Lacy Hunt: The US Economy Is Doomed to Reduced Growth

- John Mauldin

- |

- July 19, 2016

- |

- Comments

BY JOHN MAULDIN

We know high levels of government debt and deficit spending suppress economic growth, but how exactly does that happen? Dr. Lacy Hunt and Van Hoisington of Hoisington Investment Management give us a detailed look at what’s involved in my latest Outside the Box (subscribe here for free).

On the deficit spending front, the authors state that the evidence suggests that the US government expenditure multiplier is -0.01. This means each additional dollar of deficit spending reduces private GDP by $1.01. The result is a one-cent decline in real GDP.

The authors state this multiplier is likely to become even more negative. Over time, the mandatory components of government spending (Social Security, Medicare, veteran’s benefits, and the Affordable Care Act, etc.) will represent an ever-increasing share of the federal budget.

With regard to government debt, the authors describe a 2012 study by Carmen Reinhardt, Vincent Reinhardt, and Kenneth Rogoff (RR&R). The study identified 26 major public debt overhang episodes in 22 advanced economies since the early 1800s. In each instance, there was a public debt-to-GDP level exceeding 90% for at least five years.

RR&R determined that these debt overhang episodes reduced the economic growth rate by slightly more than 33%, on average. As of last year, the US economy has met these conditions for reduced growth. Government debt first exceeded 90% of GDP in 2010 and surpassed 100% in each of the past five years.

Hoisington and Hunt say that debt begins reducing economic growth at relatively low levels of government debt-to-GDP, but as the debt level rises, the debilitating impact on growth speeds up. That is, the impact increases nonlinearly.

The bottom line is that with global debt levels moving ever higher, we can expect that worldwide business conditions will continue to be poor. Plus, the slowdown ahead will cut the already weak trajectory of nominal growth. We are at risk, the authors warn, of falling into a global “policy trap.”

Hoisington Investment Management – Quarterly Review and Outlook, Second Quarter 2016

By Dr. Lacy Hunt and Van Hoisington

The Separate Constraints of Deficit Spending and Debt

Real per capita GDP has risen by a paltry 1.3% annualized since the current expansion began in 2009. This is less than half of the 2.7% average expansion since the records began in 1790. One of the most persistent impediments to growth has been the drag from fiscal policy, a constraint that is likely to become even more severe in the next decade. The standard of living, or real median household income, has only declined in the 2009-2016 expansion and stands at the same level reached in 1996.

Six considerations indicate federal finance will produce slower growth: (1) the government expenditure multiplier is negative; (2) the composition of spending suggests the multiplier is likely to trend even more negative; (3) the federal debt-to-GDP ratio moved above the deleterious 90% level in 2010 and has stayed above it for more than five years, a time span in which research shows the constriction of economic growth to be particularly severe. It will continue to move substantially further above the 90% threshold as debt suppresses the growth rate; (4) debt is likely to restrain economic growth in an increasingly nonlinear fashion; (5) the first four problems produce negative feedback loops from federal finance to the economy through the allocation of saving, real investment, productivity growth and eventually to demographics; and (6) the policy makers force the economy into a downward spiral when they rely on more debt in order to address poor economic performance. More of the same does not produce better results. It produces worse results, a situation we term a policy trap.

Deficit spending is a separate matter from debt. If the starting point were a situation of no federal debt, a discussion of expenditure multipliers would be sufficient. However, that is not the case. Federal debt levels are already extremely elevated, and the trend is escalating steadily higher.

When deficits and debt impair growth, a sequence of events impacting other critical barometers of economic performance takes place. Saving is increasingly misallocated, shifting income that generates public and private investment into investments that are either unproductive or counterproductive. Real investment in plant and equipment falters, which in turn pulls productivity, employment and economic growth down. When the policy response to poor economic performance is ever-higher levels of debt, the economy’s growth becomes more feeble, which over time causes demographics to erode, a common pattern in highly indebted countries. Then the deterioration in real investment, productivity and demographics reverberate to the broader economy through negative feedback loops that suggest that as debt moves ever higher, the restraining effect on economic growth turns nonlinear. While some economists have called these headwinds, they should be more appropriately viewed as symptoms that originated with the deficits and the debt. And these symptoms will persist as long as the debt problems continue.

