Taking a Wrench to Healthcare

-

John Mauldin

John Mauldin

- |

- October 17, 2016

- |

- Comments

- |

- View PDF

Obamacare Death Spiral

Counting the True Economic Costs

The Reason We Buy Insurance

Dallas and Writing Fast and Furiously

“The US has the most dysfunctional healthcare system in the world.”

– Elizabeth Holmes

“Healthcare is the cornerstone of the socialist state.”

– Monica Crowley

“You’ve got this crazy system where all of a sudden, 25 million more people have health care and then the people that are out there busting it – sometimes 60 hours a week – wind up with their premiums doubled and their coverage cut in half.”

– Former President Bill Clinton last week in Flint, Michigan

Cassius: “The fault, dear Brutus, is not in our stars, but in ourselves…”

– Julius Caesar (I, ii, 140-141)

No matter what happens on Election Day, we know one thing for sure: Barack Obama will stop being president on January 20. He will leave behind the signature accomplishment of his eight years in office: Obamacare. His name is on the program forever. It will be his legacy. Some of my readers see it is a disaster, and others see it as a triumph, but I think everybody agrees that there need to be some changes.

Yes, millions more people now have access to health insurance. That’s a very good thing – but access to health insurance is not the same as access to healthcare. And access to healthcare is not the same as access to affordable healthcare.

When 2017 open enrollment begins on Nov. 1, many people whom the Affordable Care Act is supposed to serve will find that unaffordable non-care is all they can get. As we will see, there are many places in the US where premiums will rise by 30 to 40% or more in just one year.

It’s not just Obamacare. In fact, the problems I am describing would have happened with or without Obamacare. The financial problems would have happened if we had Paul Ryan’s version of healthcare; they just would have come a few years later. The problems are demographic and personal in nature. For my Canadian and European readers and others who live in countries with universal healthcare, you will be able to read the first half of this letter and feel quite smug and superior. The second half will demonstrate that you are not far from having the same type of budgetary financial crisis as the US is facing.

The entire Rube Goldberg contraption that we call the US healthcare system is draining our financial reserves and not making us any healthier. As you will see, this is just a simple statement of the facts.

Let me emphasize that word system. Healthcare professionals do a magnificent job taking care of us despite many obstacles. Some well-managed hospitals and other healthcare organizations deliver excellent care and still turn a profit. They aren’t the problem. The problem is much deeper.

So this week we are going to look at the US healthcare system, not simply to critique Obamacare, but to explore the deeper problems. Warning: this letter will print much longer as the latter half of the letter has a lot of charts and graphs. (Let me thank my personal doctor and Chief Wellness Officer at the Cleveland Clinic, Dr. Mike Roizen, who sent me his PowerPoint from which I will be extracting a few charts.)

Obamacare Death Spiral

The whole point of insurance is to spread the risk of unpredictable, expensive events. Everyone pays a little to avoid being the one who must pay a lot. It works well for things like fires and earthquakes. Health insurance starts off flawed because everyone will get sick, given enough time. Assorted patches, like the Affordable Care Act (ACA), have papered over the problems and made the business model work for a while. Now the ACA may be reaching its expiration date.

Last week Minnesota’s Democratic governor, Mark Dayton, said, “The reality is the Affordable Care Act is no longer affordable.” Translation: The Emperor has no clothes. Dayton knows whereof he speaks: Four of the five carriers that offer ACA plans in his state will continue to offer plans in the exchange in 2017, but their average rate increases are all at least 50 percent. (Source)

But when you look deeper, you find out this is a crisis for a specific group of people, not for everyone. First of all, the much-hyped and much-criticized ACA covers only a very small portion of the population. Nationally, it’s about 20 million out of 300+ million Americans. Minnesota’s exchange covers 25,000 people – just 5% of the state’s population.

Obamacare gets the headlines, but most people who have health coverage get it in other ways. We have Medicare for the 65+ and disabled, Medicaid for the poor, and employer-sponsored coverage for many working people. So the fact that most people can’t afford Obamacare obscures the fact that most people don’t use or need Obamacare – or at least the public exchange part of it. (The law has broader applications that we’ll discuss later.)

