Productivity and Modern-Day Horse Manure

-

John Mauldin

John Mauldin

- |

- July 17, 2015

- |

- Comments

- |

- View PDF

Productivity & Growth

Two-Sided Growth

Gig Workers

Permanent Subpar Growth

Massive Misallocation of Capital

Maine, New York, Whistler, and Boston

“They just use your mind and they never give you credit. It’s enough to drive you crazy if you let it.”

– Dolly Parton, “Working 9 to 5”

Almost everyone wants to be more productive. I include myself in that group – there are lots of ways I could be more productive. When I have conversations with people I think are very productive, they almost always tell me they wish they were more productive. What more could anyone expect from them?

In most cases, they aren’t responding to external demands. No one is cracking a whip over them; they have personal reasons for wanting to produce more. They want their children and grandchildren to produce more, too. It’s almost a cliché in American culture: when the kids become “productive citizens,” a parent can finally feel that he or she succeeded. Multiply this by millions of families, and the result is economic growth.

What exactly do we mean by this “productivity” word? I’ve given this a good deal of thought lately, and I plan to explore it in my newsletters over the next few months. As you will see, productivity growth has both a positive side and a very negative side.

But before we go any further, I want to mention that the presentations and select videos from the 2015 Strategic Investment Conference are finally now available! Featured are videos of two of our most popular speakers, Jeffrey Gundlach and David Rosenberg, plus a number of other high-profile speakers like George Friedman and Louis Gave, plus all the expert panels. If you are a Mauldin Circle member, you can access the videos by going to www.altegris.com to log in to your “members only” area of the Altegris website (getting there takes a little navigation). Upon login, click on the “SIC 2015” link in the upper-left corner to view the videos and more. If you have forgotten your login information, simply click “Forgot Login?” and your credentials will be sent to you.

If you are not already a Mauldin Circle member, the good news is that this program is completely free. In order to join, you must, however, be an accredited investor. Please register here to be qualified by my partners at Altegris and added to the subscriber roster. Once you register, an Altegris representative will call you to provide access to the videos and presentations by selected speakers at our 2015 conference.

Productivity is a critical part of the economic growth equation. We track the productivity of entire nations by means of gross domestic product (GDP), the sum total of all the goods and services their people produce. I have some issues with the way we calculate GDP, but it’s the best statistic we have for now. (I wrote an overview last year called “GDP: A Brief But Affectionate History,” which you can read here.)

There are two – and only two – ways you can grow your economy. You can either increase your population or increase your productivity. That’s it.

The Greek letter delta is the symbol for change. So if you want to change your GDP, you write that as

Δ GDP = Δ Population + Δ Productivity

That is, the change (delta) in GDP is equal to the change in population plus the change in productivity.

If you are a country facing a population decline (like Japan), then to keep GDP growing you have to increase productivity even more. That is why I have written so much about demographics over the years. Population growth (or the lack thereof) is very important. Russia is facing a very serious problem over the next 20 years that will require either a significant increase in productivity or a high level of immigration to stave off a collapsing economy. Russia’s population has declined by almost 7 million in the last 19 years, to 142 million. UN estimates are that it may shrink by about a third in the next 40 years. But that’s another story for another letter.

One last economic sidebar. You cannot grow your debt faster than your nominal GDP forever. At some point, the market begins to think that you will not be able to pay your debt back. Think Greece. This is no different from the fact that a family cannot grow its debt faster than its ability to bring in income to pay that debt back. At some point, you run out of the ability to borrow more money, as lenders “just say no.”

As a family’s or a country’s debts grow, the carrying cost or interest expense rises, consuming an ever-larger portion of the budget until a breaking point is eventually reached. While the exact point is a matter for serious debate (and conjecture), there is a level at which debt actually limits the potential growth of an economy. Paraphrasing Clint Eastwood, a country has to know its limitations.

We are going to hear a lot about growth in the coming presidential election. A lot of people are going to offer formulas, but you can check how realistic they are because GDP growth has just three variables. If you want to increase growth, you have to increase:

- the number of workers, and/or

- the number of hours they work, and/or

- the amount they can produce in an hour.