These indirect influences of debt on economic growth, as well as how this process has proceeded in Japan, illustrates these points. Japan, burdened by a massive debt overhang for almost three decades and a 25-year policy trap, provides a road map for the United States, which is in a much earlier stage of debt overhang.

Deficit Spending Restrains Economic Growth

Negative multiplier. The government expenditure multiplier is negative. Based on academic research, the best evidence suggests the multiplier is -0.01, which means that an additional dollar of deficit spending will reduce private GDP by $1.01, resulting in a one-cent decline in real GDP. The deficit spending provides a transitory boost to economic activity, but the initial effect is more than reversed in time. Within no more than three years the economy is worse off on a net basis, with the lagged effects outweighing the initial positive benefit.

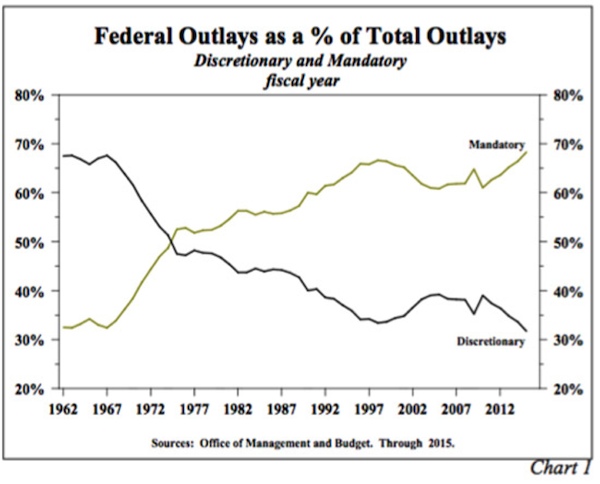

More negative. Although only minimally negative at present, the multiplier is likely to become more negative over time since mandatory components of the government spending will control an ever-increasing share of budget outlays. These outlays have larger negative multipliers. In 2015, the composition of federal outlays was 68.3% mandatory and 31.7% discretionary; the composition was almost the exact opposite in 1962, around the time this data series originated (Chart 1). Mandatory spending includes Social Security, Medicare, veteran’s benefits and the Affordable Care Act. All of these programs are politically popular and conceptually may be highly laudatory. However, federal borrowing to sustain these programs does not generate an income stream for the economy as a whole to pay for these programs. As history has evidenced, the continual taking on of this kind of debt will eventually cause bankruptcy.

Due to the aging of America, the mandatory components of federal spending will accelerate sharply over the next decade, causing government outlays as a percent of economic activity to move higher. There have been proposals for increased infrastructure spending and others for additional federal entitlements like Social Security. However, the existing present value of all unfunded federal entitlements already totals $60 trillion, about ten times the amount held in the trust funds. When funds flow into these accounts, they are immediately spent to cover the federal deficit, with the Treasury issuing an IOU to the trust fund. Thus, the trust funds merely hold U.S. government debt.

Theoretically, increased infrastructure spending could serve to reverse or halt the trend to a more negative multiplier, if true infrastructure spending were to be substituted for transfer payments, but that is not what has been proposed. The new infrastructure spending would be in addition to existing government programs. Any new infrastructure projects must generate a cash flow for the aggregate economy that is greater than what would have been generated by the private sector.

The rising unfunded discretionary and mandatory federal spending will increase the size of the federal sector, which according to first-rate econometric evidence will contract economic activity. Two Swedish econometricians (Andreas Bergh and Magnus Henrekson,The Journal of Economic Surveys (2011)), substantiate that there is a “significant negative correlation” between the size of government and economic growth. Specifically, “an increase in government size by 10 percentage points is associated with a 0.5% to 1% lower annual growth rate.” This suggests that if spending increases, the government expenditure multiplier will become more negative over time, serving to confound even more dramatically the policy establishment and the public at large, both of whom appear ready to support increased, but unfunded, federal outlays.