This is the core problem. Obamacare is a kludged-together catchall program designed for people who can’t get health insurance any other way. They are not a random sample of the population. So it should surprise no one that, as a group, they are sicker than average. That translates into higher-than-average claims once they have insurance.

That wouldn’t matter if enough younger and healthier people were in the risk pool. But they aren’t buying into the ACA, except for those poor enough to receive tax credits that can make the program inexpensive or even free. The middle-class people whom the program should theoretically help the most can’t afford it, just as Gov. Dayton says.

And thus you get this quote from Bill Clinton:

You’ve got this crazy system where all of a sudden, 25 million more people have health care, and then the people that are out there busting it – sometimes 60 hours a week – wind up with their premiums doubled and their coverage cut in half.

What he was really trying to say (I think) was that it is a good thing those 25 million people now have healthcare, but we have offloaded a great deal of the cost onto the wrong group of people: less well-off individuals who make too much to get any of the subsidies but are not making all that much money, yet have to buy their own insurance rather than getting it through a company.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Consider this example from a Health Affairs study:

[A] family of four living in Roanoke, Virginia with an income of $60,000 in 2016 would have a premium payment of $4,980 for the year for the second-lowest-cost silver plan. That plan has a $5,000 deductible. That means the family could spend almost one-sixth of their pre-tax income on health costs before they received any insurance payment.

In contrast, the tax for going uninsured would be about $725. Of course, an uninsured household would face the risk of paying entirely for major medical expenses out of pocket. But that risk is limited. The ACA allows individuals to purchase insurance at least once a year without paying a premium penalty – even if they have incurred very expensive medical bills and regardless of whether they had previous coverage.

(Actually, my own personal experience is that the coverage I provide to my employees is 40% more expensive than the figures cited above, with the same deductible. Admittedly, it is not Obamacare. I have no idea what those costs would be. As it is, finding an “in-network” doctor is a huge problem.)

This is nuts. The premiums alone are 8.3% of the family’s income. All the money buys them is the opportunity to spend another $5,000 on coinsurance before the insurance company pays anything. So for them, Obamacare is effectively a 17% income tax with no deductions.

(Yes, they do get a few benefits like wellness checks, vaccinations, etc. That helps, but the value of the benefits is a fraction of the premiums paid.)

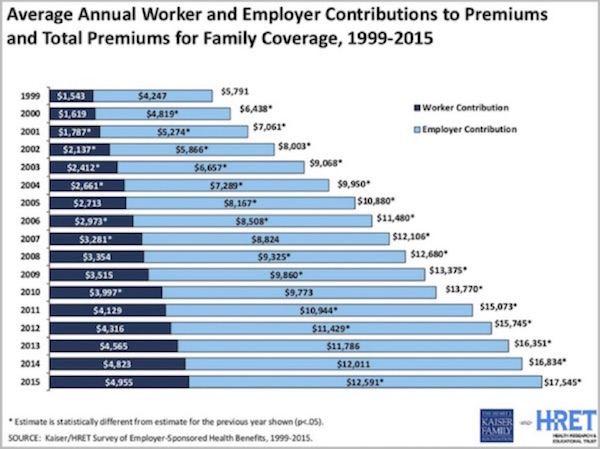

The rise in healthcare costs is not a recent phenomenon. Costs have been rising dramatically since 1999 and are up roughly three times since then, for both worker and employer contributions to insurance premiums. The chart below (from the Kaiser Family Foundation via Mike Roizen) shows that the average family paid $5,791 for coverage in 1999. If you go to the handy inflation calculator on the internet, you find that today’s cost for that coverage, if cost increases simply equaled inflation, would be $8,372, less than half what the average family paid in 2015, or roughly 45% of 2016’s likely final cost.