If you want GDP to grow, you have to make at least one of these factors go up without an offsetting decline in the others. Look at any story of economic progress or collapse anywhere in history, and these three variables will explain it.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Here in the United States, for instance, growth took off in the postwar 1950s but really soared in the ’60s and ’70s as newly “liberated” women entered the workforce, raising our total number of workers. In China over the last two decades, people moved from rural subsistence farming to urban industrial jobs. The number of workers in the overall economy didn’t change overnight, but productivity skyrocketed.

Going back further, inventions like the automobile and electricity unlocked tremendous growth by increasing hourly output. Untold thousands of workers went from shoveling horse manure to more advanced occupations.

Shoveling horse manure was honorable work back then. Those workers produced something necessary (clean streets – at least until the next horse came along), but they were capable of doing so much more. We don’t think much about it today, but the average horse produces 9 tons of manure every year. That is about 35 pounds of manure daily, plus 6 to 10 gallons of urine, all of which had to be disposed of. Not to mention the amount of labor it took to feed those horses. One-quarter of agricultural output in 1900 went simply to feed horses.

I was thinking about that last week while I was in lower Manhattan. Some of the streets I walked were still paved in part by the original, uneven cobblestones. What a pain it would have been to keep them clean. Forget sanitation.

Henry Ford (and a few others) “killed” all those jobs dealing with horses, freed a lot of our agricultural output to be sold all over the world, and thereby opened the door to better times, economically. But a lot of people had to find new employment.

“Better” for those workers was better for everyone. Affordable transportation sped up everything. The result was an economic boom that lasted through the Roaring ’20s. Millions of people left farms, moved to cities, and found high-paying factory jobs.

Do we have a 21st century breakthrough equivalent to the Model T? You bet we do. When autonomous vehicles are ready for prime time in a few years, millions of taxi and truck drivers will lose their jobs. Instead of one person driving one vehicle, we will have human car wranglers managing entire fleets as they roam through the streets. That human’s hourly productivity will be orders of magnitude higher than that of today’s drivers.

So what will the ex-drivers do for work? We don’t know yet. I’m very confident the economy will find ways to keep them productive, but I can’t say how. But their jobs will go away, just as those who shoveled horse manure lost theirs 100 years ago.

The time lag required for a return to full employment will probably be painful, too, both for individuals and for the whole economy. GDP could shrink at first if the reduced hours of unemployed drivers outweigh the higher productivity of the people managing the autonomous car fleets. That irony highlights just one of the problems in how we measure GDP. People and products will still be moved, but since it will cost less to make that happen, we may register a drop in GDP. (More on this measurement problem later.)

Northwestern University economist Robert Gordon examined productivity in a widely discussed 2012 paper, “Is U.S. Economic Growth Over?” He presented a shorter version in a 2013 TED Talk.

His is not a very optimistic view. I’ve written elsewhere about why I think he is wrong, but he is a highly respected economist, and his facts are rather straightforward. It’s his conclusions and assumptions about the future that I think are wrong. That being said, the Ted Talk is worth the 12 minutes. You’ll be glad to know Professor Gordon’s opinion isn’t universally shared. Other economists think technological advances will boost everyone’s productivity and keep growth well above 2%, despite the demographic and other headwinds Gordon describes.

GDP growth of an average of 2% over the last 15 years is not impressive compared to what we saw in the late 20th century. Is 2% really the best we can do? And for which parts of the economy?

This is a point on which both optimists and pessimists can be right. Even if aggregate growth is only 2%, some parts of the economy will perform much better as the economy makes its next transformation. I think we will see different tiers of growth.

Even today, we see how some businesses embrace change, while others hold fast to old models.

- Companies that “get it” succeed by creating entirely new markets, as Apple did with the iPhone. They can also disrupt old ones, as Uber is doing to the taxi companies.

- At the same time, it will still be possible to have a good business without disrupting anyone. If the economy is growing and/or you serve a growing demographic niche, you can do quite well.

Collectively, businesses in the second category will be able to grow only as fast as the economy around them does. Some might steal customers from others, but their aggregate earnings will be a function of population and economic growth.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The same applies to individual workers, and it’s already a 2016 election issue. Jeb Bush caught some heat for this July 8 comment to a New Hampshire newspaper:

My aspiration for the country – and I believe we can achieve it – is 4 percent growth as far as the eye can see. Which means we have to be a lot more productive, workforce participation has to rise from its all-time modern lows, means that people need to work longer hours and through their productivity gain more income for their families. That’s the only way we’re going to get out of this rut that we’re in.