Debt

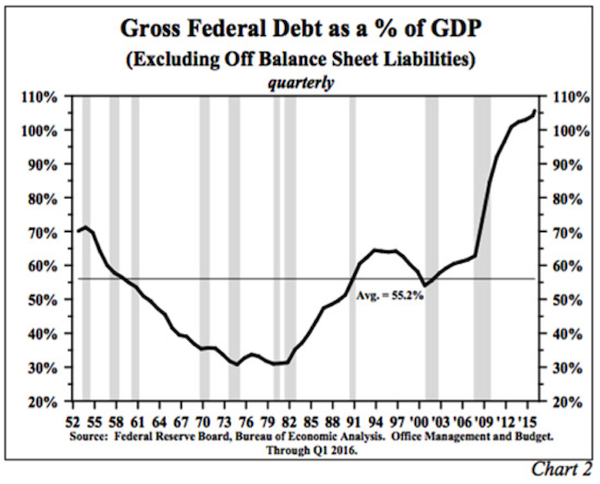

Deleterious Levels. Federal debt has subtracted, to at least some degree, from U.S. economic growth since about 1989 when debt broke above 50% of GDP, a level to which this ratio has never returned (Chart 2). The macro consequences of the debt are becoming increasingly significant. This may seem surprising to many because of confusion about the scholarly work of Carmen Reinhardt and Kenneth Rogoff (R&R) in their 2009 book, This Time is Different.

The misinterpretations pertain to a key point in R&R’s book and accusations of data inaccuracies in the statistical calculations. R&R said debt induced panics run their course in six to ten years, with an average of eight years. The last panic was in 2008, so according to their early work the time span has either ended, or is close to ending. However, the six to ten year time reference does not apply when debt levels continue to move higher over that time period. In the latest quarter, gross federal debt was 105.7% of GDP, compared to 73.5% in the final quarter of the 2008 panic.

A number of other studies (see Appendix for list), along with R&R themselves, superseded the 2009 conclusions. In 2012 in The Journal of Economic Perspectives (a peer reviewed publication of the American Economic Association), R&R joined by Vincent Reinhardt (RR&R) identify the 26 major public debt overhang episodes in 22 advanced economies since the early 1800s, characterized by public debt-to-GDP levels exceeding 90% for at least five years. The five-year requirement eliminates purely cyclical increases in debt and most of those caused by wars. RR&R find that public debt overhang episodes reduce the economic growth rate by slightly more than a third, compared with growth rates when the debt metric is not met. Additionally, among the 26 applicable episodes, 20 lasted more than a decade, and the average duration of the debt overhang episodes was a staggering 23 years. The length contradicts the notion that the correlation is caused mainly by debt buildups during business cycle recessions and confirms that the cumulative shortfall in output from debt overhang episodes should be massive. Finally, it is interesting to note that in 11 of these episodes interest rates are not materially higher; thus, the growth-reducing effects of high public debt are not transmitted exclusively through high real interest rates.

The U.S. has currently met RR&R’s criteria for slowing growth. Gross government debt exceeded 90% of GDP in 2010 and has continued to move higher since then, thus exceeding the consecutive five-year benchmark. Equally important, the debt problem is worsening. At the end of this year the government debt-to-GDP ratio will have surpassed 100% in each of the past five years, thus debt is moving into a significantly higher range.

Nonlinear Effects, Causal Factors, Feedback Loops, and the Policy Trap

Research has found that debt begins reducing economic growth at relatively low levels of government debt-to-GDP, and that this impact increases as the debt level rises. In addition, as the debt ratio moves extremely high, the debilitating impact on growth speeds up. Or, as the mathematician would say, the effect is nonlinear.

European researchers, as well as RR&R, offer causal explanations for the heavy drag on economic growth. They argue that the debt effects are explained, at least partially, by a misallocation of the limited amount of private saving as well as the likelihood that the private saving is less than in situations when debt is relatively low. In turn, these adverse savings effects reduce real investment in the private sector, which then leads to a deterioration of productivity growth, profitability, labor market dynamics and economic growth.

