Thoughts from the Frontline: Forecast 2014: The CAPEs of Hope

- Patrick Cox

- |

- January 27, 2014

- |

- Comments

"Sooner or later everyone sits down to a banquet of consequences."

– Robert Louis Stevenson

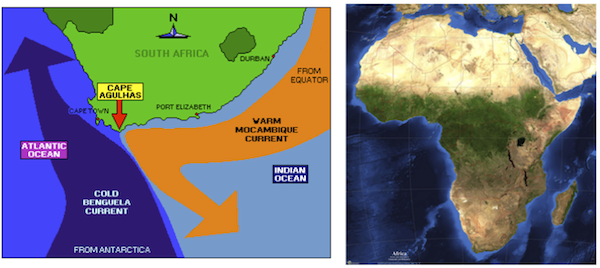

South Africa's Cape of Good Hope is one of the most dangerous stretches of coastline anywhere in the world, where the warm Agulhas Current (also called the Mozambique Current), rushing down from the Indian Ocean, meets the cold Benguela Current, pushing up from Antarctica. The difference in water temperatures alone is a recipe for legendary storms, but the two opposing ocean currents just so happen to converge where the African Continental Shelf drops off into a deep abyss.

So not only do warm and cold pressure systems converge to create raging tempests, but the underwater topography – together with surging waves from the Indian and Atlantic Oceans and fierce winds from the west – frequently gives rise to rogue waves over 80 feet tall, capable of sinking even the largest supertankers and container ships.

Just imagine how terrifying it must have been for the first maritime explorers to brave such dark and dangerous waters. The mind truly boggles at the courage and daring it took.

In a day and age when superstition abounded, unknown and unmapped places were often said to hide the most terrifying beasts of myth and legend; but rounding the Cape must have been a particularly terrifying experience for any uneducated crew. Portuguese legend warned that the long-imprisoned Titan Adamaster, who was said to have been cast into the stone of Capetown's Table Mountain, would never allow a captain and crew to pass the Cape without a fight.

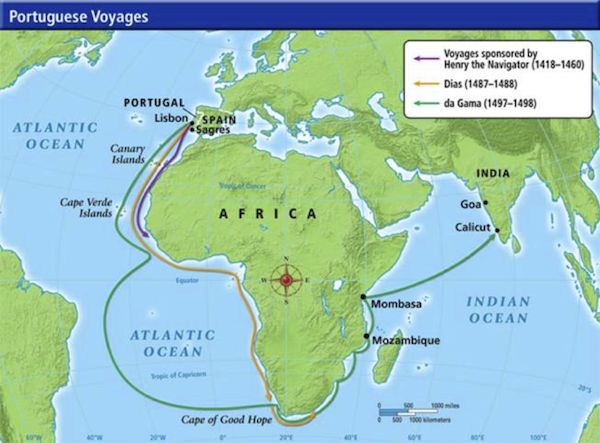

Bartholomew Dias is the first European known to have braved the Cape, in 1488 (four years before Columbus stumbled on the Americas in 1492). Sent by Portuguese King John II to find an ocean route to India, Dias was more than 1,000 miles south of the edge of any known map when a storm blew his ship away from the coastline and out to sea. Little is known of his actual voyage, since the records were later destroyed in a fire, but historians believe Dias must somehow have had knowledge of the southeasterly winds that could blow him around the Cape and against the powerful Agulhas Current (the second fastest ocean current in the world) without crashing him against the rocky coastline. Although Dias survived the storm, successfully rounded the Cape, and unequivocally proved the Indian Ocean could be reached by sailing around the southern tip of Africa, he had not planned for such a long and treacherous journey. With supplies running low and the threat of mutiny in the air, Dias was forced to turn back to Portugal – braving the "Cape of Storms" once more on the way home.

But our story continues (building toward the inevitable, if tenuous, economic connection!). The next great Portuguese explorer to round the recently renamed "Cape of Good Hope" (given that positive moniker by Portuguese King John II, who wanted to encourage sailors to risk the voyage – he was one of the original spin doctors) was Vasco da Gama, who consulted closely with Dias in planning the long, hard voyage from Lisbon to India. With Adamaster's pardon, da Gama successfully sailed around the Cape on the westerly South Atlantic winds Dias had discovered on his first voyage and finally reached Calicut, India, in 1497. Although he eventually died in India, da Gama had finally opened the trade route that European merchants had desperately sought.

Dias was not so lucky. Illustrating the soon to be learned 50-50 odds of challenging the Cape of Storms, Dias did not survive his second voyage. After voyaging to Brazil, the intrepid explorer crossed the South Atlantic Ocean on a follow-up expedition to India – and sailed right into a terrible storm just off the same Cape that had almost claimed his life a decade earlier. Four ships disappeared beneath the waves, and Adamaster had evened the score.

In the years that followed, more than two million Dutch settlers attempted to round the Cape of Good Hope, and more than one million of them fell victim to the high waves, violent storms, and nearly impossible navigating conditions. Naturally, such cataclysmic death and destruction gave rise to another dark myth: the Flying Dutchman.

Now, leaving both historical and supernatural tales aside, let's turn to another CAPE that is deserving of exploration – and that may be signaling danger. As we will see in the pages ahead, buy-and-hold investors are clearly sailing in dangerous waters, where the strong, cold current of deleveraging converges with the warm, fast rush of quantitative easing. Not only does this clash of forces create the potential for epic storms and fateful accidents, it dramatically increases the chances for sudden loss as rogue waves crash unwary investment vehicles against the underwater demographic reef!

Yes, the equity markets are an increasingly treacherous environment, but investors have an opportunity to diversify away from historically expensive equity markets into other asset classes that respond differently to changing economic conditions, and into other countries that may experience very different economic outcomes in the years ahead.

(Please note that this letter will print rather long as there are more than the usual number of charts.)

The Second Most Expensive Stock Market in the World

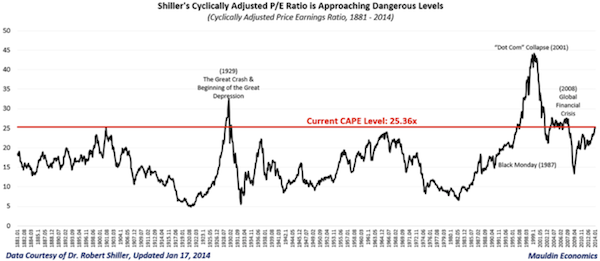

Last week's letter focused on my 2014 outlook for the US stock market and highlighted an important, but controversial, measure for long-term valuations: Robert Shiller's cyclically adjusted price-to-earnings ratio (CAPE). Unlike the more common trailing 12-month P/E ratio, Shiller's CAPE smooths out the earnings series and helps us avoid what could be false signals by dividing the market's current price by the average inflation-adjusted earnings of the past 10 years. Historically, this range has peaked and given way to major market declines at around 29x on average (26x excluding the dot-com bubble), and it has usually bottomed in the mid-single digits. Except for relatively brief windows during the late 1920s, the late 1990s, and the mid-2000s, Shiller's CAPE ratio has never been as expensive as it is today (see chart below).

As you can see, the S&P 500's high and rising CAPE ratio signals that US stocks are sailing into a well-proven danger zone. Also note that if we get a repeat of the stock market prior to 2007, the market can stay at this elevated range long enough to make investors complacent.

Not only does today's CAPE of 25.4x suggest a seriously overvalued market, but the rapid multiple expansion of the last few years coupled with sluggish earnings growth suggests that this market is also seriously overbought, as I pointed out last week and as we are seeing play out this week. Today's CAPE is just slightly less expensive than the 27x level seen at the October 2007 market peak and modestly below the level seen before the stock market crash in 1929. Although we are nowhere near the all-time "stupid" valuation peak of 43x in March 2000, a powerful narrative drove the markets to clearly unsustainable levels 15 years ago and a powerful narrative is driving markets today. Then it was the myth of dotcom and new tech, and now it is the tale of QE and the Fed.