Critics zeroed in on “people need to work longer hours,” as if he were calling American workers lazy. It sure wasn’t the best choice of words (what is it about that family and their choice of words?), but economically he is correct. To get anything like consistent 4% growth, America will need more workers who will need, in aggregate, to work more hours, and/or our output per hour will need to rise. All of the above would be best.

(Sidebar: What I think Bush was trying to say is that the number of part-time workers who want full-time jobs is way too high and we need to find more jobs for those part-time workers, not for those of us who are already working more than full-time jobs.

In a conversation we had last Monday morning in Denver, Larry Kudlow pointed out that there are still some 6 million workers who are working part-time for economic reasons, meaning they want more hours than they can get. If those workers could get more hours, productivity and GDP would go up.)

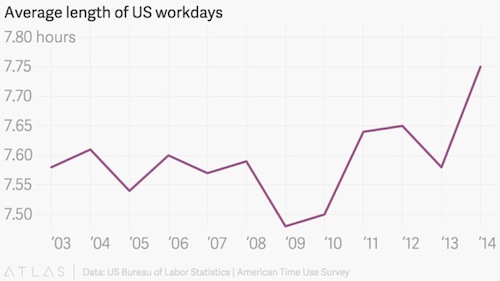

Now, getting back to the point that we need to work more hours, that actually seems to be happening:

The average US workday is about 0.2 hours longer than it was in 2005. Yes, I know, twelve minutes isn’t much, but multiply those extra minutes by millions of people working 250 days a year. We’ve added the equivalent of 50 hours (1.2 work weeks) per worker per year. If we were to reduce our hours back to where they were in 2005, the total number of workers would need to rise about 2% in order to keep total hours constant.

That would make a big dent in the unemployment rate, but that’s not what’s happening. The opposite is happening: millions remain unemployed – including millions who work “part-time for economic reasons,” i.e., they can’t find full-time jobs – even as those who have jobs work longer hours.

Why is this? I think the chart above gives us one clue. Notice how the length of our workdays popped higher in 2013–2014. That was when ObamaCare began incentivizing employers to squeeze more out of each full-time worker in order to reduce the impact of increased benefit costs.

I’m sure ObamaCare had some influence, but I doubt it explains everything. Something else is happening.

The millions who want to work full-time aren’t just sitting at home. Many who can’t find full-time positions are joining the so-called “gig economy” of part-time and contract labor. Uber drivers are just the tip of the iceberg. It seems as though any business that can replace one full-time worker with two or three part-timers is doing it.

This has a positive side – some workers get hours that are more flexible so they can care for children or juggle two jobs – but part-time work can also turn into misery. Many retail chain stores and restaurants now schedule workers with algorithms that try to match staffing with customer traffic. This practice results in ever-changing schedules that negate the flexibility.

The reason for this outcome is that businesses try to optimize the number of hours worked instead of making the hours more productive. The approach makes sense only if you presume human beings are all equally productive, interchangeable parts. We all know that’s not true.

However, it is true that many workers’ income is limited by the number of hours they can work. If you are a personal trainer, for instance, you can only do so many one-hour sessions in a day. Furthermore, competition limits the amount you can charge for each session.

Some occupations don’t have these limits. If Stephen King, Larry Ludlum, or Danielle Steele can write a book in 500 or 1000 hours, they can then sell large numbers of books with little additional work. The number of hours in a day doesn’t limit their income from that book. The same is true for many creative occupations: programmers, artists, musicians, athletes, entrepreneurs, etc. Their actual income depends on the quality of their work and the demand for it, not the quantity or the number of hours on the job.

It would be great if every worker could have such a job, but that’s not possible. We will always have “personal service” jobs where productivity has natural limits. If these jobs exist in large-enough numbers, they can hold back growth of the whole economy.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Nevertheless, more people are working, full time or otherwise, yet we are not seeing much growth. Why not?