Dr. Roizen then calculated the actual cost for a worker making $40,000 a year ($19.83 an hour). He used actual medical costs and assumed 2% inflation and a 2½% annual raise since 1999. What he found was that the worker’s take-home income minus his medical costs and adjusted for inflation was equal to only 94% of what he made in 1999. In terms of his ability to spend money on things besides medical expenses, if the wage earner wants healthcare for their family, they are walking backwards.

Then you realize that in 1999 gas was $1.14 a gallon and is now roughly a dollar higher per gallon. And using the St. Louis Federal Reserve FRED database, we find that home purchase or rental costs are roughly double what they were in 1999. If housing costs had risen only by the headline rate of the Consumer Price Index, they would now be $1039/month. They are in fact 40% higher.

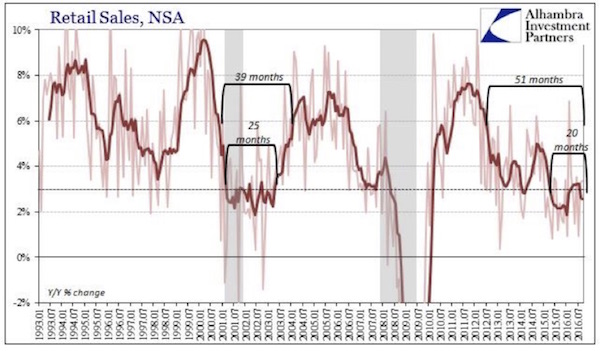

Is it any wonder, then, that retail sales are in the doldrums? The consumer is simply running out of available cash. The chart below from Jeff Snyder at Alhambra Partners (hat tip John Vogel) shows that the year-over-year growth in retail sales is lower now than it was before we entered the last two recessions. Some of my technical chartist friends would draw a line showing lower lows and lower highs and call this an “ugly chart.” The trend since 2011 is indeed ugly and disconcerting. What else happened about 2011? The real cost of Obamacare began to trickle through the system and started reducing the effective disposable incomes of those who Bill Clinton called “the people who were busting it.”

While I like to think that I “bust it,” I do not think Clinton was referring to me. I don’t like high healthcare insurance costs, which seem to rise around 10–15% almost annually, but while they’re highly annoying, they are not lifestyle-changing for me. But for middle-class Americans? The very real impact of the cost increases for healthcare and other necessities is overwhelming.

And healthcare costs are projected to rise about another 9% in 2017. Is it any wonder that 47% of Americans have less than $400 saved up for an emergency? The Trump and Sanders phenomenon – whatever you may think about either as candidates – is a sure indication that a significant portion of this country is very distressed. People don’t like the direction we are going. If you think the situation is going to be any better when healthcare costs have gone up (at least) another 30% between now and 2019–20, you are not paying attention.

Lower-income employees must use a larger percentage of their salaries for medical expenses. The $17,545 average cost is 12½% for somebody making $140,000, but for someone who takes home $40,000, it’s 43%. So that person cannot afford the coverage that an employee with a company plan gets; but since he or she is forced to buy insurance or pay a fine, they buy a plan from the ACA that almost certainly forces them to change doctors and wait longer for healthcare.

(I should note that special consideration with regard to healthcare cost should be given to those who are in the “gig economy,” who may constitute as much as 22% of today’s workforce. It is especially difficult for those people to get health insurance and healthcare, and it’s an expensive and time-consuming process. Many gig workers are uninsured, and that is a problem for the system. Fifty-one percent of them are between 18 and 34 years old – the very people you want in your healthcare system, since they do not use it very much. But if they do not buy, they cannot help bring your average cost down. There was a really cool article in Time magazine last January about the gig economy. You can read it here.)

There is a problem with all of the above numbers. They are average numbers for the US; and as the saying goes, your mileage may vary. Direct comparisons are impossible because everyone’s situation is unique. People don’t realize this because they are generally only aware of their own costs and don’t realize that costs vary so much based on location, income, health conditions, age, etc.

