Tax Reform: The Good, the Bad, and the Ugly, Part Two

-

John Mauldin

John Mauldin

- |

- February 12, 2017

- |

- Comments

- |

- View PDF

“Taxation is the price we pay for failing to build a civilized society.”

– Mark Skousen

“Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

– Ronald Reagan

Taxation is almost never an exciting subject, nor do we want it to be. The best tax system would be silent and unobtrusive. It would raise enough revenue to cover essential government functions and not a penny more. Sadly, our US system is nowhere near the ideal.

In part one of this series, I talked about whether the new tax proposals would actually create jobs and discussed the proposed “Border Adjustment Tax” and some of its possible complications. In part two, today, we will look more closely at the rest of the tax proposals. Then next week we will go much deeper into the BAT and then into what I think the tax system should actually look like, which will be far different from anything I’ve suggested in the past. That discussion will make more sense if we have placed the ideas in full context. That is today’s objective.

The BAT is not a stand-alone policy. It is one component of a broader House Republican tax reform plan, which in turn is part of an even broader federal government reform proposal called “A Better Way.” In theory, the different parts all work together, which is good but makes it hard to discuss any one element in isolation.

In this series, I’m looking specifically at the tax-reform portion of the Better Way proposal. It has other planks on national security, health care, poverty, and more. They are important, and I may discuss them in the future, but let’s leave them aside for now.

I must also note that I am not a CPA or any other sort of tax expert, and you should not make any financial or tax decisions based on what I say here. Please consult your own tax advisor for individual advice.

With those caveats, we’ll look at why we need tax reform and how the Better Way plan tries to deliver it. I want to say up front that I respect the plan’s authors for taking on this very difficult task. As you’ll see, though, I foresee major problems with some of their proposals. I hope they’ll take my criticism constructively and modify the plans to work better for everyone.

I will begin with an assumption I know some readers will resist: Government is necessary. Some of my friends and readers are anarchists, libertarians, or otherwise believe that government is inherently evil or counterproductive. I respect your sincerity, but I disagree.

Now, this is not to say that we need as much government as currently exists, or that everything governments do is useful. A great deal of it is not. Nevertheless, I believe we need some level of government to maintain civilization. That means we have to pay for the things government does. Hence, we have taxes.

The goal of tax policy should be simple: raise the necessary revenue to pay for whatever government actually, minimally needs to do. And government should do those things as fairly and neutrally as possible. Is that what happens? No.

We use tax policy to reward certain behaviors and/or interest groups while discouraging or punishing others. Using the tax code in this way is somewhat like using a baseball bat for heart surgery: It’s a blunt instrument, and not everyone will like the result. Nevertheless, that is what we do.

The outcome, over years and decades of incremental amendments and exceptions, is that we now have a system that no one fully understands, one that creates all manner of twisted, counterproductive incentives. Large parts of our economy, indeed entire industries, exist only because the tax system makes them profitable. Others don’t exist because the tax system makes them unrewarding.

Why do we tolerate this? Because, as much as we complain about the tax system, we all get something out of it. Virtually everyone has a vested interest in keeping some part of the current system intact. We also fear that any change will only make taxes worse – a perfectly rational fear, too. These concerns make change difficult.

So, to the extent that the House Republicans want to give us a better system, I applaud them for trying. Whether their ideas will work as planned is another question, which I tried to answer in part last week and will continue to explore today. I think there will be significant unintended consequences, no matter how well-intentioned the efforts.

You see, you simply cannot overhaul our current tax system, as invasive as it is, without creating winners and losers. As the old saying goes, if you want to make an omelet, you have to break some eggs. One man’s tax efficiency is another man’s tax loss. That’s just the nature of taxation. As we will see next week, I think the ideal tax system is one that is as neutral as possible and simply keeps the playing field level so that new businesses, entrepreneurs, and current enterprises, from the smallest to the largest, can figure out how to best deliver to us the products and services we need.