This line of reasoning is complicated, but the linkage can be explained as follows. As the government takes on more debt to support household income, consumers believe that saving for retirement or contingency is not as necessary since the government promises to fund income and medical care needs for those retiring. The saving rate is, therefore, lower. Since saving from income must equal real investment, the latter drops. With real investment weaker, productivity, profitability and economic growth follow suit.

The presumption of policy makers is that more deficit spending and debt is needed to address economic underperformance. While the intentions are well-meaning, the policy makers unwittingly cause an even faster rate of economic deterioration. In view of the future levels projected by such impartial sources as the Congressional Budget Office, debt will increasingly bite into the economy’s growth rate, which is a situation well documented in Japan.

Japan's Debt Linkages

For the past quarter century, Japan has illustrated the nonlinear debt/growth trap. The ratio of government debt-to-GDP has more than quadrupled, increasing from 50.9% in 1989 to 209.2% in 2015. And, as indicated by the aforementioned research, the Japanese household gross saving rate fell from 26.6% in 1989 to 6.6% in 2015. Productivity growth averaged 3.2% from the start of the data in the early 1980s through 1991, and dropped to 0.5% in the latest 10-year period, just as the academic studies suggested would happen. Finally, Japan reached the RR&R threshold of 90% government debt-to-GDP in 1999 and has exceeded that level every year since then.

These effects occurred even though the Bank of Japan (BOJ) tried to ameliorate the consequences with massive purchases of Japanese government debt. By 2015, the BOJ owned one-third of total Japanese government debt outstanding. The non-linear relationship is evident. In spite of these efforts, nominal GDP in Japan contracted 0.12% from 2000 to 2015, sharply worse than the 1.9% increase from 1990 to 2000, a growth rate that was already quite subpar for Japan.

Deteriorating Demographics: A Consequence of Extreme Indebtedness

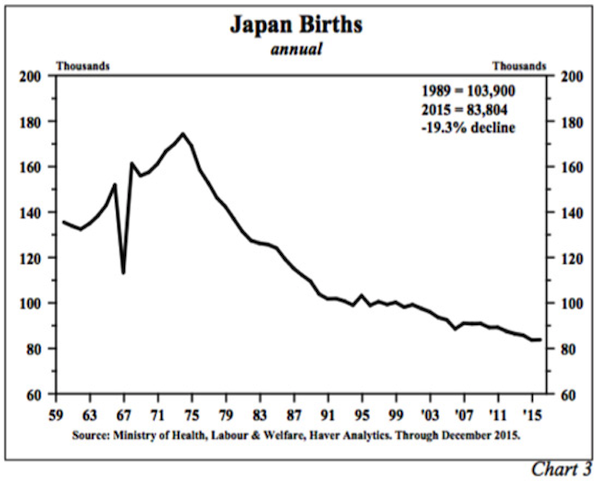

Although not identified in the studies, another linkage may also explain the increasingly negative economic performance. Demographics deteriorate when excessive debt overhangs persist. In their panic year of 1989, Japan’s demographics were poor compared to those of the United States. Importantly, after more than a quarter century of trying to solve a debt problem with higher levels of debt, their demographics are far worse. For example, the number of births fell by 19.3% from 1989 to 2015 (Chart 3). With fewer births, labor force entries decline, and eventually so does employment. As time passes this will place rising debt burdens on a falling number of people, thus prolonging the economic misery in Japan.