As noted above, the average increase nationwide next year will be 9%. But if you are in Connecticut, health insurance will go up by 25%, and in Tennessee BlueCross BlueShield coverage will go up 62%. I have heard that Oklahoma is going up by 42%. (In fairness, I should note that in some locations in Indiana costs are actually expected to go down 12%!) And then there are the special cases…

There are lots of exceptions to every generalization, but there does seem to be one factor that correlates with healthcare cost increases: fewer choices. One of the mantras we heard when we were being told about the positives of the ACA was that there would be lots of competition, which would hold the price down. The reality has been much less kind in many counties and states.

The entire states of Alaska and Alabama are expected to have only one insurance carrier each in the ACA marketplace next year. More than 650 counties across the nation will have only one insurance provider on their ACA exchanges in 2017, up from 225 in 2016. Seventy percent of those counties are rural. (Source: Kaiser Family Foundation)

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

There is even a county in Arizona (I think it has 375,000 people) that had no providers until state authorities persuaded (read: bludgeoned and threatened) BlueCross BlueShield to take on the county. Note: Under the law, the citizens of that county would still have to pay a tax penalty if they could not buy insurance, even though their choices for insurance in the private market are incredibly expensive. Talk about your ultimate Catch-22.

If you want to see how many providers there are in a particular state, you can go to this handy table from The Kaiser Family Foundation.

(Sidebar: There was a provision in ACA that allowed insurers to offer a nationwide product. Hasn’t happened.)

The picture changes completely if you are already sick, of course. If you know you’re going to need surgery next year, you can sign up for coverage, spend $10,000 on premiums and deductibles, and receive $100,000 or more in benefits. Such a deal! But not for the insurance company that picks up the rest of the cost.

Aggravating the problem are Obamacare’s price controls. Insurers can charge older customers up to three times more than younger ones. But older people generate more than enough claims to overwhelm those higher premium costs. This is why insurers are pulling out of the program. They can’t find a way to make it work when the customer profile is skewing toward older and sicker and regulations prevent insurers from charging any more. But raising premiums even higher wouldn’t work, either, because then people couldn’t afford to buy insurance.

This is what a death spiral looks like. I see no way to pull out of it unless something miraculous happens to reduce healthcare costs.

Counting the True Economic Costs

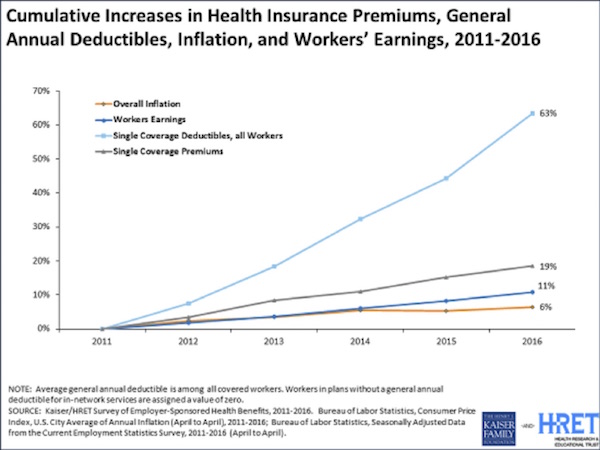

The deeper problem that extends beyond Obamacare is that healthcare costs so much. That modern medicine has so many ways to treat our afflictions is good news, of course, but it’s bad news from a cost perspective. We have endless ways to spend money on our health – and naturally, we are glad to spend it when someone else is footing the bill. In turn, insurers resist paying and find various ways to discourage spending. You can see the healthcare cost squeeze in this chart from the Kaiser Family Foundation.

In the last six years, insurance premiums rose 19%, or 3X faster than inflation. Deductibles rose 63%, more than 10X faster than inflation. Earnings rose only 11%, or less than 2X faster than inflation. Those three numbers explain why most people feel pressured by healthcare costs. In the aggregate, healthcare premiums and out-of-pocket expenses are consuming a large and rapidly swelling portion of middle-class income.