Correction from last week: I said last week that the staff of House Ways and Means Chairman Kevin Brady were very kind to meet with me but that our conversations were background, i.e., off the record. They also said my separate conversation with the chairman himself would be on the record. The way I explained this to you was unintentionally ambiguous. Chairman Brady’s staff read last week’s letter and politely asked me whether I had understood our agreement. So to clarify: The conversation with Chairman Brady was completely ON the record, and I will be quoting him again next week. I apologize for the confusion.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As I travel around the country, I am rather amazed to see how few people actually understand what is being proposed on the tax front. Those of you who have already done a deep dive on this can skip through to the next section, but the rest of you may find the following not only interesting but very important to understand.

So here is what is being proposed as the new tax system. This is how they describe the plan in their own words (and their own font, too).

Simpler, fairer, and flatter. Jobs and growth. An “IRS that puts taxpayers first.” All this sounds wonderful compared to what we have. But how will they accomplish these lofty goals?

The Better Way blueprint changes both individual and corporate income tax policies. Highlights for individual and family taxpayers include:

• A three-bracket tax rate schedule with the top rate reduced to only 33%

• Elimination of itemized deductions except mortgage interest and charitable giving

• Larger standard deductions and child/dependent care tax credits

• Streamlining of education tax benefits

• Elimination of the Alternative Minimum Tax (AMT)

• Improved Earned Income Tax Credit (EITC)

• Repeal of the Estate Tax and Gift Tax

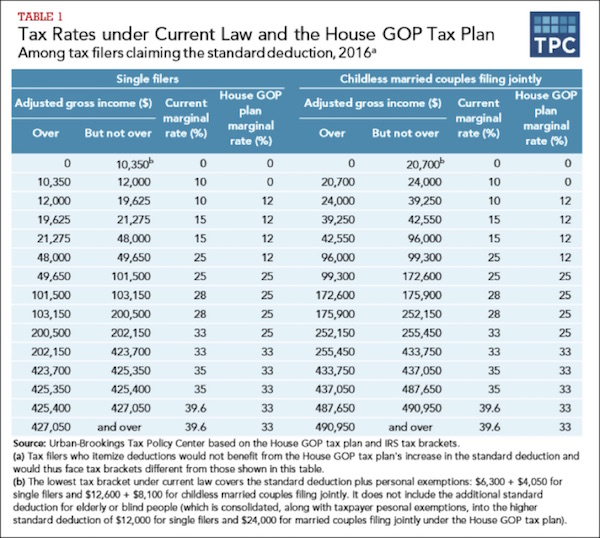

Here is a handy comparison chart from the Tax Policy Center, showing both the current rates and new rates by income level.

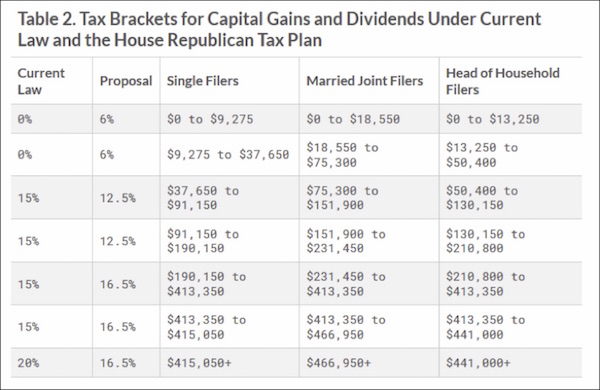

Different rates apply for capital gains and dividend income. The following chart from the Tax Foundation shows those rates under current law and the House GOP proposal. Note that the plan makes these rates even more attractive with a 50% deduction for capital gains, dividends, and interest income.

For the most part we see marginal rates going down, though the revised deductions and other features make direct comparisons difficult. For instance, look at that 33% top rate, which begins at $202,150 for single taxpayers and $255,450 for married couples filing jointly. If this plan is enacted, very few people will pay 33%, firstly because not all that many people make that much income, but also because those who do are frequently self-employed professionals or business owners. This is incredibly important. Self-employed individuals will essentially have a top tax rate of 25% – assuming they can figure out reasonably quickly how to game the system (and my bet is they can).