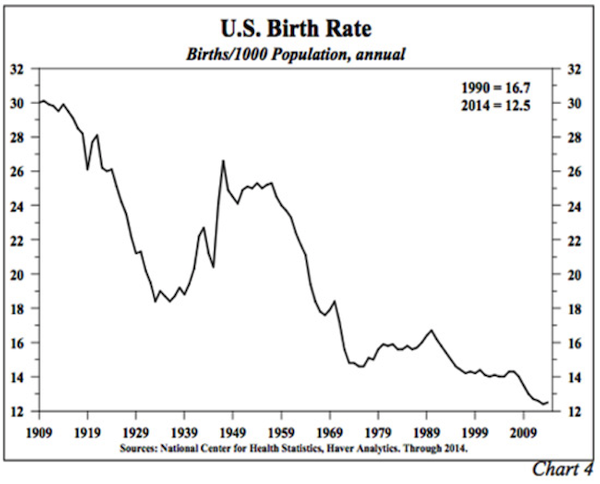

While the U.S. demographics are considerably more robust than in Japan, they did start exhibiting a parallel decline 25 years ago when high levels of U.S. government debt began reducing the trend rate of economic growth (Chart 4). The U.S. birth rate fell from the highs in the 1940s and 1950s until the mid-1970s, on what was generally believed to be lifestyle changes. However, from the mid-1970s until 1990 the birth rate moved irregularly higher, reaching 16.7 per 1000. The latest year available recorded the second lowest year of the past 25 years, at only 12.5 per 1000. A case could be made that debt could shove the U.S. economy along the downward growth/population spiral so evident in Japan.

A Forward Look

In the opening remarks to her June 15th press conference, Chairwoman Yellen used the phrase, “headwinds weighing on the economy.” She further explained, “These headwinds—which include developments abroad, subdued household formation, and meager productivity growth—could persist for some time.” These domestic and foreign items that she correctly sighted, however, are merely symptoms of the massive debt overhangs existing worldwide. Transitory growth spurts, like the one in the quarter just ended, are unlikely to be sustained. Sporadic but weakening growth will remain intact as long as the debt problems continue to worsen.

Elevated debt levels are producing poor business conditions worldwide. According to the Netherlands Bureau of Economic Policy Analysis’s (NBEPA) World Trade Monitor, the year-over-year change of the three-month average in the value of goods that crossed international borders has been hovering around 0% for the last six months. This is a dramatic slowdown from the 4.5% average growth rate registered since the end of the 2009 recession. Moreover, the last six months constitutes the weakest period since the recession. United States exports and imports confirm this deteriorating trend. In the latest twelve months, real U.S. exports and imports both contracted 1.6%. Such declines could only reflect a predominance of fragile global conditions and confirmation that the world lacks an engine of growth.

For 2016 as a whole, we expect nominal GDP to subside to around 2.5%, down from 3.1% in 2015. Year-over-year M2 growth has been above 6.5%, but M2 velocity dropped to the lowest level since early 1950 in the first quarter. Such a slump is to be expected when the wrong type of debt increasingly dominates the total.

Surging energy, rents and insurance costs boosted the year-over-year rise in the inflation rate to 1% in May, compared with several negative readings in 2015. These costs are likely to push the 12-month inflation rate slightly higher, but the bulge in these relative prices will not lead to higher aggregate inflation. Slow top-line growth in nominal GDP will ultimately force consumers to bid down prices on discretionary goods and services. As such, the faster currently observed inflation should pass.

With slowing nominal economic growth, treasury bond yields are likely to continue working lower. Stressed conditions in major overseas economies have pushed 10- and 30-year government bond yields in Japan, Germany, France, and many other European countries much lower than in the United States. In fact, the 10-year yield has turned negative in both Japan and Germany. Foreign investors will continue to be attracted to long-term U.S. Treasury bond yields. Investment in Treasury bonds should also have further appeal to domestic investors, as the second quarter likely marks the high point of economic performance this year. The slowdown ahead will cut the already weak nominal growth trajectory. Consequently, with the normal lag, the annual inflation rate, which most importantly impacts 30-year treasury yields, should begin to turn down as the year moves to a close.

Subscribe to John Mauldin’s Free Weekly Publication

Each week in Outside the Box, John Mauldin highlights a thoughtful, provocative essay from a fellow analyst or economic expert. Some will inspire you. Some will make you uncomfortable. All will challenge you to think outside the box. Subscribe now!