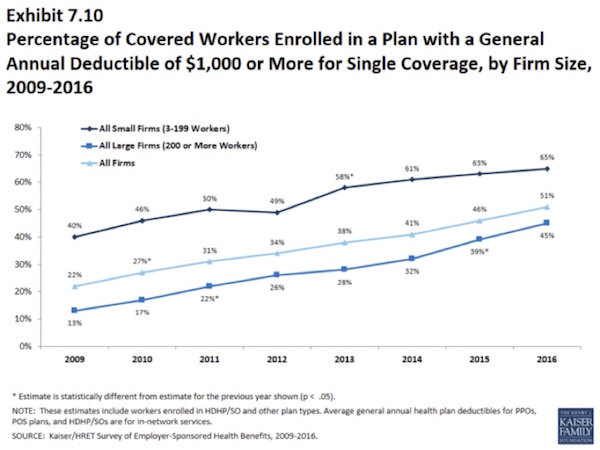

Businesses are responding to increased costs by raising the premium contributions of employees and raising deductibles. Even among large companies, 45% now have healthcare plans with deductibles of $1,000 or more.

You could look at this a different way. Any marketer will tell you that too much choice paralyzes people. You will sell more products when you offer a smaller menu with clear distinctions between the offerings. Obamacare initially did the opposite. How many people started to look, then threw up their hands in confusion? I don’t know, but cutting the offerings down to a more comprehensible number might actually increase participation.

Increased participation must happen if there is to be any hope of saving Obamacare, and it may still not be enough. So what next? Obama himself won’t get to decide; he’ll be gone in January. His successor may regret inheriting this headache.

The Reason We Buy Insurance

As I said at the beginning, the whole point of insurance is to spread the risk of expensive, unpredictable events. Because we all know that when healthcare gets expensive, it can get really expensive, really quick.

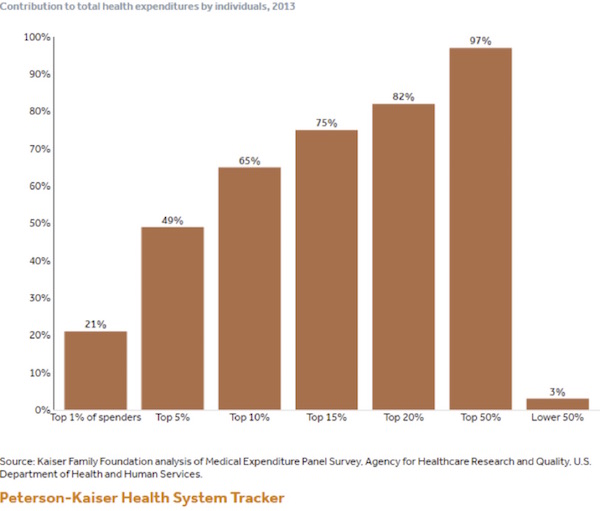

The top 1% of people who spent money on healthcare averaged over $95,000 in bills and spent 21% of the total money spent on healthcare last year. This is part of a great set of data from (again) the Kaiser Family Foundation. Just 10% of the individuals spending money on healthcare accounted for nearly two-thirds of the spending. What all this data shows is that when you need insurance for a serious illness or injury, you REALLY need it. And that is why we all have to have health insurance.

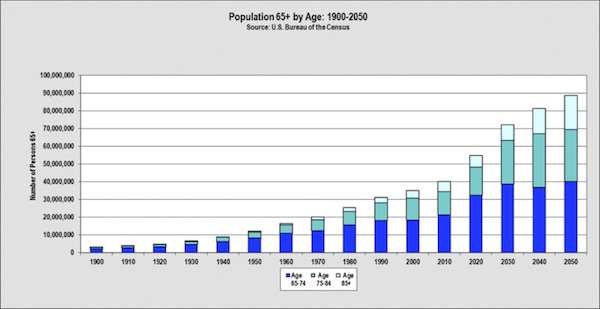

There is an inexorable demographic reason why healthcare costs are not solely in the hands of government agencies or politicians or private care providers: elderly people consume more healthcare, and as a country we are getting older. As of 2012, 34% of healthcare spending was attributable to those considered elderly (65 years and older), which would include (ahem, clearing throat) your humble but younger-than-his-years analyst. Who is doing his best not to contribute to healthcare costs.