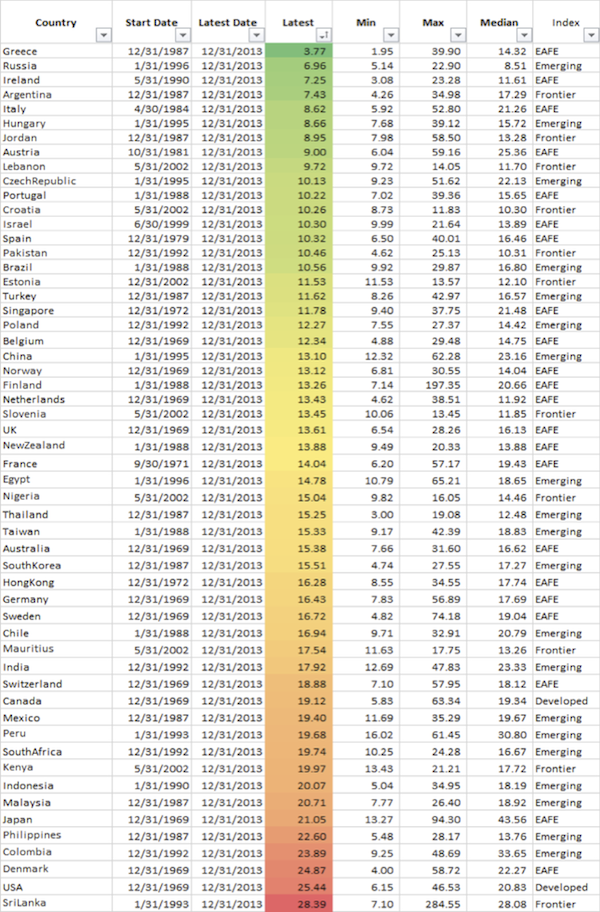

Unfortunately, the outlook for US stocks only looks more daunting when we examine CAPE ratios for foreign equity markets. Mebane Faber, chief investment officer of Cambria Investments and author of The Ivy Portfolio (2009) and Shareholder Yield (2013), regularly posts international CAPE updates to his research blog, The Idea Farm (www.theideafarm.com). Meb was kind enough to let me reprint his year-end 2013 update here.

A quick look reveals that the S&P 500 is the second most expensive stock market in the world today on both an absolute and a relative basis, second only to that of tiny Sri Lanka.

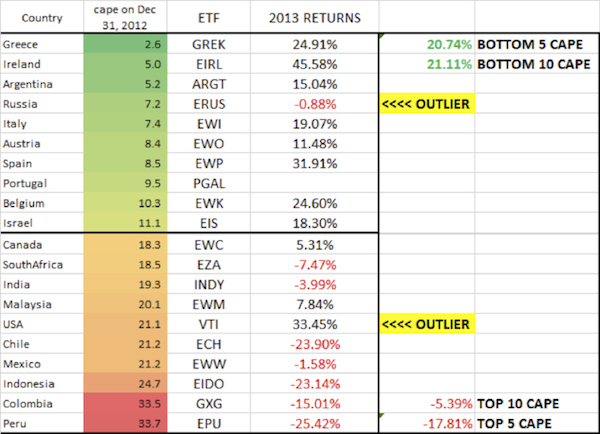

Expanding on recent valuations, Meb's work highlights that the relationship between CAPE valuation and subsequent returns is still very much intact. This next table compares the relative returns of the most expensive and cheapest markets. Study it carefully.

On average, the cheapest 10 markets as 2013 opened returned over 21% last year, while the most expensive 10 markets lost more than 5%. This is just one year, but we would expect to see the same basic relationship over the course of the next decade, if history is a reliable guide. I want to draw your attention to a fascinating observation: look at the outliers.

Russian stocks lost almost 1% in 2013, despite showing the fourth lowest CAPE at the beginning of the year. That's not a huge surprise. Valuations tell us a lot about long-term potential returns but not much about short-term timing. Momentum works until it doesn't.

US stocks tell quite a different story. They returned over 30% last year, despite starting 2013 with the sixth highest CAPE valuation. Rather than reversing course in the face of sluggish earnings growth, CAPE multiples expanded from 21.1x to 25.4x. By comparison, every market that started 2013 with more expensive CAPEs than the US's saw notable reversals of fortune, especially the top three: Peru's CAPE fell from 33.7x to 19.7x; Colombia's fell from 33.5x to 23.9x; and Indonesia's fell from 24.7x to 20.1x.

The impressive thing about US stocks is not simply that positive sentiment and Fed liquidity continued to drive valuations higher, but that the market rallied as much as it did with very modest earnings in the face of historically dangerous valuations. I have said it before, and I will say it again: Sentiment, rather than fundamentals, is driving the US stock market, and sentiment can quickly reverse.

Since we have no idea when the inevitable correction will come, we must expect it at any time. Shiller's CAPE can keep rising longer than any of us expect in the United States, but no one should be surprised if it corrects next week, next month, or next year. My friend, all-star analyst, and Business Insider Editor-In-Chief Henry Blodget makes a compelling point: "Anyone who thinks we need a 'catalyst' for a market crash should brush up on their history… There was no 'catalyst' in 1929. Or 1966. Or 1987. Or 2000. Or 2008…"

So let's take Henry's advice and brush up on our history…

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

© 2013 Mauldin Economics. All Rights Reserved.

Thoughts from the Frontline is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.MauldinEconomics.com.

Please write to subscribers@mauldineconomics.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.MauldinEconomics.com.

To subscribe to John Mauldin's e-letter, please click here: www.mauldineconomics.com/subscribe

To change your email address, please click here: http://www.mauldineconomics.com/change-address

Thoughts From the Frontline and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President and registered representative of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA and SIPC, through which securities may be offered. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs may or may not have investments in any funds cited above as well as economic interest. John Mauldin can be reached at 800-829-7273.