The 3 Best Asset Classes To Brace Your Portfolio For The Next Financial Crisis

- Jake Weber

- |

- July 20, 2017

- |

- Comments

No one knows when the next financial crisis will hit.

The 2008 financial crisis originated in sub-prime mortgages. Rampant speculation in dot-com stocks triggered a market panic in the early 2000s.

What will spark the next crisis?

Fed Chair Janet Yellen said last month that she didn’t expect a financial crisis in our lifetimes…. Of course, later she downplayed her comments, but it doesn’t change the message.

And if we’ve learned anything from the past, the most reassuring Fed rhetoric comes at times when we should be worried the most

After all, it’s the Fed’s job to instill confidence in the market.

That’s why now is a good time to review your portfolio and make sure you’re prepared for a black swan of any sort.

Here are my favorite assets classes/sectors that hold up best in financial crises.

Consumer Staple Stocks

Unless you’re a market oracle, a 100% allocation in cash is not your best move. Bull markets tend to last longer than most people think. So you want to be prudent yet open to the upside potential.

What is the single-best sector to invest in if you’re worried about a market crash?

The answer is in the table below.

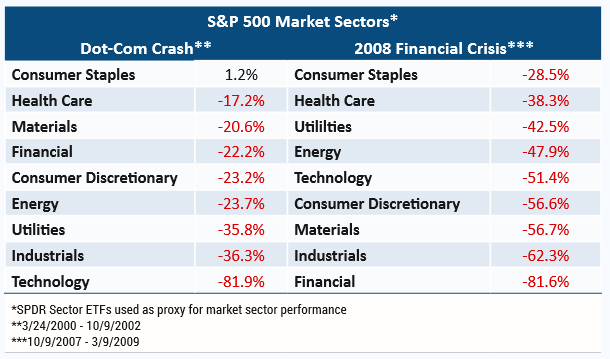

This table shows the performance of market sectors if you invested in each at the peak date for the S&P 500 to its trough date for the Dot-Com Crash and 2008 Financial Crisis.

In both market crashes, consumer staples have held up best. No matter how bad the economy, people still need to eat, brush their teeth, and buy medicine.

Buying the best consumer staples stocks is not going to protect you from losses in a stock market crash. But if history is any guide, the sector should fare better than the rest of the market.

Gold

If you look for the best asset class to hedge your portfolio against a financial crisis, look no further than gold.

In the Dot-Com Crash and the 2008 Financial Crisis, gold saw positive gains. When the S&P 500 dropped -22% in 2001, gold staged an impressive 25% rally.

Make no mistake, gold isn’t just a hedge against financial crisis.

It has been a safe and lucrative place to allocate some cash since the turn of the century. Gold had a notable run with 12 consecutive years of positive returns, enduring two financial crises and outperforming the S&P 500 in eight of those years.

Cash

This advice may sound too obvious, but it’s more of a reminder. Because greed and promised returns often take hold of our common sense.

This is especially true when people seem to be making money in just about every asset class—or as my colleague Jared Dillian (a former Lehman Brothers trader) refers to it, the everything bubble.

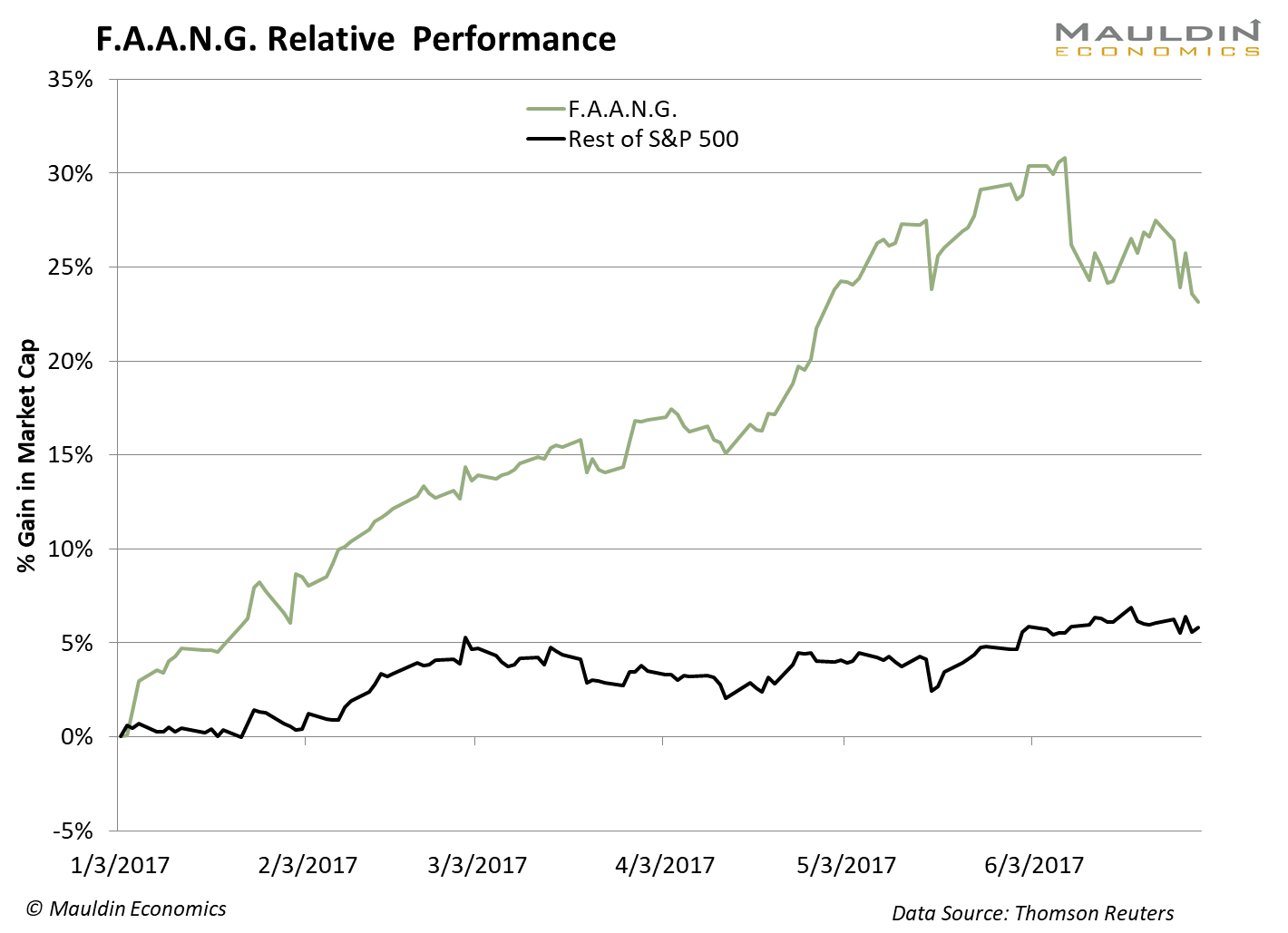

It’s been over a year since the S&P 500 saw its last correction. Its market capitalization soared by 29% in the first half of the year, 23% of which is attributed to the five stocks, aka FAANG!

Don’t let the fear of missing out guide your investment decisions. If you’re sitting on big gains, especially in the FAANG stocks, it’s a good time to cash in.

Act Now

Don’t be fooled by Janet Yellen.

The Fed’s policies have done nothing to restore the economy. This stock market rally has been driven by stimulus, not fundamentals. This won’t last forever.

A more hawkish Fed signals that the Fed has reached the end of its rope. Now it’s only a matter of time before the stuff hits the fan.

The three asset classes in this article are a good starting point in building a bullet-proof portfolio for the next crisis. However, if you want get into the weeds, I suggest the free weekly newsletter by Jared Dillian, a colleague of mine who was the head of ETF trading at Lehman Brothers in the midst of the 2008 crash.

Nobody can guide you better than a former Wall street trader who faced the crisis first-hand. But don’t wait too long—time is not on your side.

Get Thought-Provoking Contrarian Insights from Jared Dillian

Meet Jared Dillian, former Wall Street trader, fearless contrarian, and maybe the most original investment analyst and writer today. His weekly newsletter, The 10th Man, will not just make you a better investor—it’s also truly addictive. Get it free in your inbox every Thursday.