They haven’t written all the fine rules and details yet, but given the system as proposed, care to make a wager with me as to how many self-employed individuals will manage to have their actual on-the-book W-2 wages drop to under $200,000 and the rest of their earnings become self-employed income? Do you want to take the over, or the under, on 90% of them doing so? (The other 10% being simply clueless.) I would, of course, take the over. Do you want the under? I didn’t think so.

Again, the tax rate on income for proprietorship and pass-through entities (LLCs, sub-S corporations, and the like) tops out at 25% under this plan. High-earners who aren’t already business owners or contractors will reorganize. Something similar happened with the 1986 Reagan tax reform.

Sidebar: As I have pointed out in previous letters, the flawed data that the French economist Thomas Piketty uses to describe wealth and income disparities (which do of course exist) is actually government data, although he tortures the numbers and ignores what doesn’t fit his uber-socialist agenda. Amazingly, in 1986 we saw the biggest one-year leap in US income in history. (It was truly massive.) Except that there was no actual bottom-line difference. It was all an accounting difference. President Reagan and Congress shifted corporate taxes among different types of corporations and personal earners; and not so amazingly, almost everybody (including your humble analyst) reorganized their businesses so that their income fell into the lower tax rates. What Piketty records as a huge spike in income was actually just a simple tax reorganization.

If this presently proposed tax reform passes as currently written, a very similar reorganization will happen. Trust me on this one. By the way, this response is not a bad thing. It’s just something that happens when you change the rules on taxation. Everybody organizes their businesses so as to pay the least possible amount in taxes.

OK, even more tax-gaming opportunities: Maybe your LLC becomes a C corp. (Sorry to foreign readers for the inside-baseball lingo!) Your income now becomes “W-2 wages” that you hold under $200,000. And then you dividend the rest to your bank account at 16.5%. After paying 39.6% in recent years, that will feel like tax heaven. And will that dividend be subject to the Medicare surcharge of 4%? The details on how those rules will be applied are going to be very important. And as I further note below, that strategy will only work for certain types of companies! More winners and losers!

Other changes to corporate income taxes include:

• Reduced top rate from 35% to 20%

• Elimination of the corporate AMT

• Immediate, full deduction for capital investment expenditures

• Indefinite carryforward of net operating losses

• Interest on future loans nondeductible

• Elimination of most deductions except the research and development credit

• Exemption of foreign-subsidiary dividends from US tax

• US companies can repatriate currently deferred foreign cash holdings at an 8.75% tax rate

Let me say that some of these features are very appealing. Getting rid of the AMT, both corporate and private, for example, is a very good thing. (For what it’s worth, I seem to be able to avoid the AMT most years, so this really doesn’t affect me; but I know it is a large hassle to a lot of people who file income taxes.) Many of the other changes really will make it much easier and less complicated to pay taxes, and increasing the earned income tax credit and streamlining education tax benefits are both good things.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The Better Way plan’s other elements will also bring about major changes in the way American businesses operate. I’m not sure anyone has truly thought these through yet.

Good-bye, depreciation and amortization. Businesses will be able to immediately “expense” (deduct from income) capital expenditures that formerly had to be split over many years. Build a factory this year, and the full construction costs will be deductible this year. Land costs will still have to be amortized. This simplifies bookkeeping, which is nice, but it will also have an impact on balance sheets. Some businesses will have massive tax carry-forwards to match against future sales generated by the capital expenses. So we will really be trading depreciation accounting for tax carryforward accounting. I’m not sure this change will be an improvement and won’t be surprised to see weird side effects.

This also means that the actual effective corporate tax rate is going to be a LOT lower than 20% for most business, especially tech firms and manufacturers, biotech companies with large R & D outlays, and other firms with large capital costs. Business (like mine) that have little in the way of capital costs will get no advantage from turning into a C corp and going the dividend route with income. I would actually pay more going that route. Small manufacturing firms? Tax heaven.