The number of people over 65 is rising exponentially. There were 35 million of us in the year 2000, and there are about 47 million of us today. We will more than double that number by 2060, and in just 13 years – in 2030 – we are going to have 25 million, or 60%, more elderly people than we have today.

In just 13 years – by 2030 – we are going to have 25 million more people, or 60% more elderly people than we have today.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In 2015 we spent roughly $3 trillion, or almost $10,000 per person ($9,523), on healthcare. If costs rise as predicted, the number will top $10,000 this year. Per person. Including kids, etc. That is about 17.5% of total US GDP right now.

Is GDP growth going to total 60% between now and 2030? Not at the rate we’re going. At 2% per year – and no recessions – it will be about half that much. The number of elderly people and the amount they spend on healthcare is growing faster than the economy is. Government statisticians project healthcare spending to be 20% of GDP by 2022. So by 2030 we could be spending 23%–25% on healthcare.

Put that into your statistical pipe and smoke it, and then try to figure out how we’ll pay for healthcare. That is either a massive (as in obscenely high) tax increase or grandma does not get healthcare. And since nobody wants to tell grandmother she can’t have healthcare, providing it means a huge and still-rising tax burden. And you cannot make up that kind of money by getting the “rich” to pay their fair share.

And for my European and Canadian friends (and the rest of you in the so-called developed world), your aging problems are roughly as challenging as ours, and you are going to face similar dynamics. Except that you have it worse. Many of you are already paying 40% to 50% of your national GDP in taxes. (Some countries, like France, are paying much more!) Where are you going to get the money to cover your increased healthcare costs?

This is a global crisis and is the reason that Alan Greenspan recently despaired in an appearance on CNBC. He was talking about things that bothered him in general, but then he got specific. (Source: CNBC via Zerohedge)

Greenspan warned that fundamentally it is not so much an issue of immigration, or even economics, but unsustainable welfare spending, or as Greenspan puts it, “entitlements”:

The issue is essentially that entitlements are legal issues. They have nothing to do with economics. You reach a certain age or you are ill or something of that nature and you are entitled to certain expenditures out of the budget without any reference to how it's going to be funded. Where the productivity levels are now, we are lucky to get something even close to two percent annual growth rate. That annual growth rate of two percent is not adequate to finance the existing needs.

I don't know how it's going to resolve, but there's going to be a crisis.

This is one of the great problems of democracy. It goes back to the founding fathers. How do you handle a situation like this? And it's very troublesome, but eventually you get things like Margaret Thatcher showing up in Britain. Their situation is far worse than ours. And what she did is she turned it all around essentially by, as I remember it, the miners were going to strike and she decided – she knew they were going to strike. Since at that point, the government owned these coal mines, she built up a huge inventory so that when they went on strike, there was enough coal in Britain so that eventually the whole union structure collapsed. She fundamentally changed Britain to this day. The fact that we are doing so well in the E.U. is not altogether clear that it is the E.U. or whether it was Margaret Thatcher.”

When asked if “we need an accident of history” to address this, Greenspan replied “Probably. In the United States, social benefits, which is the more generic term, or entitlements, are considered the third rail of American politics. You touch them and you lose. Now, that is a general view. Republicans don't want to touch it. Democrats don't want to touch it. They don't even want to talk about it. This is what the election should be all about in the United States. You will never hear one word from either side.”

The only place I could find that had the entire interview was Zero Hedge, and you can view it here. My friends Tom Keene and Mike McKee of Bloomberg Surveillance do a brilliant job of prompting Greenspan with great questions. There is a reason why we love to have interviews with them. (You have to scroll down to the bottom of the print section for the video of the interview. Rather sobering remarks, but they’ll make the gold bugs happy.)

I am going to close here rather than subject you to an additional 3000–4,000 words on the reasons costs are going up – and then propose my “only true solution.” But that does leave me with a topic for next week.

