These 3 Demographic Factors Pretty Much Predetermine Your Financial Future

- John Mauldin

- |

- April 8, 2016

- |

- Comments

BY JOHN MAULDIN

In this week’s Outside the Box (my free weekly newsletter), I’d like to share an interesting analysis of the growing wealth and income divide from Ray Boshara.

He is senior adviser and director of the Center for Household Financial Stability at the Federal Reserve Bank of St. Louis. The center conducts research on family balance sheets and how they matter for strengthening families and the economy.

The essay is fascinating yet sobering. I can kind of go along with some of the author’s ideas, but the Progressive cheerleader thing is a little disconcerting. That being said, the data squares with other work I have seen.

The wealth and income divide is not 1%-99% but more like 25-75. (There is a link to a book at the end for those who want a really deep dive.)

Anyway, I found the data in this essay very interesting, and I think you will, too.

Thrivers and Strugglers: A Growing Economic Divide

By Ray Boshara, Federal Reserve Bank of St. Louis

Originally published on Ecointersect.com

Bravo to MacKenzie. When she was born, she chose married, white, well-educated parents who live in an affluent, mostly white neighborhood with great public schools. She also chose her birth year wisely, making sure that she graduated from college and entered the job market when the economy was rebounding from the Great Recession. Thanks to the wealth and financial savvy of her parents, MacKenzie graduated from a private, four-year selective college debt-free, giving her many career options as well as the ability to start saving for a home and retirement.

Because of her great “choices,” MacKenzie is likely to accumulate wealth and achieve financial health over her lifetime. She and her parents belong to the roughly one in four American households we can call “thrivers.”

But too bad for Troy. Despite being just as bright as MacKenzie, he chose nonwhite parents who never married and live in a poor, highly segregated neighborhood with lousy public schools and few opportunities to be involved in music, sports and civic activities. Troy’s young, hard-working, conscientious mother was never able to start college. In order to manage the frequent ups and downs in her financial life, she has accumulated debts to family members and credit cards. She also lacks the know-how and networks to get Troy on a college-bound track, something his school fails to do as well. And Troy unwisely chose to finish high school just as the Great Recession was getting underway. So, finding any job, let alone a decent-paying one with benefits, eludes him.

Because of his bad “choices,” Troy is not likely to accumulate much wealth or feel financially healthy over his lifetime. He and his family belong to the roughly three in four American households we can call “strugglers.”

Research from the Center for Household Financial Stability at the Federal Reserve Bank of St. Louis suggests that three demographic drivers – age/birth year, education and race/ethnicity – increasingly matter for building wealth and financial security. MacKenzie and her family’s efforts to build wealth are buoyed by these demographic tailwinds, while the lack of them creates headwinds that hamper Troy and his family’s efforts to succeed financially.

Let us consider each of these characteristics, or drivers, separately.

Race, Ethnicity and Wealth

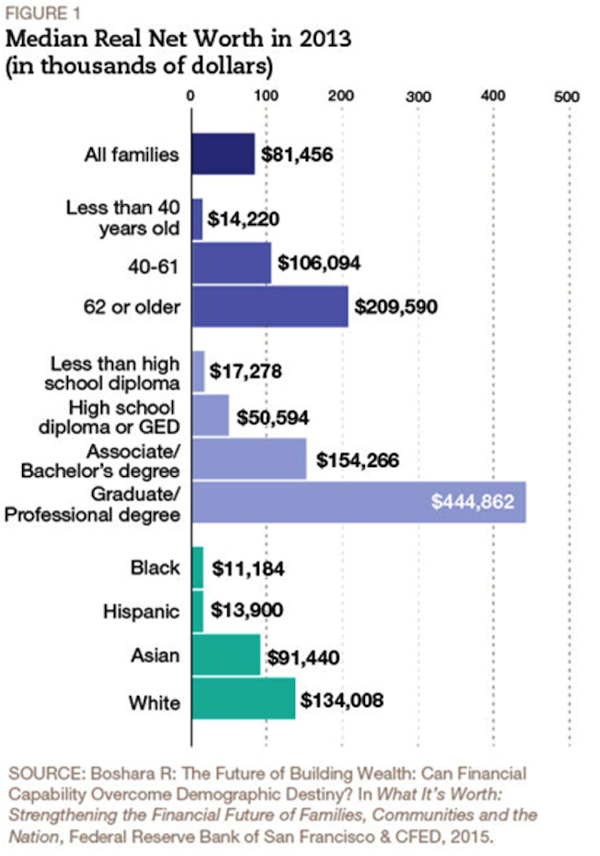

Beginning with race or ethnicity, a few facts stand out.[1] First, the wealth gaps are disturbingly large and the rankings have persisted since 1989. White families rank first, followed by Asian families, Hispanic families and then black families. With the exception of Asians, the median net worth of all groups in 2013 was about the same as in 1989; the Great Recession wiped out most of the post-1989 gains. However, prior to the recession, whites and especially Asians had seen dramatic increases in their wealth. Since 2010, they have seen their wealth begin to grow again, while the wealth of blacks and Hispanics has continued to decline. (See Figure 1.)

Also, wealth disparities are starker than income disparities. Median wealth for Hispanics and blacks is about 90 percent lower than that of whites. In contrast, median income of Hispanics and blacks is only 40 percent lower. This suggests these two groups may have had few opportunities to “convert” their diminished incomes into wealth, such as through homeownership and retirement plans. And although one would expect age and education to help explain the persistent differences in wealth accumulation across racial and ethnic groups (whites are generally older and better educated than blacks and Hispanics), our research shows that the wealth gap is largely unchanged even among equally educated, similarly aged whites and nonwhites. Stated more starkly, education does not appear to be an equalizer, at least in terms of wealth. Therefore, other factors must be in play, including early childhood experiences, parental influences and, of course, deep and historical discrimination against blacks and other minorities.

Education and Wealth

Not surprisingly, the association between a family’s education and its wealth is very strong and has become stronger with time, leading to large gaps in wealth by level of education.[2] Only families with college degrees or higher have seen their wealth increase since 1989 (even though all groups saw their wealth decline in the Great Recession). Those lacking a high school diploma saw their wealth plummet 44 percent between 1989 and 2013, while families with a high school diploma saw their wealth decline 36 percent. Meanwhile, families with a two- or four-year college degree experienced a 3 percent increase since 1989, while the wealth of those with advanced degrees spiked 45 percent.

Notably, however, the correlation between education and various measures of economic and financial success does not represent causation. That is, the college degree itself may only partially explain differences in wealth. The degree serves as a marker of many other factors also correlated with educational attainment, such as native ability, family background, marriage patterns (i.e., the tendency of college graduates to marry other college graduates), being read to as a child and the likelihood of receiving gifts or inheritances.

Age and Wealth

Finally, let’s look at age or, more precisely, year of birth. Of course, older families are expected to have more wealth than younger families. But what we are observing is something deeper, even historical.[3] To our surprise, age is the strongest predictor of balance sheet health, even after accounting for race and education. Americans in their 20s and 30s lost the most wealth in the recession and have been the slowest to recover. The wealth of younger adults is concentrated in homeownership, which suffered greatly during the recession.

Younger adults also have significant mortgage and consumer debts, and few liquid assets. In addition, they faced severe labor market challenges during and following the recession. But this is not just a recession story; it’s a generational, more troubling story: An American born in 1970 is projected to have 40 percent less wealth over their lifetime than an American born in 1940. Clearly, some larger economic and social forces are underway, reshaping economic opportunity in the U.S.

Policy Implications

In a world where uncontrollable factors – birth year, race/ethnicity, parents – and education – a choice, but influenced by all of the above factors – appear to increasingly matter for building wealth and financial success, three policy responses hold particular promise:

1. Give greater weight to demographic factors in targeting public resources.

Although income has been the primary benchmark for safety net and tax benefits, our research suggests that age or birth year, race or ethnicity, and education must play a greater role in targeting scarce public resources. The U.S. has dedicated massive resources, ruled on issues such as desegregation and voting rights, reduced discrimination in housing and lending practices, built schools and universities, subsidized higher education for disadvantaged students and otherwise striven and often succeeded in helping less-educated and minority families move forward. College attendance rates have been steadily rising, and minorities now hold more elected offices than ever, for example. However, millions of these families remain economically vulnerable; in some ways, they are now even more fragile, given growing economic penalties on less-educated and minority families. Therefore, broad, ambitious efforts to invest in these families must not only continue but be strengthened.

With regard to age, the U.S. has invested less during the earlier years of life, and the country lags in per capita spending on children compared with other advanced nations. In fact, the U.S. social contract has relied on the ability of younger workers to finance the safety net of older Americans. However, because that social contract is now threatened, and given the challenges facing younger Americans, smarter and more robust investments earlier in life are merited. For example, could we consider more of an age-based social contract, where newborns, school-aged youth and young adults starting their careers and/or families receive a public benefit to help them build human capital and net worth? These investments could be modeled on the “pay it forward” idea, where public investments in individual families (through, for example, no- or low-cost tuition plans) are paid back later in life directly through earnings or, indirectly, through greater productivity and economic growth.

2. Create ways for families to save when children are young and integrate savings plans into other early interventions.

In the assets field, there is a growing body of evidence that savings accounts and assets early in life lead to better outcomes later in life. The Assets and Education Initiative finds that “early liquid assets (ones the household has when the child is between ages 2 to 10)... work with children’s academic ability to influence whether they attend college. The effect is stronger for low-income children than it is for high-income children.”[4] Two studies using randomized trials in the SEED OK experiment in Oklahoma show that Child Development Accounts (CDAs)[5] have a positive impact on social development for children around age 4. This effect was greatest in children in disadvantaged groups.[6] A second study finds that CDAs increase the psychological well-being of mothers, and again the effect was greatest among disadvantaged groups.[7]

Consideration should be given to strategies that integrate CDAs and similar early asset strategies into the fabric of other interventions aimed at young children. For example, a CDA might be offered to every mother who enrolls in a prenatal health program, or to every child entering Head Start or a preschool program. Reading programs might offer an education-focused CDA. Pell grants might be “front loaded” so that income-eligible children at age 5 receive a small portion of their Pell in a CDA, which would then reduce their Pell grant at age 18 accordingly. The College Board has, in fact, advanced a similar idea. It will be difficult, in my view, for stand-alone CDA interventions to reach all economically vulnerable children. Accordingly, integrating early assets and early childhood interventions holds promise for both impact and scale.

3. Help parents and other adults build liquidity and financial assets.

Of course, we cannot build family financial health and well-being by investing only in kids and ignoring their parents and other adults. Accordingly, we should adopt a “two-generation” approach.[8] Struggling families need a range of sound balance sheet investments, including better banking options, credit repair, more college and retirement savings, fewer debts and paths to sustainable homeownership and small-business opportunities. But one intervention in particular cuts across family balance sheets and promotes both financial stability (a family’s first priority)[9] and economic mobility: creating liquidity.

The need for liquidity is well documented. The Federal Reserve Board’s Survey of Household Economics and Decisionmaking (SHED) finds that an unexpected expense of just $400 would prompt nearly one-half of all households to borrow funds, sell something or simply not pay at all.[10] Fed data also show that the top savings priority for families is emergency or liquid savings, yet only about half of all Americans have such savings. And CFED finds that 44 percent of households are “liquid asset poor.”[11]

When families have more liquid savings, they can better manage their cash flows and volatility; rely less on friends, family and payday lenders to meet cash shortfalls; have better banking options; and save for education, training or a small business, as well as a home or apartment in a better neighborhood. In my view, no intervention better cuts across the health of U.S. family balance sheets – and does more to promote family stability and mobility – than building emergency savings and liquidity.

To be most effective, these three policy recommendations must be integrated into other efforts. Although one or two interventions, including the most promising ones, are not likely to erase enormous gaps in education, earnings or wealth, they are likely to significantly reduce the financial health disparities experienced between future thrivers like Mackenzie and strugglers like Troy.

Adapted from Boshara, R: “The Future of Building Wealth: Can Financial Capability Overcome Demographic Destiny?” In What It’s Worth: Strengthening the Financial Future of Families, Communities and the Nation, Federal Reserve Bank of San Francisco & CFED, 2015.

Subscribe to Mauldin Economics

Subscribe to Mauldin Economics' free newsletters, which will help you understand what's happening in the world’s economy so you can make informed investment choices based on current, clear, and valuable observations.