Interest not deductible: Inability to deduct interest expense will discourage borrowing. That’s probably a good thing overall, but in some industries it could be catastrophic. (Note that the current plan would apply only to interest on future loans. I predict that if the policy goes forward, then unless they backdate the requirement, there will be a lot of loan business in the few months before it takes effect.)

Here again the benefits don’t get evenly distributed. Think about how the change will affect REITs, which generally use a lot of leverage and other structures that presently spin off cash flow paired with tax and interest deductions. Also, think of all the hedge funds and other investment tools that use leverage and deduct the cost. Knowing how “creative” our banking and real estate industries can be, this policy could open Pandora’s box. You can bet the accountants and tax lawyers are going to be watching the actual rulemaking process very closely.

Side issue: If there is no such thing as depreciation and amortization and interest expenses are not deductible, that will play havoc with measures like EBITDA, maybe even making the concepts useless. Maybe corporations will have to report actual earnings rather than game the system. No, that’s just a dream – they’ll figure out some other way to game earnings.

Foreign Operations: What the proposed tax policy does is encourage businesses to produce goods in the US and export them overseas.

I am going to stop here, because the next step is to address the issues surrounding the Border Adjustment Tax. And that means we have to address the trade issues the BAT will create. Plus, the Republican proponents of this bill assume that since it does something similar to what other countries are already doing, they won’t react or retaliate. Next week we will look at the large and potentially very serious impacts this change could have on currencies and global credit markets.

Some of the proponents of the BAT concept clearly don’t understand game theory. Once you change your status relative to the other players in the game (in this case the game of international trade), the other players always react. We will explore what that might mean.

We are nearing the end of a prolonged state of taxation equilibrium. To expect other global players not to react as we disrupt that equilibrium is naïve. That doesn’t mean that we don’t need to change the way our corporations are taxed, or that we shouldn’t give our corporations the same competitive advantages every other country gives their companies; but we have to think the proposed changes through in a way that understands multiplayer game theory. This exercise is especially important if you are an investor and your investments and/or your income are closely tied to how well the economy does.

There are some really exciting elements in this tax proposal. And then… The good news is that this plan is bold. The bad news (at least from my standpoint) is that it is not bold enough. Bluntly, getting the BAT approved by this Congress is going to be difficult. If you’re going to try to change things, then REALLY change things. We will talk about what that means next week, too.

Boston, Cayman, and New Jersey

I’m finishing this letter back in Dallas, after having been in Orlando for three days. It turns out that I have to be in Boston Monday afternoon; and the weather gods are telling me that rather than wait till Monday and probably not get there because of snow, I need to leave this Sunday morning. After Boston, if everything works out according to plan, I will fly to Miami to meet Shane, and we will proceed to the Cayman Islands, where I speak at the Cayman Alternative Investment Summit (caymansummit.com/) and then spend a few days on the beach enjoying the weather and catching up on some of my reading.

This conference has a really solid lineup of speakers, and I’m looking forward to meeting a few new faces and spending time with old friends. I note that Arnold Schwarzenegger (the Terminator himself) will be speaking, along with a few other interesting “noneconomic” speakers. Plus, they host the Legends Tennis Tournament on Friday evening, which is quite the event.

Old friends Nouriel Roubini and Constance Hunter (the chief economist at KPMG) and I will be on a panel creatively titled “Guardians of the Galaxy: Have Central Bankers Lost the Plot?” I suspect that Nouriel and I will have differing views on the role of central banks. If nothing else, the session should be entertaining.

We are still working on the details, but I will be speaking to investors in a few towns in New Jersey in the middle of March. More as we firm things up.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

We are finalizing the details of the Strategic Investment Conference, too. I am getting the final few keynoters lined up. You really don’t want to miss this conference. It takes place in Orlando May 22–25. We always sell out, so don’t wait till the last minute. I really hate telling people there’s no more room at the inn. You can register here.

It’s time to hit the send button. The emails are piling up in my inbox, and I really need to do something about it. I feel like that last quartet in the Robert Frost poem:

The woods are lovely, dark and deep,

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

Your heading for snow country analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin