Thoughts from the Frontline: The Lions in the Grass, Revisited

- Patrick Cox

- |

- April 6, 2014

- |

- Comments

“In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

“There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

“Yet this difference is tremendous; for it almost always happens that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa. Whence it follows that the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil.”

– From an 1850 essay by Frédéric Bastiat, “That Which Is Seen and That Which Is Unseen”

I’ve come to South Africa a little bit ahead of my speaking tour next week to spend a few days “on safari.” Which is another way to say that I am comfortably ensconced in a game lodge next to Kruger Park, relaxing and trying to get some time to think. We’ve been reasonably lucky on the game runs: besides the usual lions, rhinoceri, water buffalo, etc., we’ve seen both cheetah and leopard, two animals that avoided my vicinity on every other trip to Africa. I’m here at the end of the rainy season, so everything is lush and green, and you have to get a little lucky to find the animals in the dense bush.

In several moments here, I was reminded of an essay I wrote two years ago called “The Lion in the Grass.” So I went back and read it and decided to update it fairly extensively in order to talk about the hidden lions we don’t see today that could catch us unawares tomorrow. Just like the African bush I am surveying at this moment, the economic landscape out there could harbor some serious but still unseen problems.

I have been captivated by the concept of the seen and the unseen in economics since I was first introduced to the idea. It is a seminal part of my understanding of economics, at least the small part I do grasp. It was introduced by Frédéric Bastiat, a French classical liberal theorist, political economist, and member of the French assembly. He was notable for developing the important economic concept of opportunity cost. He was a strong influence on von Mises, Murray Rothbard, Henry Hazlitt, and even my friend Ron Paul. (I will have to ask Rand about his familiarity with the Frenchman the next time I see him.) Bastiat was a strong proponent of limited government and free trade, but he also advocated that subsidies (read stimulus?) should be available for those in need. “[F]or urgent cases, the State should set aside some resources to assist certain unfortunate people, to help them adjust to changing conditions.”

Today we explore a few things we can see and then try to foresee a few things that are not quite so obvious. The simple premise is that it is not the lions we can see lounging in plain view that are the most insidious threat, but rather that in trying to avoid those we may stumble upon lions hidden in the grass.

But first, I really want to urge you to consider joining me in San Diego May 13-16 for my Strategic Investment Conference. We are continuing to fill out the strongest list of speakers we’ve ever had in our 11 years at this. My good friends George Gilder, Stephen Moore of the Wall Street Journal, and Neil Howe (who wrote The Fourth Turning) have all agreed to come and join Niall Ferguson, Newt Gingrich, Kyle Bass, David Rosenberg, and a dozen other A-list speakers from around the world. You can see who else will be there by clicking on the link above or here.

And I’m especially honored and pleased to announce that Vice Admiral Robert S. Harward, Jr., has agreed to join us on Wednesday night as a special keynote speaker. The three-star admiral (just recently retired) is a Navy SEAL and former Deputy Commander of the United States Central Command. In addition to his numerous other positions and awards, he also held the title of “Bull Frog” from 2011 until 2013 (longest-serving SEAL on active duty).

This is simply the finest economic and investment conference anywhere in the country. Don’t procrastinate; make your plans to come and register now.

When I was discussing this concept with Rob Arnott (of Research Affiliates and the creator of Fundamental Indexes) in Tuscany a few years ago, he mentioned the following photo, which he took on the savannah in Tanzania. I think it’s a perfect way to start out our discussion of the lions in the grass.

Going back to Bastiat, let’s look at that first sentence:

In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

It is natural to focus on the apparent dangers in front of us. That is part of our evolutionary heritage from the time when humans were first dodging lions and chasing antelopes on the very African savannah in Rob’s picture. But we soon learned that, if we were to survive, it wasn’t enough to dodge the lions we could see. It is the hidden lions that may spring upon us suddenly and take an arm or a leg.

Below I have once again reproduced Rob’s picture. Even when I knew there was a hidden lion, I couldn’t find it. But after it was pointed out to me, it is now the first thing I see. And there is a direct analogy there, to both economics and investing.

So, before you go to the next page, I suggest you go back and look one more time to see if you can spot the hidden lion. Just for fun, you know.

I showed this to a friend of mine who is a hunter, and he found it almost immediately. But then he has taught himself over the years to look for hidden game. And as Bastiat noted, it is the skilled economist who looks for the effects that are hidden, the surprises that are unseen. It should be a habit to look at the potential second- and third-order consequences of what we can see happening before our eyes. That way, we not only avoid the hidden lions, we also turn what would hunt us and do us harm into the hunted. Sometimes, the dangers themselves can be turned into a very nice trophy indeed – if you can act in time.

As I noted, that previously invisible lion is now the first thing I see. And that is the way with economic lions in the grass. Once someone points one out, it’s obvious, so obvious that we soon convince ourselves that we would have seen the lion without help. How many people told you they “knew” all along that subprime debt was going to end in tears? Or that the housing market was a bubble? Or that we would be plunged into the Great Recession?

I remember that in the fall of 2006 I was beginning to talk about the probability of a recession, in this letter, in speeches, and in numerous media interviews. (There is one such episode still up on YouTube.) I was told I was ignoring what the market was telling us, and indeed the market proceeded to go up for another six months or so. Being early is lonely. Me and Nouriel. J

Today there are a lot of people who tell us they knew there was a recession coming all along. In fact, the farther we get from 2006, the greater the number of people who remember making that call. It now seems I had no reason to feel so lonely out there on that limb, scanning the tall grass of the savannah. In retrospect, it seems that limb was rather crowded.

So, with that in mind, let me show you where the other lion is. Then go back and look at the first picture. After a few times you will see the hidden lion almost before you see the obvious ones.

I should note that a lion in the grass is different from a black swan. A black swan is a random event, something which takes us all by surprise. Economic black swans are actually quite rare – 9/11 was a true black swan. Other than Nostradamus some 500 years ago, who saw it coming?

The last recession and the credit crisis were not true black swans. There were those who saw it all coming, but few paid attention. They were dancing right along with Chuck Prince to the rousing music of a bull market and swelling profits.

As we know now, a few people saw the subprime crisis coming and made huge fortunes. Sadly, pulling that off generally required one to risk a small fortune to play in that game. So while I talk about the lions hidden in the grass, remember that if you can figure out how to play it, there can be large profits betting on that which is unseen by the markets.

Now, let’s look at a few obvious lions and then see if we can spot a few hidden lions lurking nearby.

By some miracle, Mario Draghi and his team at the European Central Bank (ECB) continue to get from their communication tools what most central banks have to take by force. Widespread complacency has washed over the region in the months and quarters since July 2012, when Mr. Draghi introduced the Outright Monetary Transactions (OMT) facility and adamantly promised to do “whatever it takes” to preserve the euro system.

As a result, government borrowing costs are converging back to pre-crisis levels even as falling inflation brings the next debt crisis forward … and markets are clearly still responding to the ECB’s increasingly hollow commitments.

Without changing the ECB’s main policy rate at this week’s monetary policy meeting, Mr. Draghi once again attempted to talk his way to a policy outcome by suggesting that he has the broad-based support to authorize quantitative easing, if and when it is needed. It will be needed – and maybe soon.

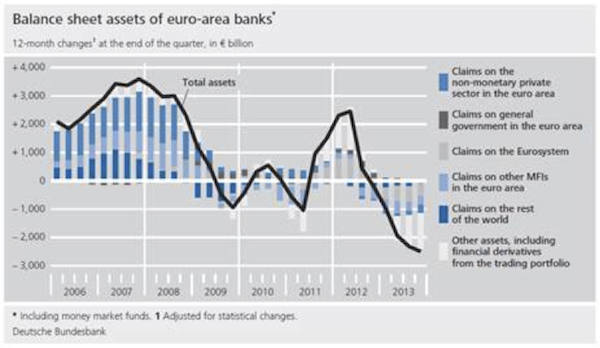

As I wrote late last year, European banks are in terrible shape compared to US banks. We think of German banks as the epitome of sobriety, but they have been on a lending binge to creditors who now appear to be in financial trouble; and with 30- or 40-1 leverage, they could easily see their capital fall below zero. Despite modest bank deleveraging across the Eurozone since early 2012…

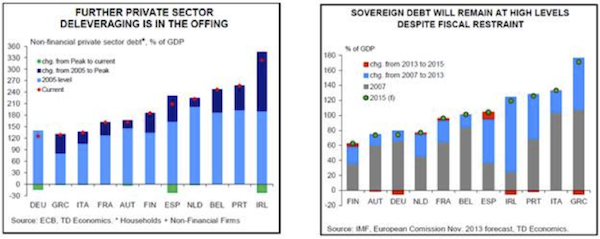

… public and non-bank private debt burdens have not improved:

Low inflation is also seriously disrupting government debt trajectories. The analysis below from Bank of America Merrill Lynch shows how low inflation, near 0.5%, raises debt trajectories in France and Italy that would be a lot lower under a normal, 2%, inflation scenario. As the charts show, persistent “lowflation” for several years could add another 10% to 15% to the public debt-to-GDP ratio in each country … even if rates stay where they are today.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

© 2013 Mauldin Economics. All Rights Reserved.

Thoughts from the Frontline is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.MauldinEconomics.com.

Please write to subscribers@mauldineconomics.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.MauldinEconomics.com.

To subscribe to John Mauldin's e-letter, please click here: www.mauldineconomics.com/subscribe

To change your email address, please click here: http://www.mauldineconomics.com/change-address

Thoughts From the Frontline and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President and registered representative of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA and SIPC, through which securities may be offered. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs may or may not have investments in any funds cited above as well as economic interest. John Mauldin can be reached at 800-829-7273.