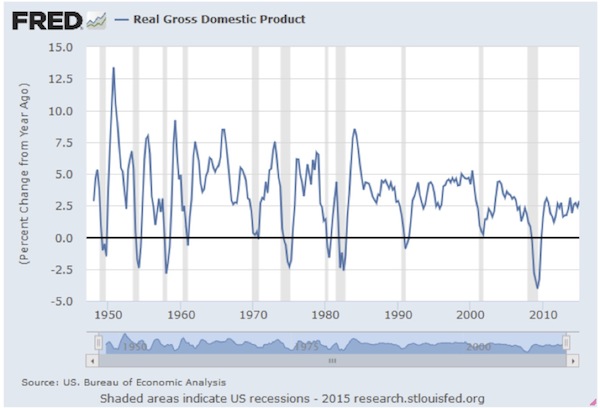

Obviously, something is holding back growth. The fact that a leading presidential candidate views 4% growth as aspirational shows how low our expectations have dropped. The US easily outpaced that modest growth in most expansions until the last decade or so. There were periods when we were growing at 5% or 6% or more! The tapering off of GDP growth over the last 15 years is noticeable in the chart below.

Productivity may be part of the answer. Maybe we’re working more but not producing more. This notion supports Robert Gordon’s thesis. Innovations like electricity, jet engines, and computers have done all they can. He thinks we are returning to the much lower growth that prevailed before the Industrial Revolution.

I’m not that pessimistic; I see innovation everywhere. I truly believe it is going to help everyone – but the thing that puzzles many economists is that all this new productivity that we are supposed to be getting from the wave of innovation coming out of technology is not showing up in the data.

This was actually part of the lead story in the Wall Street Journal this morning, “Silicon Valley Doesn’t Believe U.S. Productivity Is Down.” The article features commentary by Google chief economist Hal Varian:

To Mr. Varian and other wealthy brains in the world’s most innovative neighborhood, productivity means giving people and companies tools to do things better and faster. By that measure, there is an explosion under way, thanks to the shiny gadgets, apps and digital geegaws spewing out of Silicon Valley.

Official U.S. figures tell a different story. For a decade, economic output per hour worked – the federal government’s formula for productivity – has barely budged. Over the past two quarters, in fact, it has fallen. Sluggish productivity is raising alarms all the way to Federal Reserve Chairwoman Janet Yellen.

Productivity matters, economists point out, because at a 2% annual growth rate, it takes 35 years to double the standard of living; at 1%, it takes 70. Low productivity growth slows the economy and holds down wages.

The 68-year-old Mr. Varian, dressed in a purple hoodie and khaki pants, says the U.S. doesn’t have a productivity problem, it has a measurement problem, a sound bite shaping up as the gospel according to Silicon Valley.

“There is a lack of appreciation for what’s happening in Silicon Valley,” he says, “because we don’t have a good way to measure it.”

One measurement problem is that a lot of what originates here is free or nearly free. Take, for example, a recent walk Mr. Varian arranged with friends. To find each other in the sprawling park nearby, he and his pals used an app that tracked their location, allowing them to meet up quickly. The same tool can track the movement of workers in a warehouse, office or shopping mall.

“Obviously that’s a productivity enhancement,” Mr. Varian says. “But I doubt that gets measured anywhere.”

Consider the efficiency of hailing a taxi with an app on your mobile phone, or finding someone who will meet you at the airport and rent your car while you’re away, a new service in San Francisco. Add in online tools that instantly translate conversations or help locate organ donors – the list goes on and on.

He’s absolutely right; but to politicians and economists focused on budgets and debt and wages, the argument misses the point. The government can tax something only if its value is determined in dollars. Google and Microsoft Word and Dragon NaturallySpeaking and the Internet and a dozen other things that all enhance my productivity really don’t cost all that much. I like to think I’m productive, but putting this letter out doesn’t add to GDP, nor do any of the other tools that I used, except through their modest price. The government gets no increased taxes unless I can figure out a way to make money from my “free” letter model (which, thankfully, we do).

So in a way, I am helping to grow the economy; and if Mr. Varian is right, we might be underestimating our true productivity. But if the economy we can measure in dollars doesn’t grow more than 2%, it is difficult for the government to get more dollars. If we can’t grow at more than 2%, government debt and deficits become ever more significant. Nominal wages are also affected by GDP growth.

Goods and services move the official US productivity needle only when consumers and businesses pay for them. Anything free, no matter how much it improves everyday life, isn’t included.

Google offers us all a very powerful search engine that has made us all more productive. And yes, Google gets a lot of money for that. But the value that Google has added to the world, I believe, far exceeds the revenues that Google gets. That value doesn’t get measured in GDP and certainly doesn’t move the tax revenue needle and seemingly hasn’t been reflected in wages earned by the average worker.

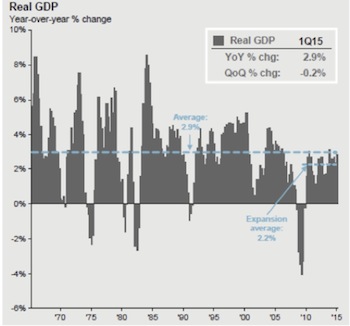

Let’s return to the problem of slower growth that I mentioned above. I just saw a fascinating paper from Lakshman Achuthan of the Economic Cycle Research Institute. Looking at past economic expansions, Achuthan and his colleagues found that the current slow-growth expansion is consistent with a long-term trend toward slower growth since the 1970s.

You can see what he means in this chart from JPMorgan.

Quarters with real year-over-year GDP growth greater than 4% were common in the 1970s, 1980s, and 1990s. We’ve now gone more than a decade without one. In fact, with GDP growth running at just 2.9%, the Fed is seriously considering higher interest rates.

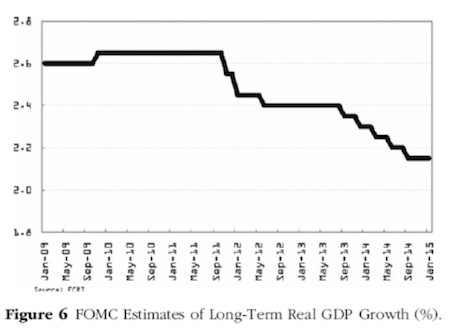

Achuthan points out how the Fed’s own growth projections are getting steadily lower even as it looks to “normalize” interest rates (i.e., raise them).

Adding all this up, we seem to be on a productivity plateau. Some workers and companies are dramatically more productive now, but they aren’t offsetting stagnation in the rest of the economy.

Massive Misallocation of Capital

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

What is holding back productivity growth? I don’t think it is lack of innovation or creativity. Smart people all over the world are inventing amazing things. I see another culprit (which I admit sets me at odds with mainstream economists): easy money.

As we know, the Federal Reserve and other central banks pumped astronomical amounts of liquidity into the global economy since 2008. With interest rates already very low, they started buying assets via their various QE programs.

I think history will show that the result is a massive misallocation of capital.

- With central banks driving down interest rates, savers and investors saw their incomes reduced. The losses they incurred limited their ability to invest in business startups. While we all celebrate Silicon Valley and the venture capital business, the reality is that most small businesses are not started with venture capital but with personal savings and investments or loans from friends and family. When you reduce the amount of money available on Main Street, it should be no surprise that you get fewer new business startups. In fact, for the first time in the history of this country, we are seeing more businesses close than are started. The Federal Reserve would contend that low rates make the cost of money lower, but very few new businesses get started with just bank loans from a small community bank.

I am shocked at the amount of money that banks will lend me today. I truly am. But back in 1977 at the tender age of 28, all I could get was $10,000 for inventory. And I paid 18% interest. Well, there is an example of a bank lending to small business. Except I later found out they really didn’t. My mother went to them and guaranteed the loan without telling me. Otherwise, I was just some kid with a business idea. It was literally friends and family at the beginning, after all.

How many great ideas died in the last decade for lack of funding? I think the answer would startle us. I’ll bet some of them would have boosted productivity enough to get GDP to that 4% Jeb Bush thinks would be wonderful.

- Instead of going to the people and businesses who could have made best use of it, all that money simply drove asset prices higher – mainly stocks and real estate.

- Financial engineering became the mantra of the day. It is now cheaper to buy your competition than it is to actually invest in equipment or people and compete with rivals. Or you can borrow money cheaply to buy back your own stock, thus engineering increased profits per share and bonuses for management all around.

- Meanwhile, the Obama administration and Congress gave us financial regulations (Dodd-Frank) that drove a lot of innovation out of public markets and into Silicon Valley’s private ventures. This is certainly spurring innovation – but innovative people elsewhere still struggle to raise capital.

I agree 4% growth would be great, but we ought to see even more in an expansion. That was “normal” just 20–30 years ago. Now it is just a dream.

How do we turn dream into reality? In addition to the better tax and incentive structures combined with the revamping of regulations that I wrote about a month ago in the letter called “Cleaning Out the Attic,” the financial sector needs to do a better job of connecting capital to ideas. Congress did help by passing the JOBS Act, but regulators have greatly diminished its potential impact. We really need to open up the venture market to take advantage of 21st-century technology and the Internet. It is happening, but a lot more slowly than it would if there were clear regulatory guidelines and incentives rather than the constant barrage of regulatory barriers.