Quick one-paragraph outline: The United States spends 20–25% more on healthcare on average than Europe does because we are 20–25% sicker. Verifiable facts. It’s sad, but we know the causes. And since many of our countrymen are actually from European stock, we can’t blame it on our genes.

The solution? I will share with you the results of a multi-company test with hundreds of thousands of participants of all ages, which has not only lowered the rise in healthcare costs, it has actually reduced them over five to seven years. As in, costs today are less than they were five years ago. The reduction is actually driven by one of the few things that economists of any stripe can agree on: that incentives matter. By changing the incentive structure (as well as the support structure), it seems we can encourage people to be healthier.

And while demographics make it clear that costs will still go up even if we’re healthier (since the elderly are bigger consumers of healthcare), those costs can be reduced and then they can go up in a way that is manageable.

Dallas and Writing Fast and Furiously

I will be speaking this week at the MoneyShow Dallas, which will take place October 19–21. I will be speaking three times on Thursday, October 20. The first presentation will be a midmorning panel with Steve Moore and Mark Skousen on how the presidential election will affect your portfolio. The second one will take place shortly thereafter: I will share my thoughts on how the Federal Reserve will react in the macroeconomic environment that is unfolding. Then that afternoon I will make my first presentation to the public on how I think portfolios should actually be structured to meet the upcoming challenges, and I will be going into some detail. Click on the link above and register. You can see the rest of the speakers and the agenda there, too. There are some very good speakers at this conference (including friends Steve Forbes and Jeff Saut), and I am looking forward to interacting with as many of them as I can. Attendance is free, and I will actually have a booth in the exhibit hall where I will spend time meeting and talking with attendees.

I am speaking for my friends at the Commerce Street Bank at their annual Investment Conference on Thursday, October 27, at the George W. Bush Library here in Dallas.

We are already starting to plan the 2017 Strategic Investment Conference. Every year I say we can’t make it any better than it was the year just past, and every year we do. SIC 2017 will be no exception. It will take place May 22–25 at the Omni Hotel in Orlando, Florida. This is an ultra-luxurious facility and can comfortably handle our capacity crowd.

Sometime in the next few days you’ll get an email from me giving you a chance to add your name to the waitlist for the conference, which guarantees that you’ll receive priority notification when registration is open.

I will still be finalizing speakers for the next few months or so, but it will not be long before we start to actually offer early-bird registration. This year there will be a limited number of early-bird (or discount) registrations – first-come, first-served. Last year the conference sold out in one month (four months in advance!), and we had to scramble to add capacity – and still had to turn people away. This year we will be only slightly bigger, as we are concerned about growing the conference too fast – we want to make sure the attendee experience is perfect. But the deal will be, when we say we are sold out, we really will be sold out except for a waitlist. So if you think you want to come, you really do need to register as soon as possible when we start the process. Just a heads up…

I am finishing this letter up a little later than normal, but the amount of data available on Obamacare and healthcare costs, plus demographics and the real reasons why we spend more on healthcare here in the US, is just a tad overwhelming. Once I started doing a deep dive, it was hard to come back to the surface to write. It was only when I realized that this topic actually needed two letters that I was able to get my head around it.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

I will soon be picking up my old friend Jeff Saut and his wife Cheryl, who will join us for dinner. Shane and I are cooking what we think of as a gourmet feast on the grill out by the pool, and the weather is perfect here in Dallas. Jeff is one of the finest financial and economic minds I know, and Cheryl is just plain fun. I always enjoy every moment I get with them.

Likewise, I am really looking forward to spending some time with Chris Wood of CLSA, who is coming in from Hong Kong. Most of Friday I will spend in a booth at the MoneyShow, talking to people who drop by. I don’t get a chance to do that very often, and I really enjoy it. You get the best questions and meet the most interesting people that way.

It is time to hit the send button as the kitchen is calling. Preparing great feasts takes time. I may be a fair country-boy writer, but I am a brilliant chef, if I do say so myself. And so too do those who get to partake of my creations. Just saying… You have a great week!

Your normally humble but not about his cooking analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin