure out how to address the distribution of not just wealth but meaningful, purposeful work more evenly throughout society.

The more I think about the future of work – and it’s the most difficult chapter of the book I am working on – the more questions I have. And the answers remain vague. This is forcing me to contemplate philosophically uncomfortable concepts. The real angst that so many people are experiencing is easy to see. There were headlines this week about the odd dip in longevity among middle-class white males, for the first time in 250 years. The falloff is attributed to suicide, alcohol, and drugs. No mystery there, but the astonishing thing is the sheer size of the problem. People are looking for hope, and unfortunately, far too many of us see no hope and end up in a sad downward spiral. This problem has to be addressed, and solutions are not just a matter of tax policy.

Trump has made a down payment on at least trying to do something about our disastrous inner cities by talking Dr. Ben Carson into taking a run at the problem. If you don’t know his story, he came up on the wrong side of Detroit to become one of the most celebrated doctors in the world. The movie Gifted Hands was about him. Honestly, I don’t know what he can do. But at least he viscerally understands the problems.

Neil made the point that Bernie Sanders lost massively in the black communities in Southern states. He came to the South and talked about black people as being victims. That is not what the large majority of blacks are looking to hear. They want to know how things are going to change for them. They are looking for exactly the same hope and promise that white middle America is looking for. At the end of the day, we are far more alike than we are different.

And with that I will hit the send button and spend a few hours on the train trying to work through a few hundred emails. And maybe even dip into a few books. I flew in very early Friday morning to meet with Andy Marshall, who is now 95 and still at the very top of his game. He is often called the Department of Defense’s Yoda. He was appointed by Nixon and reappointed by every president up to and including Obama as the head of the Net Assessment Division of the Defense Department, which looks at future problems and threats. He is the greatest futurist alive today – he can see geopolitical and defense patterns and issues develop long before they are apparent to anybody else. We talked about a lot of things, but I also asked him questions pertinent to my upcoming book on what the world will look like in 20 years.

By the end of our session I had bought about half a dozen books on my iPad. In several, I simply bookmarked the chapter he thought was relevant. He literally had hundreds of books in a stack on a table, and those were the ones he had read recently. I can’t tell you what an honor it is to be allowed to simply to visit with him. When you look at his schedule, which he keeps on an old-fashioned calendar on his coffee table, you realize what a parade of people, many whose names you would recognize, are coming to him for advice and counsel. There was a book written about him, called The Last Warrior, and it’s well worth reading

I may do a few TV hits in NY, but it’s all so last-minute as the new cycles keep shifting, so you never know who the producers really want to have on. I will send out a tweet when I know. You should be following me on Twitter. Have a great week. I’m looking forward to having dinner with my friends Rory Riggs and Steve Blumenthal tonight, and Shane is joining me in New York for the next few days. Then Ed D’Agostino and Olivier Garret are coming in to talk about our publishing business and to share a holiday dinner. It should be fun.

Your just enjoying the season and getting together with friends analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin