Thoughts from the Frontline: Nothing But Bad Choices

- Patrick Cox

- |

- September 16, 2013

- |

- Comments

It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong.

– Thomas Sowell

With a few exceptions here and there, crises in government funding don't simply arrive on the doorstep unannounced. Their progress toward the eventual Bang! moment is there for all the world to see. What final misdeed triggers the ultimate phase of the crisis is less predictable, but the root cause is almost always the same: debt. And whether that debt is actually borrowed or is merely promised to the populace, when the market becomes worried that the ability of the government to fund its promises is suspect, then the end is near. Last week we began a series on what I think is an impending crisis in the unfunded pension liabilities of state and local governments in the United States.

To talk about the situation using the word crisis can seem a little hyperbolic. The problems are distributed throughout the country, yet not every city or state has significant unfunded pension liabilities. And even those that do can muddle through for very long time before a smoldering problem explodes into an actual crisis. Think Detroit. You could see the crisis building for years and years in the media before it finally reached the breaking point. And Detroit was not the first city to go bankrupt, though it has been the largest. But unless significant action is taken to alleviate the problem of debt, we are going to see even larger cities and then whole states enter a crisis period. And as we will see from the data, we are not talking insignificant states. This week we continue our series on the unfunded liabilities of states and cities. Note: this letter will print a little longer than most, as there are lots of charts and graphs.

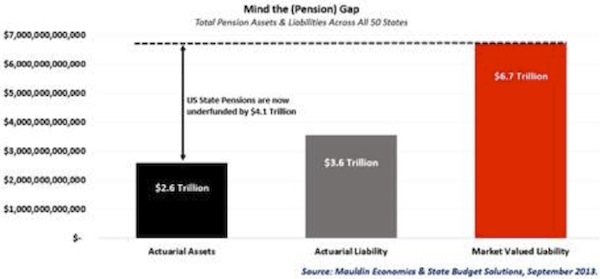

As we discussed in last week's letter on state pensions, official estimates of accrued liabilities understate funding shortfalls by conveniently assuming unrealistic investment returns into perpetuity. While official estimates report state-level unfunded liabilities across all 50 states at only $1 trillion today, the unfunded liability burden jumps to over $4 trillion if we discount those liabilities at more reasonable expected rates of return.

In case you were wondering, the $4.1 trillion funding shortfall includes only state-run pensions, meaning that funding gaps at local levels of government are not included. We went to great lengths this past week to calculate the total pension gap at both state and local levels across all fifty states, but we were told the data does not exist – at least not in one place.

Many cities and counties invest their funds with state pension plans rather than managing them separately, but the best estimate I could get was that if you included all the separately managed city and county pensions, it might increase the total amount by anywhere from 10 to 20%.

Even without another $500 billion to $1 trillion in unfunded pension liabilities, the implications of this gaping hole in the available pension research are truly mind-blowing, considering that, in extreme cases such as we are seeing in Detroit, local unfunded liabilities may become obligations of the states for purely political reasons. So we are stuck looking at the problem from a state-run-pension perspective, knowing that the actual shortfall could be even larger. If anyone knows of better sources for this data, I would really appreciate hearing about them.

The Aggregate or the Particular?

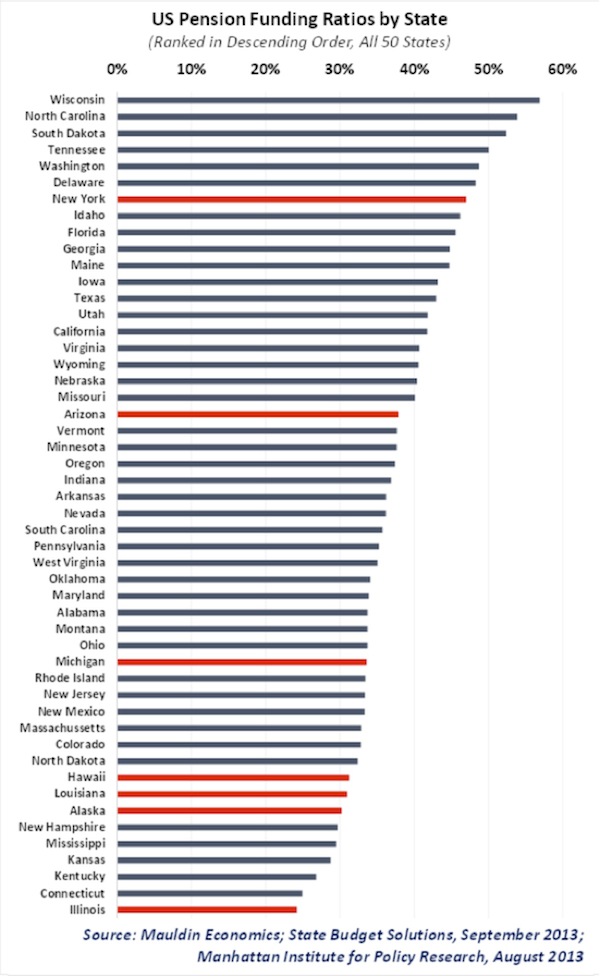

It may be tempting to look at aggregate pension shortfalls at the national level, but these shortfalls really amount to a state-by-state issue that will ultimately force troubled states to (1) increase taxes, (2) cut public services, and/or (3) reduce retirement benefits for current and already retired public employees. Cities and counties like Detroit (or Chicago?) that manage their own pensions and are underfunded will confront the same set of choices.

Making matters even more complicated, not all states can legally cut public employee retirement benefits. Illinois, Alaska, Louisiana, Hawaii, Michigan, Arizona, and New York (shown in red below) all have clauses in their state constitutions that protect public employee defined-benefit pension plans. While most states can reduce pensions to address their budget deficits, these seven must first amend their state constitutions. As you can see, several of these states are at the bottom of the pack in terms of funding ratios, but Illinois is the most vulnerable. (Funding ratios use the more conservative model suggested by Moody's and GASB, as we talked about last week.)

At only 24% funded, according to Moody's new methodology, Illinois is the single-most underfunded state in the union – the worst of an entire basket of bad apples. This week will focus primarily on Illinois, but we will cast our eye around the country in coming weeks.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

© 2013 Mauldin Economics. All Rights Reserved.

Thoughts from the Frontline is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.MauldinEconomics.com.

Please write to subscribers@mauldineconomics.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.MauldinEconomics.com.

To subscribe to John Mauldin's e-letter, please click here: www.mauldineconomics.com/subscribe

To change your email address, please click here: http://www.mauldineconomics.com/change-address

Thoughts From the Frontline and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President and registered representative of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA and SIPC, through which securities may be offered. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs may or may not have investments in any funds cited above as well as economic interest. John Mauldin can be reached at 800-829-7273.