Just as Henry Ford destroyed the jobs of manure shovelers and those who manufactured buggies and harnesses, Silicon Valley and tech entrepreneurs everywhere will be destroying jobs as they create whole new categories of industries and businesses that will replace or reform the status quo.

Henry Ford is often cited as a model because he employed workers in his factories and paid them well. But he and his competitors employed only a small fraction of the people whose jobs he made obsolete, as high tech continues to do today. Those people had to either create new businesses or wait until an entrepreneur came along with an idea to employ them.

If we are truly worried about where the jobs will come from in the future, then we need to make sure that those who want to create and fund new businesses can do so as easily as possible. The World Bank has created a ranking of countries by how easy it is to start a business in them. The United States is ranked 46th. I might quibble here or there with some of their stats, but not even being in the top 10 is miserable.

If you want to know why we are having a problem with a slow recovery, you might start with that simple statistic. And by the way, those new businesses show up in GDP, productivity, and tax revenues. Up until very recently, net new jobs were almost always a result of new businesses. If you want to know why wages are stagnant, productivity is down, and unemployment is frustrating, you need look no further.

Maine, New York, Whistler, and Boston

Let me offer a quick apology. To most of you, it appears that I have written two Thoughts from the Frontline letters this week. Actually, we only realized midweek that we did not send out last week’s letter to the entire list. As it turned out, the list we did use had all the names of those who are supposed to check to make sure the letter goes out on time. So we really didn’t “get it” until we began to get questions from those of you who missed me.

I’m back in Dallas for the latest heat wave after spending nine extra hours in the Admirals Club in Denver, waiting for a plane to fetch me home at what turned out to be a very late hour. Oh well, at least I finished two books and got off a bunch of work. In two weeks my youngest son, Trey, and I will head to New York for a day before going on to Grand Lake Stream, Maine, for our annual fishing trip with our fellow economists and their friends. Trey is now 21, and we’ve been going for nine years, so he’s grown up with these guys.

There is a possible trip to Whistler, British Columbia, to see my friend Louis Gave for a few days, as well as more potential one-day trips here and there. I’m still planning my foray to the Boston area to be with my friends Woody Brock and Steve Cucchiaro. Woody has this fabulous home up in Gloucester, and Steve has a brand-new sailboat that he wants to take out. It sounds like a very relaxing week. We may go up a little early and spend the weekend with Jack Rivkin at his home in the Hamptons. I have never been there, but it sounds fun. Maybe even go back to a Yankees game with my friend and mortgage guru Barry Habib. Barry has second-row home plate seats and can get us on the field for batting practice. We went last Sunday for a day game, and I was reminded how baseball allows for good conversation and a relaxing afternoon. Basketball, my favorite game, is too fast-paced to permit a conversation with a friend. Baseball is truly a sociable pastime.

I was talking with my daughter Melissa yesterday. She has a new gig as a freelance copywriter (she is actually quite talented), and we were comparing notes on productivity and technology tools for writers. She stopped to take a call and called me back a little later. It seems someone stole her checking account data and password and hit her account some 50 times in 30 minutes, mostly simply verifying the account. The bank closed the account, of course, but she is in a two-week limbo where they can’t tell her anything about her account. And they don’t want her to open a new account. Just go away and wait. Even the money she had just deposited 30 minutes earlier is unavailable, even though it hadn’t gotten to her account. Talk about a catch 22. She is not happy with Bank of America. Fortunately she still had some checks coming, so she won’t be destitute. She is still trying to figure out how someone got her password. “Can phones be hacked?” She was remarkably calm about all this.

For the record, daughter Tiffany is in Spain doing an aggressive tour of architecture and art to finish up her master’s degree at SMU. Just one of those things she wanted to do. Abigail is preparing to give me yet another grandchild. Her sister Amanda is taking care of her own daughter and working. (The twins are both in Tulsa now.) All the kids seem to have busy lives, with something always happening. It seems I’m going to have to start really using Facebook if I want to keep up with my kids and see pictures of my grandkids.

You have a great week. It might be summer, but I am busier than ever. Even if Jeb wanted me to, I am not sure I could work more hours. Not and get in the needed gym time, which I am doing right after I hit the send button.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Your trying to be more productive analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin